Low freight rates and high diesel prices made a challenging 2023 for trucking, but many experts are predicting rates and tonnage to bounce back in 2024—though the economy may not warm up until the spring or summer months.

The bankruptcy of less-than-truckload carrier Yellow made mainstream news this year, and small carriers left the industry in record numbers. For those that remain, there is potential for a rebound, but they might have to be patient.

See also: Yellow: Pension plan unjustly seeking ‘free money’ from bankruptcy case

"Spot rates have been down 30 to 40% for a year and a half," Rusty Rush, Rush Enterprises president and CEO, told FleetOwner. "Contract rates have been beaten up, interest rates are through the roof, used-truck prices are down. Those are four different things that, not one of them is a killer, but all of them combined" caused a challenging landscape for the trucking industry.

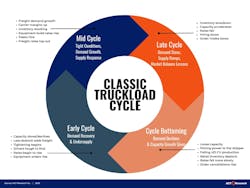

According to Avery Vise, VP of trucking research firm FTR Transportation Intelligence, low rates have been caused by overcapacity, but as they hit rock bottom, there is nowhere to go but up.

“The good news is that I don’t think there is any more room to go down. We are in a stable market at this point,” Vise said in his Insight 2023 presentation. “It is not likely to get weaker, but there is no expectation it will get stronger soon.”

Atlas Logistics SVP Matt VanderLinde told FleetOwner, “We see it getting better. Not so much in the beginning, but I think those trends are going to start getting better as we get into the second quarter.”

However, according to Bryan Courcier, SVP of transportation and construction advisory at Hilco Valuation Services, there is still an overcapacity of trucks and trailers, and with “some forecasting only 1% to 1.5% GDP growth over the next year, it will feel much like a recession.”

Analysts at ACT Research also expect the freight economy to improve in 2024, though demand for freight demand will be soft for the rest of the winter. The research firm predicted that for-hire volume growth will return as overall fleet growth fades, likely in the second quarter of 2024.

“Class 8 orders over the next few months will be pivotal in setting the tone for capacity and rates in 2024,” ACT stated on its website.

The freight recession is expected to continue throughout the first half of 2024, according to a CNBC survey of logistics executives.

More than half of respondents said they expect full truckload freight rates to fall in the first quarter of 2024, while a third expect them to go up, and 17% expect them to remain stagnant. For less-than-truckload carriers, half of respondents said they expect rates to be down in Q1 2024, while 33% said they would go up, and 17% predicted they will remain unchanged.

However, respondents are more optimistic about the second half of the year, with half saying they expect rates to rise about 5%, a third expecting a 10% rise, and 17% saying freight rates could jump as high as 15%.

There is also record inflation to contend with. The Federal Reserve has been raising interest rates to control inflation levels that reached a 40-year high, resulting in conservative business spending. The possibility of interest rates being cut in 2024 could spur businesses and consumers to spend more, increasing freight demand.

“When the Fed raises rates, people tend to hold on to money a little bit longer, and they tend to put a little bit less out there into the marketplace as far as reinvesting,” VanderLinde said. “And we do a lot of work with retailers and restaurants, so those refurbs, remodels, and things of that nature tend to slow down a little bit during times like this.”

Further, 2024 is also a presidential election year, which brings uncertainty, VanderLinde said.

“It's going to be an interesting year,” he said. “We're just going to plan on being flexible and continue to pivot to make sure that we are moving with the trends.”