The trucking industry has long depended on diesel engines and fuel to drive our nation’s fleet of heavy-duty vehicles. However, with the tremendous strides that have been made in alternative fuels and electric vehicle technologies, including emissions reductions, price competitiveness, and fuel efficiency, we may have finally reached the turning point where diesel trucks begin to take a back seat.

Today’s fleet vehicle market is extraordinarily diverse compared to what it once was just a decade ago. Roush CleanTech, an alternative fuel vehicle technology provider, recently announced the first propane engine to be 75% cleaner than the current emissions standards for nitrogen oxides (NOx) set by the Environmental Protection Agency (EPA). The new 6.8-liter propane engine can be used in some heavy-duty applications, such as school buses and Class 7 commercial trucks. Roush has also said that it expects to meet even cleaner NOx emissions standards in 2018.

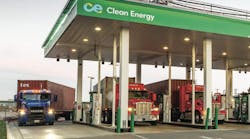

On the natural gas side, Cummins Westport Inc., a prominent natural gas engine manufacturer, has announced 9- and 12-liter engines that are 90% cleaner than the current NOx emissions standards.

In addition, these natural gas engines can be fueled by natural gas that is developed from renewable sources, providing significant greenhouse gas (GHG) emissions reductions. These new engines are designed for truck and bus applications up to 80,000 lbs. and have an on-highway range capability of 700 miles.

Meanwhile, there have been several new players jumping in the fuel-cell, hybrid-electric, and all-electric vehicle ring over the last year, including some of the industry’s most reputable OEMs. Kenworth, a division of Paccar, announced it is developing a hydrogen fuel-cell and a hybrid-electric Class 8 tractor. Toyota, the Japanese automaker, has also made headlines recently for unveiling a Class 8 hydrogen fuel-cell prototype. BYD, a leading manufacturer of electric vehicles, has an impressive lineup of battery-electric buses and trucks that cover the full range of vehicle types. Also in the battery-electric truck race, Tesla, the premier maker of all-electric passenger vehicles, recently announced it plans to unveil its version of a Class 8 battery-electric truck later this year.

While technology for heavy-duty alternative fuel and electric vehicles continue to advance and prices inevitably go down as the vehicles reach commercial maturity, regulations are continuing to tighten and customers across the nation are demanding cleaner and more efficient fleet vehicles.

Meanwhile, diesel vehicles haven’t shown significant technology improvements in the last few years that reduce emissions while improving fuel efficiency. The main issue facing the diesel industry with today’s diverse vehicle market is that there is an inherent trade-off between fuel efficiency and lower NOx emissions for diesel vehicles. Diesel engine makers will need to figure out how to have both without compromising the power heavy-duty trucks need for standard duty cycles.

NOx emissions are only half the battle as public opinion is increasingly focused on GHG emissions, which adds another layer of complexity for diesel vehicles. Whether or not the federal administration chooses to move forward with GHG emissions regulations, such as EPA’s Phase 2 GHG emissions reduction plan, several states across the country are ready to make their own rules while high profile customers, such as Walmart and UPS, are looking to reduce their carbon footprint while reducing their fuel costs.

Some diesel OEMs are likely looking at more aftertreatment processes to reduce emissions, but that will undoubtedly raise engine and maintenance costs, which provides an opportunity for other platforms to enter the market. As momentum builds for these new platforms, most major OEMs have signaled their commitment to bring these vehicle options to market. With all of these factors shaping the future fleet vehicle market, it’s only a matter of time to see which vehicle technology will rise to the top.