If you've had trouble justifying the cost of wireless communications or seen only limited benefit for your particular fleet's operation, it may be a good time to reconsider. New generations of hardware, vastly expanded communications networks and an explosion of new services aimed at a variety of fleet applications could well change your mind.

The cost, coverage and capabilities of these new systems are going to make wireless data communications the must-have productivity tool of the decade for the entire trucking industry, and fleet managers who recognize the potential first are going to enjoy a significant advantage as competitors play catch-up.

About ten years ago, longhaul truckload carriers became the first customers for wireless communications for the simple reason that it made economic sense in that type of operation. The need to keep widely scattered trucks loaded and generating revenue meant those fleets could justify a relatively expensive communications system that let them dynamically dispatch drivers anywhere in the U.S. Whether those first systems used satellites or a network of analog cellular services, the most important feature was national coverage.

“Missing a backhaul can cost (truckload carriers) thousands of dollars, so wireless communications quickly became extremely important to them, and they could afford its high cost,” says Les Dole, CEO of onboard computer manufacturer Cadec Corp.

Private fleet operations, which often run fixed routes with multiple stops, “couldn't tolerate that kind of expense because their emphasis is on controlling expenses, not generating loads or revenue,” says Dole.

Similarly, national coverage “was overkill for (LTL) P&D operations,” says Norm Ellis, senior director of business development for Qualcomm Wireless Business Systems, the first and still largest mobile communications provider in trucking.

Not only is national coverage unimportant to P&D operations, but they also need to communicate relatively large amounts of data many times during a route. By design, the national systems are most cost-effective with small amounts of data transmitted at well-spaced intervals.

In recent years, however, wireless technology has advanced in two important areas. That will make it more broadly useful to the entire trucking industry.

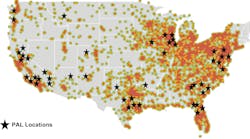

First, the networks have expanded in both coverage and capacity, with new terrestrial, or land-based, systems offering lower cost service that fits higher-data applications like those needed by private fleets and LTL carriers.

“We've all seen what digital technology has done to rates for wireless voice service,” says Dave Ladner, the founder of PeopleNet Communications, and now vp-corporate business development. “There's good digital coverage in major cities now, and people are developing (data) systems for metro area fleets that use that coverage to carry more data at affordable costs.”

The Baby Bells and other wireless providers for the consumer market are all investing heavily now to upgrade their systems to handle wireless Internet access. “That requires pretty good bandwidth, and trucking is going to be able to take advantage of that added capacity,” says Michael Brown, director of product management for @Track Communications.

Hybrid networks have also developed, offering lower-cost terrestrial service when coverage is available and automatically switching to satellite when a vehicle is out of terrestrial coverage. “That kind of least-cost routing opens (wireless data) service to much more than truckload. It makes it viable for LTL fleets, regional distribution fleets and, really, any dynamically dispatched fleet,” says Ladner.

The second important development is vastly improved wireless hardware. Mobile data devices for both the well established and new wireless data systems have dropped in price while adding power and functionality.

“The hardware has capabilities that were unthinkable a few years ago,” says Eric Bleyl, vice president of Aether System's transportation and logistics division. “You now have fast processors in ruggedized handheld units with native communications capabilities.”

Practical, affordable multimode devices for the hybrid terrestrial/satellite systems are also beginning to show up on the market, “offering access to a combination of low cost and coverage that optimizes a fleet's communications dollar,” Bleyl says.

“The criteria for evaluating wireless service has always been the same — cost, coverage and capacity,” says Ellis. “All three are now at the point that wireless data systems can be justified in many fleet environments.”

So which fleets have the best opportunity to take advantage of these new wireless data services? The first category mentioned by most wireless providers is private fleets.

Many companies have invested heavily in supply chain systems to control inventory within their own walls, “but once they put it on their trucks, they begin to lose visibility,” says Ellis. While many private fleets have tried to gain some visibility with mobile voice systems, “you can't integrate voice,” Ellis points out. “If you're moving high-value or perishable goods, or in a competitive business like food services, you can't beat data for supply chain visibility.”

Companies with private fleets also put a high priority on customer service. “Drivers can use cell phones to communicate with customers and their offices, but someone has to answer the calls, and it takes time for a driver to communicate verbally,” says Cadec's Dole. “With a wireless data system, location monitoring, customer notification, etc., can be done automatically without driver intervention, and customers can monitor their own delivery schedules over the web. The driver also has the ability to resolve customer problems right on the spot.”

For example, one private fleet using daily routes to distribute new products and pick up old ones for recycling has to give its customers two hours' notice before a delivery so they can prepare for the exchange, says John Sweitzer, vp-corporate strategy for GlobeRanger Corp., a new supplier of wireless “supply chain visibility” systems.

“At the beginning of the day, the dispatcher has to call the first five stops for each driver, and then the drivers have to make the rest of their calls as they go through their routes,” says Sweitzer. “Think of the cost of just making all those calls.”

A wireless system now automatically tracks each truck's location, and when a vehicle gets within a predetermined distance from its next stop, the system automatically notifies the customer. “The driver doesn't have to stop, the dispatcher doesn't have to make those calls, and the customer still gets their notification,” Sweitzer says.

With their higher data capacities, the new wireless data options also complement e-commerce business strategies that are becoming increasingly important to many businesses with private fleets.

