To say that the forecast for the price of diesel fuel is grim is like saying Hurricane Katrina brought a lot of rain to New Orleans last year. In short, the recent spikes in diesel fuel costs — led by oil prices exceeding $75 a barrel — could add $10.6 billion to the trucking industry's fuel bill this year alone.

Based on the Energy Information Administration's (EIA) recent adjustment of its national diesel price forecast to an average price of $2.70 per gallon, the American Trucking Assns. (ATA) projects motor carriers will spend $98.3 billion on fuel in 2006. That's a considerable increase over the $87.7 billion they spent in 2005 and $65.9 billion in 2004

“For many motor carriers, fuel represents their second-highest operating expense, accounting for as much as 25% of total operating costs,” says Bill Graves, ATA president and CEO. “An affordable supply of diesel fuel is imperative to keep our trucks moving, because fleets must be guaranteed sustainable operating costs in order to continue delivering everything that is delivered by truck.”

By and large, most fleets can adequately compensate for the price of diesel by passing the extra cost on to customers in the form of a fuel surcharge — in effect getting customers to cover the difference between the weekly cost of diesel and the carrier's base fuel cost. Yet even with the fuel surcharge, carriers are still paying more for fuel — and many only collect a portion of the fuel surcharge, depending on how agreeable the customer is about paying it - leaving them I n the end with higher operating costs.

Smithway Motor Xpress is a good example. As G. Larry Smith, Smithway's president and CEO, explains, “Our improvement in earnings has been slowed somewhat by increasing costs in the first quarter, notably fuel, as average diesel prices increased 22%” compared to the first quarter of 2005. Fuel surcharge revenue “mitigated approximately 89% of that price increase,” he says.

Consequently, even the most fuel-efficient fleets are taking a fresh look at ways to improve fuel economy, even if by just a fraction of a percent.

“Each improvement of 0.5 liters per 100 kilometers [0.1 mpg] reduces our fuel bill by about $280,000 a year,” notes Jon Sigurdson, fuel manager for Bison Transportation, Winnipeg, Manitoba. “That is a strong incentive to improve fuel economy.”

STRATEGIC APPROACH

Improving fuel economy across the fleet, and holding on to the savings over the long term, requires a strategic approach, says Herb Schmidt, president and CEO of Contract Freighters Inc. (CFI). Average mpg stats for CFI are between 6.5 and 7 mpg, with some drivers able to log 8 mpg.

The get those kinds fuel economy results, says Schmidt, fleets must focus on the following:

Equipment specs

“You must have your equipment spec'd correctly in order to be in position to get the best fuel economy,” he says. Specifically, Schmidt is referring to aerodynamic options such as fuel tank skirts and roof deflectors, as well as transmission gears and rear axle ratios that are properly matched with the engine's ideal operating range.

Driver skills

“They are the second — and perhaps most critical — building block to better fuel economy,” explains Schmidt. “For example, we spend a whole day in orientation with new drivers to teach them how to drive our trucks to get the best fuel economy. They must understand why that matters, because we rely on the driver's professionalism and skills to get the best fuel economy from our equipment.”

New technology

“We take every chance we get to test new components,” he notes. “Take [Michelin X-One] wide base tires. We converted to them early on for the rear axles of our tractors and saw fuel economy improve 2/10th of a mile per gallon. Now we're spec'ing wide base on our trailers and that would add 3/10th of a mile per gallon savings.” CFI is looking at trailer skirts to help reduce drag, and is also considering adding Kenworth's battery-based Clean Power System to its company-owned tractors to cut engine idle time. “We're always trying to stay ahead of the technology curve,” Schmidt says.

Routing, refueling network

Like most carriers, CFI is trying to map out better truck routes for its fleets, not only to improve delivery times, but also to prevent wasting fuel in traffic congestion. The carrier also has a national refueling network set up with Pilot and other truck stops to make it more convenient and cheaper for its drivers to refuel — when it makes sense to do so.

“You don't want to be too restrictive, however. A driver forced to go to a cheaper locale may save a nickel per gallon, but burn three hours of fuel in the process, which means he burned more than he saved, price-wise,” Schmidt says. “We leave it to our drivers to determine if they can effectively refuel at those locations. [It's important] to trust and use the driver's experience and skill.”

SMART ROUTES

Getting better route intelligence could also help, especially in terms of avoiding traffic congestion. “Simple things such as an awareness of road construction and route conditions can prevent high idle time situations,” says Bruce Lawyer, assistant chief engineer at Peterbilt Motors Co. “This is one of things we're looking to provide via telematics, though the technology hasn't matured yet for widespread use. But it would allow much better pre-trip planning by computer. To me, that could be a big key to improving fuel economy.”

