The humanless difference: Autonomous efficiency goes beyond fuel savings

LAS VEGAS—Early autonomous trucking is more fuel-efficient than traditional long-haul operations. However, the actual fleet savings could come from taking the trucker out of trucking. Like so many Americans, the trucking industry is learning more about artificial intelligence's potential benefits and pitfalls.

TuSimple recently published details on an AI trucking benefit: Iits self-driving Class 8 tractors are getting 11% better fuel economy on open roads in Arizona—and even better results on some specific routes when compared to human-driven tractor-trailers. Other trucking AV companies told FleetOwner this week they are also finding similar gains thanks to the smoother, slower, more predictable robotic driving on divided highways.

Brad Ysseldyk, Trimble's director of autonomy business development, told FleetOwner that he expects actual long-haul AV fuel savings to be closer to 10% than higher numbers—"maybe even a little bit lower."

See also: Newsom vetoes California's anti-autonomous truck bill"From a fuel standpoint, I don't think it's going to be as great," he explained during an interview at the Trimble Insight 2023 user conference. "I think the real cost savings from autonomous vehicles is going to be on driver costs, which is about 45% of the overall cost of transport. So if you can eliminate that—and I am not suggesting it's going to be 100% elimination because there could be other unforeseen costs—that's where the real savings are going to come from."

He said Trimble recently surveyed more than 150 C-suite executives and found that the No. 1 reason for adopting autonomous technology would be to lower costs, followed by improving safety. With thousands of Americans killed in highway crashes each year, AV companies have touted safety as a chief benefit of their technology.

AV trucking's humanless benefits and questions

Louis Nastro, Trimble's senior director of strategy for its on-road autonomy division, said he takes an engineering perspective for AV cost benefits. Human drivers operate differently—some might be heavier on the gas while others are heavier on the brakes, for example. "Fuel is part of it, but what about the harder you're driving the vehicle, the more you're diminishing the maintenance cycles, and you're going to have vehicle diagnostics and prognostics issues."

"If you can harmonize in the aggregate across an entire fleet to get a consistent operation through autonomy, it's fuel, yes, there's an environmental impact, there's a cost impact," he continued. "But there's also the heavy maintenance aspect so that if you are driving more consistently, the diagnostics and prognostics become better."

See also: California's AB 316 pushes cleaner, safer highways into next decadeThat futuristic fleet savings is still many years away,but the development and potential of AV to augment fleet operations (which is still being tested with safety drivers behind the wheels of self-driving Class 8 tractors) is powerful. And that is among the reasons unions like the Teamsters are pushing politicians to pump the brakes on robot trucks, as played out in California this summer.

"This is about the future of work, and I am tired of people talking about the future of work without talking about the future of workers," Lorena Gonzalez, California Labor Federation executive secretary-treasurer, said after the California legislature passed AB 316, which would have limited AV truck testing and operations in the Golden State through the rest of the decade. "Big Tech continues to say, 'We're going to make life more efficient.' No. You're going to make your life more profitable."

Of course, technological advancements have been changing work since man invented the wheel. And artificial intelligence is becoming a big, shiny tool that all business leaders are eyeing to see how it can improve their business.

But most fleets and AV providers say the technology won't see widespread adoption across the U.S. for years—probably decades. It will start slowly in the Sun Belt on long-haul routes. Human drivers will still be needed for freight's first and final miles, which could create more regional jobs and perhaps provide drivers with more home time. However, on open highways, it is becoming more and more evident that AV tech can benefit operations, the environment, and the safety of the general motoring public.

See also: Kodiak pilots autonomous truck roadside inspection program"We think that it's going to make a better decision than the driver—at least as good of one," according to Matt McLelland, VP of sustainability and innovation at Covenant Logistics (No. 51 on the FleetOwner 500: For-Hire).

"But we don't see AV replacing any of our drivers," he noted during a Trimble roundtable discussion with trucking industry journalists this week. "We see it augmenting the fleet. Maybe at some point, after we're all pushing up daisies, that'll be the case. But what we tell our drivers right now is that if you take a job with us as a 21-year-old driver, you can retire with us in the future."

Autonomous trucking will need humans

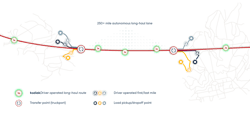

Capacity-as-a-service startup Loadsmith, which recently ordered 800 Kodiak Robotics AV trucks to deploy on its future autonomous freight network, will rely on human drivers for the first and final miles. Founder and Chief Executive Brett Suma told FleetOwner that he can't build out his autonomous freight company without humans, particularly small fleets and owner-operators.

"The biggest thing that people need to realize is that autonomous is great," he told FleetOwner this summer. "It's incredible technology. It will provide a lot of elasticity and stability in the supply chain. But it's also great that we can build the future of work for these great men and women that do this job of driving."