“Early wireless technology centered around monitoring vehicle location and performance,” says John Boyko, director of transportation business for Arch Wireless Inc., a two-way paging provider that has expanded into a full range of wireless data services. For many private fleets, monitoring vehicle performance “doesn't affect the bottom line, but starting the billing process as soon as the driver makes a delivery does, and so does replacing paper with electronic documents,” says Boyko.

FOR-HIRE, TOOPrivate fleets aren't the only trucking operations that will benefit from the new generation of wireless data systems. Less-than-truckload carriers have long recognized the potential benefits of real-time data links with their pickup-and-delivery trucks, but running on thin margins, have been unable to afford the available systems. Instead, they have had to rely on radio and other low-cost voice systems to stay in touch with drivers and batch systems to collect route data at the end of each day.

“The price point is about right now for LTL fleets to start collecting inbound freight information in real-time,” says Aether's Bleyl. “They don't have to wait to the end of the day anymore to plan outbound loads.”

Qualcomm's Ellis agrees. “LTL is ready now for wireless,” he says. “Terrestrial products in particular are going to change the landscape for their P&D operations with dynamic dispatching and advanced load-planning data. Wireless data will give (LTL) carriers a real advantage in the marketplace, and fleets will either adopt it quickly or be left behind by the pacesetters.”

Whether they're regional LTL operations, private fleets or even longhaul truckload carriers, smaller fleets are certain to be among those most changed by new wireless systems. Not only was the hardware and service of early systems too expensive for most small operations, but you had to integrate the wireless data with a back-office system to get the real payback for your investment. Few smaller companies had the information technology resources or systems to exploit their full potential.

However, the emerging systems allow users to choose only the features and benefits that can be justified in their particular application, from bare-bones dispatching to relatively full-featured e-commerce management systems.

“Six or seven years ago, your only choice was a full-featured system,” says @Track's Brown. “Now you're seeing new products that fit a number of value sets with different price points.”

While every level of the trucking industry is going to benefit from declining cost in wireless hardware and service, small and medium-size fleets will also get significant competitive bump with wireless from another quickly developing technology — the Internet.

As an inexpensive data network available to anyone with a PC and phone line, the Internet is letting smaller fleets use advanced dispatching and e-commerce systems without investing in expensive programs or personnel to maintain those programs. Instead, they can pay subscription fees to access those programs over the Internet with a web browser, allowing ASPs (application service providers) to manage their wireless data and other back-office functions.

“We already have a number of partnerships to provide web-based dispatch over our wireless network,” says Kevin Hussey, a regional wireless web sales manager for Nextel Communications. “They can be as simple as two-way text messages or as complex as data systems integrated with a fleet's customer database or back-office applications.”

“The first (wireless data) solutions were too limited in their applications to justify the expense for most fleets,” says Vinit Nijhawan, president of Kinetic Computer Corp. “People wanted to use that wireless data in day-to-day operations. The ASP model works well because it's flexible enough to integrate easily with all types of business systems. And even if a carrier isn't using e-commerce (to do business) with a shipper, the carrier can still offer that shipper freight visibility online with an ASP and a wireless system.”

DELIVERING SERVICEMany fleets carry no cargo other than the drivers' expertise, tools and support equipment. “In some ways managing service people in the field is similar to managing cargo with wireless,” says Brown. Many can benefit from location monitoring, dynamic dispatching, real-time customer service resolution, and other wireless applications found in cargo systems.

However, field service has it's own set of requirements, and those requirements will also be addressed by many of the new wireless systems, making them widely useful for service fleets.

“Anyone with a fleet has the same challenges — optimization, integration of data from the field, customer service,” says PeopleNet's Ladner. “But field service fleets need a different platform to address those needs.”

One part of that platform is a wireless device optimized for the service environment. Often that means a portable, ruggedized unit that can be taken into a work area and can connect the technician to the wireless network. Built-in bar-code scanners to handle parts inventory are useful in many service applications, and most need a good communications bandwidth to handle larger amounts of data than a cargo application might require. Devices that are more powerful, more flexible and far less costly than those available even a few years ago can now meet all of those requirements.

Another wireless data option that's been long anticipated, but never quite ready for widespread use, is remote trailer tracking. The recent developments in cost, coverage and capacity, however, seem to have finally given trailer tracking the push it needed to become a viable commercial service.

Earlier this year the country's two largest truckload carriers, Swift Transportation and Schneider National Carriers, announced contracts to equip all of their trailers with a trailer tracking system from Qualcomm.

Even though they signed with a competitor, “I think the announcements are good for the whole industry,” says @Track's Brown. “With the economy slowing down, it may take a few years for everyone to see the value in trailer tracking, but when companies like Swift and Schneider see value, it's there.”

Related products from Qualcomm, GlobeRanger, Wireless Data Solutions, Vistar and others for tracking construction equipment have also begun to enter the market, offering construction fleets the same increased utilization and security at prices they can justify.

Given the explosion in wireless technology and the new services that explosion has generated, “it's easy to feel a bit overwhelmed by all the options,” says Cadec's Dole. The key to understanding and evaluating those options is to “look beyond the wireless concept and see them as part of a powerful platform that can let fleets reduce their most labor-intensive chores,” he says.

“In a way, it's like the (desktop) computer revolution,” Dole says. “At first, businesses used PCs just for word processing, but now you wouldn't think of a PC without email and an Internet connection. In a few years, it's going to be the same with trucks and wireless communications.”

For a companion guide to specific wireless data products for trucking, go to www.fleetowner.com