Jeff Papows, CEO of navigation software maker Maptuit, concurs. “Today, the typical over-the-road truck today costs $1.16 per mile to operate,” he notes. “If we can ‘suppress’ 40 miles out of an average trip — either by speeding up delivery over a shorter route or eliminating delays by re-routing around an accident — that's going to save them a lot of money over time.”

Randy Barnett, a project manager at refrigerated carrier Stevens Transport, notes that increased control over the routing and fueling through use of Manhattan Associates' carrier management program improved equipment utilization by 5% and reduced fuel expenses by over $500,000 a year. This resulted in a savings of nearly $2 million over a four-year time period.

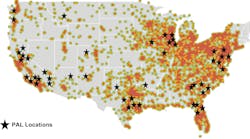

“We use this system to consider both fixed and variable costs and to balance them against driver requests and preferences, thereby minimizing out-of-route miles, lowering fuel and fuel tax costs, and decreasing tolls,” Barnett says. “It also had a major impact on our relationships with fuel suppliers, dramatically increasing the number of ‘authorized’ fuel stops from 170 to more than 1,000, which has contributed to our fuel savings.”

INFORMATION NATION

According to Schmidt, information ties all of the pieces of the fuel economy puzzle together. Without engine and odometer data — gallons of fuel burned, percentage idle time, and miles traveled — there's no way to accurately gauge fuel savings, he points out.

“It's all about statistics — we closely track fuel mileage with engine data from our trucks,” he notes. “We measure the big picture in terms of who gets the best and worst fuel economy among our drivers and we re-train accordingly.”

Data is also a critical ingredient in fuel savings efforts at Bison; it's a big part of why most of the 500-unit fleet currently attains 7.7. mpg.

In a case study conducted by Canada's Office of Energy Efficiency, Bison detailed how it uses a system developed by Sigurdson to provide a monthly summary of total fuel use by vehicle, including fuel economy, total fuel consumed, fuel consumed while idling, cost of fuel consumed while idling, and average vehicle speed.

Using historical fuel economy data, Bison established a fuel efficiency benchmark for each of the five tractor types in its fleet. If drivers exceed the target for a three-month period, they receive a financial bonus; and the more they exceed the target, the bigger the bonus.

Having that data is important because there is a difference of up to 12 liters per 100 kilometers [23.5 mpg] in the mileage achieved by the most fuel efficient and least fuel efficient drivers. “Having data helps identify the amount of time a driver spends at combinations of vehicle speed and engine rpm levels. [This enables us to] quickly identify idle time and whether a driver is revving the engine too high for the vehicle speed, thus adversely affecting fuel economy,” Sigurdson notes.

APPLICATION-SPECIFIC

Another important consideration for fleets is ensuring that the specs they develop for their equipment match the intended work application. Specs that improve fuel economy in one type of operation may not result in similar gains in another.

“Fleets that run a lot of highway miles need to focus on aerodynamic packages such as getting sun visors, roof fairings to match trailer height, side extenders, and fuel tank fairings,” explains Ramin Younessi, chief test engineer for Freightliner. “However, the average LTL and day cab tractor don't generate enough speed to make aerodynamics a benefit. Also, in pickup and delivery operations, those side fairings can get in the driver's way.”

Reducing tractor weight can provide fuel economy benefits, especially in heavy-haul applications such as tanker trucks. However, it's hard to measure fuel savings in this scenario; the primary factor behind reducing tractor weight is to gain more payload capacity, says Ed Saxman, product manager for Volvo Powertrain.

“Not many trucks can take advantage of a fuel economy benefit from weight savings,” he says. “You have to think about what the haul is and how it's loaded. You can't really measure pure fuel economy savings with 200-lb. weight savings.”

Another factor overshadowing the entire application-specific spec'ing debate is the impact of emission-reduction regulations on fuel economy, both in terms of engine design changes and the requirement to use more expensive ultra low sulfur diesel (ULSD) fuel. The lower energy content of ULSD has the potential to result in a decrease in fuel economy.

Clarence Werner, chairman, president and CEO of Werner Enterprises, believes fuel economy is going to suffer more seriously than expected from the switch to ULSD, on top of losses from the new emissions control systems. “When truckload carriers are required to use ULSD for all of their existing trucks, preliminary estimates are the new fuel may decrease mpg by approximately 1% to 3%,” he says

The potential of ULSD to have a negative impact on fuel economy, combined with an estimated 1% degradation from the change in ‘07 engines creates a real concern for Werner, especially in light of his experience with ‘02 engines. “Right now, the percentage of our truck fleet with post-October 2002 engines is 95%…and we continue to experience approximately 5% lower miles-per-gallon with them,” he says.

