Report touts savings from 33-foot twin trailers, downplays truckload's concerns

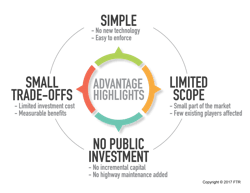

A new report from FTR Transportation Intelligence said allowing twin 33-foot trailers on the nation’s highways could lower costs as much as 10%, while having minimal disruption on the operations of the overall trucking industry.

“The productivity gains from allowing 33 foot trailers will reduce the amount of work required in the trucking industry - resulting in fewer trucks on the highways, less damage to the pavement and reduced emissions,” said lead author Noel Perry, FTR partner and transportation economist. Perry previously held research positions at Schneider National, Cummins Engine Co. and CSX Corp.

Size-and-weight rules have long been a contentious issue within the trucking industry. Recent federal efforts to approve the use of twin 33-foot trailers have failed, but some analysts have suggested they could receive approval during the Trump administration.

FTR said the additional length provides an 18% increase in cubic capacity over the current 28-foot trailers, and 24.5% gain over 53-foot dry van trailers. By putting more freight on trucks with the longer doubles, the result would be lower costs to carriers, shippers, and end consumers, especially those fueling “the exploding online market place.”

Adoption costs would fall mainly on the less-than-truckload and parcel carriers interested in the change, and there would be little, if any, cost to the public, the report said. At the same time there would be a reduction in trucks on the road.

FTR’s report breaks down several of the frequently cited reasons public safety groups and truckload carriers tend to oppose the change.

Perry noted although individual tractor-trailers would produce additional emissions, he estimated a 10% reduction when factoring in the fewer number of rigs needed. Similarly, he projected drops in fuel use, highway wear, and congestion, as the larger trailers move the same amount of freight in 14% less highway space.

Additionally, Perry suggested any potential per-truck safety risk “should be more than offset by the reduction in overall rigs.”

FTR projects the total population of doubles could increase from 5% of all trucks today to as much as 8%. While that does represent a significant increase, a common refrain from safety advocates, the argument falls flat when factoring in the overall decline in total trucks on the road, the report said.

Perry was also critical of truckload carriers fighting the change, suggesting their economic concerns are overblown. He estimated it would impact less than 2% of the truckload market.

“Any pressures on truckload operations will be limited to small, specialized niches,” the report said.

As with previous innovations, Perry said truckload executives would be able to efficiently manage these changes through rate alterations or operational adjustments.

Earlier this year, the Truckload Carriers Association reiterated its opposition to efforts to gain approval for twin 33s.

“While TCA strongly supports a thoughtful, evolutionary pace for the development and deployment of productivity innovations that benefit the entire trucking industry, the revolutionary change of allowing twin 33-foot trailers on federal-aid highways would have only benefited a small minority of the trucking industry, while the nature and pace of such a change would have been detrimental to the trucking industry in general, and to the truckload carrier segment specifically,” the group said.

FTR’s report also listed several factors that could limit the use of the longer trailers, if they are approved.

Facilities need to be located close enough to approved highways to allow direct pickup and delivery, and provide the needed the maneuvering space and extra docks to handle the longer doubles. Another limitation could be the ability to find backhauls to make them economically viable, the report noted.