Covenant's McLelland said that fleets are realizing that while AV technology can provide driver-related fleet savings, it also is creating other types of work.

See also: Nodar's new object detection technology offers trucking new view of the road"When AV was first presented to carriers, it looked like the value proposition was going to be mostly about the driver-out and the savings not just with driver cost but also the recruiting, retention, hours of service, and all the unit economics of the device," he explained. "But when you start looking at all the edge cases—how to deal with breakdowns, how to deal with refueling, how to do a pre-trip inspection—there's all these other jobs that seem to be spinning up that the driver used to do."

McLelland said that his fleet hasn't seen enough about how the cost-per-mile will break down once the AV technology is mature. As more AV companies continue to eye the middle of the decade for actual driver-out freight transport, Loadsmith wants to begin driver-out operations on major freight lanes by late 2025.

But Covenant, which is working with Torc Robotics, is playing the long game by watching the AV market develop. "At some point in the next year, we'll start putting things into a spreadsheet again and start figuring out the unit economics of it," he said. "We still haven't got costs that have been shared about the costs of the trucks, so there's still a lot of unknowns for us."

AV fuel efficiency is just the start

What is less unknown is that Level 4 autonomous trucking technology can create fuel savings. It is leading to 11% to 27% better fuel efficiency than human-driven, heavy-duty trucks, according to a new TuSimple performance study.

But fuel savings are just the tip of the efficiency iceberg that autonomous trucking could bring to the middle mile this decade. While widespread AV adoption is likely a generation or two away, technology developers are seeing the path to more efficient operations, emitting less carbon, more predictable maintenance, and other potential cost savings.

See also: Torc zooms in on the AV perception challengeMichael Wiesinger, VP of commercialization at rival Kodiak Robotics, said the actual efficiency benefits of autonomous trucking could be even more significant. While he declined to share the fuel efficiency savings that Kodiak is experiencing in its budding AV operations in the South, he detailed "adjacent benefits" during the roundtable discussion at the Venetian Convention & Expo Center.

Because AV trucks drive slower and smoother than human-operated equipment, there is natural fuel savings. "I think that is absolutely valid and is 100% happening with autonomous trucks," Wiesinger said. "But if you think about it, it's not only from the driving behavior but also from some miles you can eliminate."

He said AV trucks would use fewer out-of-route and deadhead miles than humans because a driver needs to get home or find parking, for example.

"If you think about those things beyond just the obvious driving smoother or driving slower—and actually think about this from a network perspective—what you can actually change and how you can reduce inefficient miles, that's a huge sustainability effect in saving fuel and saving carbon emissions."

Walter Grigg, industry partnerships leader for Torc Robotics, said that AV technology helps trucks maximize utilization. Connecting diesel-powered long-haul autonomous trucks on the middle mile with battery-electric trucks on the first and final miles could create a low-carbon model for fleet operations.

"Diesel is going to be the powertrain for a while on long distance for the energy density," Grigg said during the Trimble roundtable. "That's where they are designed to run efficiently. They prefer to run there. So you're able to take them off the road in the other scenarios where they're not running efficiently: sitting at stop lights idling, or they're rumbling to someone's home or whatnot. So there are tons of opportunities in aggregate. They're kind of small but kind of big all at once."

Grigg declined to share Torc's fuel efficiency data but said the company is "absolutely seeing" savings.

TuSimple study finds AV efficiency

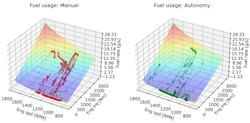

In its On-Road Maneuver Performance Study, TuSimple analyzed more than 30,000 miles of highway driving in Arizona, split roughly 50/50 between manually driven and autonomously driven miles, and compared the fuel efficiency performance of the company's skilled and experienced professional drivers versus its autonomous driving system.

"Across the trucking industry, fleets and shippers are seeking ways to reduce fuel costs and limit greenhouse gas emissions for on-road vehicles, so we set out to evaluate how our L4 autonomous technology could help meet these objectives," Cheng Lu, TuSimple president and CEO, said earlier this week. "While there is general industry consensus that autonomous vehicles' smoother and more preemptive driving patterns can offer safety benefits, we now can clearly demonstrate the technology also reduces fuel consumption, which is better for the bottom line and the environment."

See also: TuSimple looks to offload U.S. operationsThe primary objective of the study was to quantify the actual improvement in fuel economy for highway operations, which is the main operation for long-haul trucks.

According to the study's findings, if the 11% fuel efficiency improvements of TuSimple's Arizona study were applied to 20% of U.S. long-haul trucks, the industry could save 279 million gallons of diesel annually. This would reduce carbon emissions by about 6.3 billion lb.

TuSimple now offers a fuel and emissions savings calculator so fleet owners and operators can see their potential savings based on current operations. The On-Road Maneuver Performance Study of TuSimple is available for download here.