Demand for Class 8 vehicles remained strong in February as the freight industry begins its slow recovery, according to preliminary data from ACT Research and FTR Transportation Intelligence.

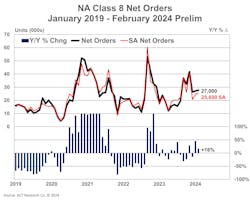

ACT’s preliminary data counted 27,700 Class 8 equipment units sold in February, up 600 units from its January count and 16% year over year. FTR counted 25,700 units, down 9% from January but up 11% year over year.

Although both counts are lower than last fall's peak, they represent a significant improvement over February 2023.

“Weak freight and carrier profitability fundamentals, and large carriers guiding to lower capex in 2024, would imply pressure in U.S. tractor, the NA Class 8 market’s largest segment,” Kenny Vieth, president and senior analyst at ACT, said. “While we do not yet have the underlying detail for February order volumes, Class 8 demand continuing at high levels again this month suggests that U.S. buyers continue as strong market participants.”

FTR noted that the Class 8 vehicle market is not much better than replacement-level orders, though the count is above seasonal expectations. The last peak was in November, at 36,000 units; orders for the last three months have been stable at about 10,000 units lower.

The final numbers for both groups for February will be published in mid-March.

A mixed bag for Class 8 demand

Demand for Class 8 equipment is being influenced by several competing variables.

For example, demand is brought down by cool U.S. economic activity, overcapacity of equipment, and economic uncertainty. Demand is brought up, however, by new technologies, replacement of aging equipment, looming EPA NOx emissions standards in 2027, and nearshoring trends.

As experts Mitch Hunter and Bryan Courcier wrote for FleetOwner, the 2024 truck market is expected to be a stable but challenging year.

“The market for Class 8 trucks in 2024 is unlikely to be primarily driven by the same factor that dominated 2020 through 2023: the global pandemic,” the authors said. “As we enter into more ‘normalcy,’ we are at bottom-of-cycle levels regarding freight demand in a very manageable consumer goods inventory environment. This means a lack of demand for over-the-road freight and a continuance of the same theme of the past 18 months.”

See also: Daimler Truck CEO: We’ll be ready for any pre-2027 order surge

How does this year compare to 2023?

The beginning of 2024 overall saw strong demand for Class 8 equipment, despite the difficult market for carriers.

Preliminary counts from FTR and ACT for January measured a 35-45% year-over-year increase. The February data aligns with ACT’s commercial vehicle forecast, which predicted a bump in Class 8 production and sales for February.

DAT Freight and Analytics reported all-time highs for spot freight volumes in January, up 1-6% year over year for van, refrigerated, and flatbed equipment.

Despite these attractive numbers, the general freight market is not expected to perform much better in 2024 compared to the previous year.

However, this year will probably not be much worse for trucking, according to an FTR analyst. FTR’s Trucking Conditions Index predicted generally pessimistic market conditions throughout 2024 but not quite as poor as 2023.

See also: Diesel drops while gasoline goes up

“Our forecast is that it’s not going to get any better for shippers and probably not any worse for trucking companies,” Avery Vise, FTR’s VP of trucking, told FleetOwner. “We see sort of a prolonged kind of strengthening of the market.”