As rates still lag, trucking forecast is cloudy going into 2024

Prevailing sentiment earlier this year said that trucking was headed toward a recession like the rest of the U.S. economy. Though opinion has shifted against even a mild downturn nationwide as interest rates have come under control, freight-hauling itself still has challenges heading into 2024 with flat rates, deflated capacity, demand that still is stubbornly down, and suddenly reinflated fuel prices, as several new reports show and industry analysts say.

Two trucking data aggregators, ACT Research and FTR Transportation Intelligence, led the way with recent outlooks that are decidedly mixed, with FTR's slightly more pessimistic. A red flag for FTR and a third industry data firm, DAT Freight & Analytics, remains a slumping spot market with rates on DAT's load board, DAT One, trending as much as 11% lower than in 2022. Data from another load board that FTR watches and partners with on reports, Truckstop, yields similarly shabby results.

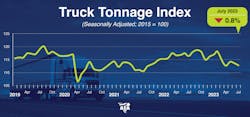

Yet one more barometer, the latest tonnage report from trucking federation American Trucking Associations, dipped 3% in July compared to July 2022, the fifth consecutive year-over-year decline in the ATA measure and a sign that the freight market remains soft. The measure slid 0.8% in July after falling 0.3% in June, according to ATA, which calculates tonnage based on surveys from its membership that it has been doing so since the 1970s.

See also: Diesel's summer surge slows, U.S. average rises about a penny

In an Aug. 23 report, FTR said its Trucking Conditions Index (TCI) also was trending down, reflecting modestly weaker market conditions for carriers. Freight rates were slightly less negative, according to FTR, but all other vital factors deteriorated. Critically, June's TCI was the most negative since November, according to FTR.

"Based on our assessment, for-hire trucking companies have already faced the longest period of consistently unfavorable market conditions since the Great Recession," said Avery Vise, FTR's VP of trucking. "We expect negative TCI readings to continue for nearly a year longer and little, if any, improvement until early 2024. As we have noted before, the challenges are not uniform as the current market is hitting small carriers much harder than larger ones, especially considering the recent upturn in diesel prices."

In an Aug. 11 report otherwise devoted to more upbeat heavy- and medium-duty tractor and trailer forecasts, Kenny Vieth, president and senior analyst at ACT Research, said of conditions in trucking: "An improving economic outlook is not a panacea to cure the freight industry's sloshy capacity situation. A less bad freight market in 2023 and rising 2024 economic expectations are at least helping to boost one side of the supply-demand imbalance with which truck and trailer buyers are currently wrestling. Adding even more new trucks into an already overcapacitized market risks keeping capacity looser for longer."

Song remains the same for spot rates

Measures from DAT Freight & Analytics of spot rates, volume, and load-to-truck ratios don't contain much good news, either, especially for smaller fleets and owner-operators, who rely more heavily on the spot market than do larger carriers, which haul freight in their lanes via more lucrative and longer-term contract rates, though even those have been lower. By comparison, spot rates are a one-time price a shipper pays to move a load at current market pricing.

A snapshot of the spot market based on DAT One activity for the week ending Aug. 12 had arrows pointing down all around for load posting activity (which fell 13.5% from the prior week, with refrigerated, or reefer, and flatbed load volumes each down 15.8%), load-to-truck ratios all lower in dry van, reefer, and flatbed, and per-mile spot rates dropping between 2 cents and 5 cents in the three equipment categories—all while the U.S. average price for diesel fuel was rising 57 cents in a month, according to the U.S. Energy Information Administration.

See also: Seasonality chills July freight volumes, rates

Owner-operators consistently complain about spot rates that, at least for dry van, still float barely above $2 per mile; for the week ending Aug. 12, the van rate on DAT One was $2.07 while the reefer rate was $2.45 and flatbed was $2.51. DAT reports attribute some of the slump to a typical summer freight cycle, but spot rates have been this low or lower for most of 2023.

Earlier this month, in its weekly Spot Market Insights for the week ending on Aug. 4, FTR did see spot rates in the Truckstop system rise for the first time in 10 weeks, but that turned out to be a momentary blip, as rates on that load board continue to run well below 2021, 2022, and FTR's five-year average—more evidence that the spot market remains in a prolonged lull. And rates are lower, but so is volume. In an Aug. 18 analysis from DAT on its monthly Truckload Volume Index, DAT saw slippage in the TVI in July, ranging from 3.4% to 12.8% among dry van, refrigerated, and flatbed.

In that Aug. 18 report, Ken Adamo, DAT's chief of analytics, had advice for spot market customers in this environment, especially accounting for recent fuel-price surges: "Spot rates, as a reminder, are 'all-in' rates, meaning no separate fuel surcharge to help mitigate the risk of fuel-price fluctuations. You have to negotiate each individual load with fuel and operating costs in mind, which is not always easy. The sudden increase in fuel prices is testing the wherewithal of small carriers at a time when freight volumes are in a seasonal lull."

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.