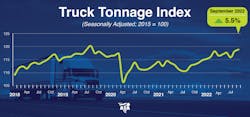

American Trucking Associations said Oct. 18 that its advanced seasonally adjusted for-hire truck tonnage index increased 0.5% in September after rising 2.1% in August. In September, the ATA index equaled 118.8 versus 118.2 in August.

“The latest gain put tonnage at the highest level since August 2019 and the third highest level on record,” ATA’s Chief Economist Bob Costello. “This is another example of how the contract freight market remains strong despite weakness in the spot market this year. During the third quarter, tonnage increased 0.5% over the second quarter while increasing 5.6% over the same period in 2021. That was the largest quarterly year-over-year increase since the second quarter of 2018.”

See also: Smaller carriers face more risk as fuel prices resume rise

August’s increase was revised down slightly from ATA’s Sept. 20 release.

Compared with September 2021, the seasonally adjusted index increased 5.5%, which was the 13th straight year-over-year gain. In August, the index was up 6.7% from a year earlier. Year-to-date through September, compared with the same period in 2021, tonnage was up 4%.

The ATA tonnage index has an established base year that is always represented by the number 100, and the current base year is 2015.

ATA’s index that isn’t seasonally adjusted, which represents the change in tonnage actually hauled by fleets before any seasonal adjustment, equaled 119 in September, 3.8% below the August level, which was 123.7. In calculating the index, 100 represents 2015. ATA’s for-hire truck tonnage index is dominated by contract freight as opposed to spot-market freight.

ATA calculates the tonnage index based on surveys from its membership and has been doing so since the 1970s. The report includes month-to-month and year-over-year results, relevant economic comparisons, and financial indicators.