ORLANDO, Florida—Heavy-duty shop revenue is climbing back to pre-pandemic levels, according to Fullbay's third annual State of Heavy-Duty Repair Report. And for Fullbay CEO Patrick McKittrick, that means shops also should be increasing their technician pay.

McKittrick unveiled the key findings of Fullbay's third annual State of Heavy-Duty Repair report at American Trucking Associations' Technology & Maintenance Council (TMC) meeting here at the Orange County Convention Center. In 2023, Fullbay collected data from 1,600 respondents from 500 participating Fullbay shops who used the platform over a 12-month period.

See also: Fleets moving from preventive to predictive maintenance save more

According to the report, a 19% increase reported by shops created an average $12,150 more in monthly revenue in 2022 than the year before. In addition, 25% of shops surveyed were pulling in between $1 to $2 million each year, while 17% reported revenue between $250,001 and $500,000. One possible revenue driver for shops is that fleets have had to hold onto older equipment longer, driving up their maintenance costs, McKittrick noted.

“While the year-over-year growth looks to have slowed down, the reality is that 2021’s rebound from the pandemic likely inflated those figures. Overall, growth continues to look strong,” said Jacob Findlay, Fullbay co-founder and executive chairman, in the report.

As a result, Fullbay’s report found that 75% of shops increased their labor rates in 2022, which, in turn, trickled down to an average hourly labor rate of $118 in North America and a corresponding increase in average invoice rates, which were roughly $965 across the country.

See also: More TMC 2023 coverage

This increase in business could be due partially to the increased digital presence of shops. Overall, Fullbay reported that 89% of shops have a website, and 25% of shops with websites receive 11 to 15 leads from their digital efforts monthly.

“I was personally a little surprised that only 89% of the shops that we talked to indicated that they have a website,” McKittrick admitted. “We're going to continue to see that number go up to eventually reach 100%.”

Technician pay, lingering parts shortages

With shops beginning to reach pre-pandemic levels of profitability with the help of their online presence, Fullbay reported that technicians at large have begun to see a shift in the way they’re paid and how much they receive.

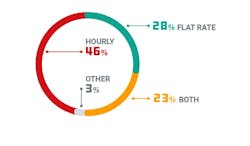

McKittrick also noted that 46% of shops still pay their technicians an hourly rate, with the highest-paid techs typically residing in the Southwest at $46 per hour and the lowest paid in the Midwest at $35 per hour. But that statistic is set to change as per-job pay is on the rise for technicians.

See also: Transforming data into intelligence can give fleets the edge

“There’s very definitive time guidelines for how long a specific job should take,” McKittrick explained. “More and more shops are willing to bill that exact amount of time, regardless of the exact amount of time it takes a technician to do that job. That kind of flat-rate, per-job compensation is going to continue to grow, in our opinion.”

When it comes to figuring out how labor rates impact technician pay, Fullbay found that for the shops that did not raise their labor rates, more than half of them also did not raise the hourly rates of their technicians. Of the shops that did raise their rates, 8% of them reported they did not bump the hourly rates of their technicians. The good news is that a majority did: 92% of shops that increased their labor rates increased tech pay, and 40% of those who did not increase their labor rates increased tech pay as well.

“You would think that if I'm going to pay my technicians more, I need to raise my hourly rate,” McKittrick said. “But you still have shop owners who feel bad about [raising labor rates and] just don't feel like you're in a position to be able to raise their labor rates to their customers. It certainly needs to be done, every single thing is getting more expensive. And it's OK for shop owners to raise their labor.”

Speaking of items getting more expensive, while Fullbay’s report showed that the parts shortage is starting to ebb, an increasing number of shops have been seeking alternate vendors. According to the report, 14% of respondents described parts shortages causing large-scale disruptions for their operations were down 3% from 2021.

“People started getting more and more creative at seeking alternatives, whether it be online alternatives or local alternatives that they can actually get that part,” McKittrick explained.