“That's why you have to do both: spec the truck right and train the driver,” emphasizes Wayne Simons, research and development lab manager for Kenworth Truck Co. “If you spec it wrong, you limit potential fuel economy improvements. If you drive it too aggressively, you don't get any of fuel economy benefits of a properly spec'd truck.”

Spec'ing for Fuel Economy

Bob Weber, chief engineer for Class 8 vehicles at International Truck & Engine Corp., says fleets can improve their fuel economy numbers by adhering to the following spec'ing and operating suggestions:

Slow down; use speed governors. “Speed is the largest factor in fuel efficiency because aerodynamic drag forces go up exponentially with vehicle speed,” he says. International offers a programmable option on its engines called Vehicle Speed Limiting (VLS) that caps how fast the truck can travel. Slowing down from 70 to just 60 mph using VLS could yield fuel savings of up to 10% a year.

Spec a fuel-efficient engine. Though engine selection is a matter of personal preference, fleets should be aware of engine-specific fuel consumption patterns.

Gear vehicles to cruise speed. Spec the transmission final drive ratio, axle ratio and tire size to match the OEM-recommended engine rpms for your highway cruising speed. Powertrain optimization can yield fuel savings of up to 10% a year.

Spec roof deflectors. These are particularly beneficial for tractors hauling tall trailers and operating at speeds of 45 mph and above. Estimated annual fuel savings is 10%.

Spec low rolling resistance tires. Assuming optimal tire pressure, they can yield fuel savings of up to 10% a year.

Reduce engine idling. A number of idle reduction solutions are available, including programmed engine shutdown, fuel-fired heaters, and electric air-conditioners.

Spec an automated transmission. Can result in fuel economy savings of 5%.

Spec low engine speeds. Setting engine cruising speed at 1,800 rpm rather than 2,100 will enable the engine to operate more efficiently, thus improving fuel economy about 5%.

Specify cab side extenders. For tractors hauling-sided trailers traveling at speeds of 45 mph and above, the addition of cab side extenders can improve fuel economy 3%.

Monitor tire pressure weekly. Could cut your fuel costs by up to 3% a year.

Spec chassis skirts. For vehicles traveling at speeds of 45 mph and above, skirts can offer about 3% in fuel savings annually.

Spec a direct-drive transmission: With a final drive ratio equaling 1.0, this can save 2% a year in fuel costs.

Spec aerodynamic mirrors. For vehicles traveling at speeds of 45 mph and above, aerodynamic mirrors will provide about 1% to 2% fuel savings annually.

Spec a bumper dam. For vehicles traveling at speeds of 65 mph and above, a $150 bumper dam can improve fuel economy 1.5 %.

Medium-duties tough on fuel economy

Improving the fuel economy of medium-duty trucks can be a lot harder than it is for their over-the-road heavy-duty counterparts. According to Bob Weber, chief engineer for Class 8 vehicles at International Truck & Engine Corp., “Most medium-duty trucks operate under 45 mph, don't operate at consistent engine speeds, and spend a lot more time at idle.”

Chuck Blake, senior technical sales support manager for Detroit Diesel Corp., points out that the high percentage of idle time — often 25% or more — and the stop-and-go driving mean that medium-duty vehicles have completely different gearing needs.

But Weber notes that the increased idle time offers lots of opportunity to shut down the engine, which saves fuel. “Understanding the duty cycle is critical, as a programmed 15-second auto shut down and auto restart could be a big fuel saver,” he says.

In addition, driver-control features such as setting vehicle speed limits and using automatic or automated transmissions can increase fuel economy in medium-duty applications. “Fuel economy drops at each shift point using manuals, whereas with automatic or automated modes we see a 2% to 3% improvement,” says Weber.

However, according to Mike Eaves, medium-duty product manager for General Motors, making additional spec'ing changes to medium-duties does not impact fuel economy nearly as much as it does on OTR heavy-duty vehicles. A percent here, or half a percent there is the most we can hope for, he adds.

Some of the steps GM is taking to address fuel economy issues in medium-duties for next year's models include adding a 6-sp. Allison automatic transmission alongside the 5-sp. currently offered. “That one extra gear gives us opportunities to match more shift points to engine horsepower and torque, which improves fuel economy,” Eaves explains. “We're also working on more fuel-efficient rear axle ratio options, which is something the medium-duty customer typically didn't care about in the past.” Again, he stresses that these changes “are only going to deliver tweaks to fuel economy, not major improvements.”

Even the use of APUs to reduce engine idling is limited in the medium-duty segment, as Eaves says it's a cost prohibitive option in this market due to the their chassis space requirements.

— SEAN KILCARR