As freight demand grows, supply chain challenges are creating immense backlogs for heavy- and medium-duty commercial vehicles and trailers, according to various reports and studies by ACT Research this month. Orders for new Class 8 trucks and trailers continue to be pushed off into 2022, raising the price of used trucks as the secondary market becomes more scarce.

Those backlogs for new vehicles and trailers “are essentially filled through 2021 and well into 2022, with backlog-build ratios above traditional ranges and inventories below traditional thresholds,” Kenny Vieth, ACT Research’s president and senior analyst, said. “As has been the case since the start of the year, supply chain constraints, rather than fleet/consumer demand, are the primary driver of how many vehicles will be produced in 2021.”

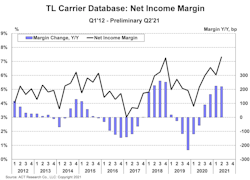

The first half of 2021 has been a profitable start for truckload fleets, according to ACT analysis of publicly traded truckload (TL) carriers. “The entire TL group saw profits rise to record levels in the second stanza—to 7.3%—10 basis points above the previous record quarter for profitability set in Q4 2018 and 138 basis points higher than the comparable quarters in the 2018 run-up,” Vieth said.

Fleet profitability should continue rising into 2022 “on a very strong footing,” Vieth said, crediting a filled freight pipeline and slow new commercial vehicle production. “The relationship between carrier profits and heavy vehicle demand is both obvious and irrefutable,” he said. “The questions that remain are the speed at which fleets overcome driver capacity constraints and the speed at which vehicle production rises once current supply-chain constraints are overcome.”

Much of this data comes from ACT’s North American Commercial Vehicle Outlook, a report that forecasts the trucking industry’s future over the next one to five years. The report is geared toward helping OEMs, Tier 1 and Tier 2 suppliers, and investment firms plan for the future. The information included in the report covers forecasts and current market conditions for medium- and heavy-duty trucks, tractors, and trailers, the macro economies of the U.S., Canada, and Mexico, publicly-traded carrier information, oil and fuel price impacts, freight and intermodal considerations, and regulatory environment impacts.

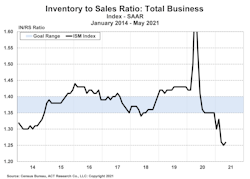

While ACT’s total business inventory-to-sales ratio rebounded from its May 2021 bottom—its smallest number in over eight years—it “remained well below the recent range in this ear of multiple sales channels,” Vieth explained, “showing that at May’s sales rate, it would take $150 billion of inventory accumulation to bring the ratio to the low end of its recent range—suggesting a good pipeline for freight.”

Veith noted that with “steamships piling up on both coasts,” the case for strong freight activity through the end of this year and beyond is even stronger. “It is often said that freight is not a backlog business,” he said. “Low inventories and stacked-up ports make this period an exception to the rule.”

Vehicle market

With new vehicles hard to find thanks to supply chain kinks leading to production delays, used truck prices are rising as their inventories shrink at dealers across the U.S., according to ACT.

Preliminary July data shows used Class 8 truck volumes at dealers dropped 3% month-over-month and 19% year-over-year. Through the first seven months of 2021, activity is 13% higher compared to the same period a year ago. “Typically, there is not much difference in activity between June and July,” said Steve Tam, ACT vice president.

ACT’s preliminary release of its State of the Industry: U.S. Classes 3-8 Used Trucks report showed that average prices dropped 3%, as average miles was up 4% and age rose 3% compared to June. Compared to July 2020, the average used truck price was 45% higher, with average miles and age each up 1%. On a year-to-date basis, the average price is 31% above its year-ago level for the first seven months of 2020, with average miles and age each down 1%.

“The bigger issue continues to be the narrative surrounding the trickle of inventory coming into the secondary market from the new truck side of the industry,” Tam said. “Unable to take delivery of new trucks when originally planned, new truck buyers are hanging on to units they had planned to trade. And of course, those new trucks have had their production hampered by pervasive parts shortages.”

The scarcity of new and used trucks available for purchase and a strong freight demand are driving up the prices for equipment for the rest of the year. “Looking ahead, pricing will most likely peak around mid-year 2022, based on expected economic/freight activity and forecast supply and demand,” Tam said. “It is important to keep in mind that when the market inevitably slows, it will be doing so from a record level.”

Trailer capacity tightens too

Looking at the other side of the trucking equipment equation, trailer manufacturers continue to seek increased production rates. Still, they are struggling to achieve that goal, according to another ACT report on trailer components.

“Material and component supplies, as well as staffing issues, continue to generate headwinds for U.S. trailer OEMs,” Frank Maly, ACT director of CV transportation analysis and research, said. “There are some indications that staffing challenges may be easing slightly, and that the upcoming end of supplemental unemployment benefits could further improve workforce availability.”

But even if staffing problems recede, Maly noted that “pricing and availability of components and materials are resulting in higher trailer prices and a build-up of red-tag units, with the volume of these units expected to continue growing during the upcoming months.”

With some trailer OEMs “unwilling” to accept future orders because of these uncertainties, “meaningful pent-up demand is occurring due to the reluctance to accept dry van and reefer orders at this time, with the average industry backlog-to-build ratio extending to the end of Q1’22, at June 2021 build rates,” Maly explained.

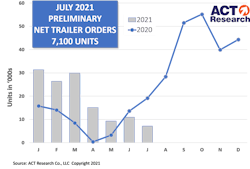

In July, trailer OEMs posted 7,100 net orders, according to preliminary ACT data. That total is about two-thirds of June’s volume and is 63% fewer orders than in July 2020.

“Trailer orders remained low for the fourth consecutive month in July,” Maly said. “The issue is certainly not demand-related, as fleets remain bullish regarding equipment acquisition. With existing order boards stretching through the end of Q1 2022 on average—and well into Q2 2022 for dry vans and reefers—OEMs continue to limit order acceptance.”

OEMs remain reluctant to take new orders as they grapple with the supply chain, limited staffing, and rising component and material prices, Maly said. “However, when the order season eventually opens, expect a surge of pent-up volume to flood in, likely resulting in a very significant commitment of available 2022 production capacity.”

But that ramp-up in production and orders is being held at bay. “While some announcements point to additional industry capacity coming online, those continuing component and staffing issues could make it challenging to fully utilize that potential in the near-term,” Maly said.