A charismatic executive works his way up the ladder to the chairman’s suite at a major manufacturing company through his determination, intelligence and gall—and he won’t take ‘no’ for an answer. It was the classic American success story, just slightly pre-Silicon Valley.

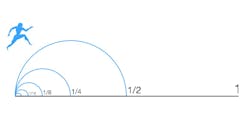

Except the great American can-do attitude crashed headlong into something that could not be done (some accounting irregularities along the way didn’t help, either).

For anyone who’s been around trucking since at least the turn of the millennium, I clearly refer to the rise and fall of Dan Ustian at Navistar, and to his very nearly taking an historic American company down with him over a stubborn refusal to adopt SCR technology to keep up with strict EPA truck emissions requirements during the 2007-2010 cycles.

I’m reminded because Navistar recently settled with the U.S. Environmental Protection Agency, agreeing to a $52 million civil penalty, among other terms, to resolve Clean Air Act violations related to its failed engine emissions controls. It’s a story that does not need to be retold here; just type “Navistar EGR” into the FleetOwner search box.

As luck would have it (and “luck” for journalists can be as simple, lately, as talking to folks at public events again), I’d just visited with Navistar VP of Marketing Diane Hames at ATA’s MC&E in Nashville.

I was at the company's booth to discuss the rollout of the new International MV series, the brand’s next-gen medium-duty truck. But because I started writing about trucking when Navistar ruled the vocational space with a professed 50% market-share target, and because I’ve known Hames for much of that time, I impolitely steered the conversation away from the shiny new product and asked her about the company’s plans for reclaiming that substantial market share lost during the engine mess. That, in turn, led to an even broader discussion of Navistar’s return as a fully-focused competitor and innovation leader in the North American truck market.

Global resources, responsibilities

This summer, Traton Group (formerly Volkswagen Truck and Bus) completed a long-anticipated merger with Navistar, adding the Chicagoland-based parent of International brand trucks and engines to the global family that also includes Scania and MAN.

Hames, who had served as general manager, marketing and strategy for Daimler Trucks North America, has a lot of experience working for a global truck manufacturer.

“You’ve got to keep in mind we're just three and a half months in now—and in the middle of a pandemic—so these things take time,” she noted. “But the thinking is clearly more forward. We've got the luxury of having a long-term horizon, with a bias towards growth and investment in this market. So that's refreshing. We look forward to being reengaged and fully committed in the market again, and not having to worry about the challenges that Navistar has had over the last decade: finding rounds of funding and investment to be able to meet the quarterly expectations.”

Still, Traton has “high expectations” for the company’s performance, she emphasized. But rather than being only as good as the latest quarterly investor report, Traton is focused on a “broader perspective” and on meeting global sustainability and decarbonization goals for the benefit of customers, employees, shareholders and the environment.

Along with sustainability initiatives, over the next five years Navistar’s “foundational growth” will mean expanding the dealer business with investments in the network; better leveraging of current capabilities and technologies; retaining the feel of being a proud American company while also making the transition to “something bigger, something that’s extra-national” and understanding the responsibilities across markets; and, finally, navigating the “known unknowns,” such as coming emissions regulations and the move to electrification.

But, I suggested, aren’t OEMs getting ahead of the market? A sustainable vision of the future is fine; but fleets need trucks that work today and modern, clean-diesel technology is about as good as it gets for long-haul trucking.

“We're going to have to get our heads around the fact that what we know today and the assumptions that we make about internal combustion engines are not the goals [for regulators],” Hames said. “It's not about NOx; it's not about particulate matter; it's not about the warranty for the customer—those are just the means to an end that they're trying to achieve, and that’s trying to get to a zero-carbon future.”

The challenge for truck manufacturers (and their customers) is that this “end-around approach” for getting rid of carbon emissions leads to rules that will drive the total cost of ownership for traditional internal combustion engines high enough that non-ICE vehicles make economic sense in the marketplace.

“I don't look at it as we're getting ahead of [the market]. It is our job to educate and assist customers and the dealer network in this transition,” Hames said. “We are trying to make sure that we, as an industry, are going to be relevant, because it's coming. We have a responsibility to make sure that we're defining our space.

“I like to say that disruption is the language of the disrupted, and creation is the language of the creators. So, as an industry, we have to define which side we're going to be on as we go forward.”

Indeed, this time of transition is “exactly the environment” for innovation, and if current leaders in the commercial vehicle space don’t keep up, they won’t be leaders for long.

“We see all the money floating around, going into all these startups and different ideas,” she said. “A lot of them will wash out but a lot of these ideas and technologies that are in the raw today will get developed. If we're not part of it, somebody will be.

“And it's not just about the OEMs being disrupted—it's about our customers being disrupted, and our dealers being disrupted. We need to make sure that we're defining and creating our future instead of [becoming] a Kodak or Betamax on the backside of this.”

Medium-duty revival

While Navistar and the International brand made a mistake with engine technology, Advanced EGR became Betamax while the company continued to make trucks. But by the mid-2010s, Navistar was no longer king of the medium-duty mountain. Hames aims to reclaim that hill.

“We want to reestablish a leading position in the medium-duty market—that’s part of Navistar’s heritage,” Hames said. “Of course, we want to grow in all segments; but we want to be the leader in the medium-duty space again and make that a core part of the dealer business as we're trying to grow.”

The market slippage in the previous decade was directly a result of the engine issues, and indirectly the financial strain meant more capital going to warranty costs and buy-back deals. But even after the failed engines were dropped when International teamed with Cummins and then developed the MAN-derived A26, Navistar “became more internally focused” and “cut back” on some product offerings “because you can only afford to do so much,” Hames explained.

“That's been the process we've been going through the last three, four years: trying to get back that deep understanding of the market segments,” she said. “Diamond Partners was the program that we launched as part of the vocational growth initiative that is now with the new HX and the new MV. As we went through the product-cycle investment, we tried to make sure we were doing the right things to actually give our dealers the best footing to get back into these markets.”

Development of the MV has also benefitted from one of the largest pre-series production runs at International, getting the new platform out in the market and into the hands of truck equipment manufacturers so that the new trucks are ready for upfit for the 2022-23 buying season.

COVID-19 has also been a challenge for MV development, as designers and engineers haven’t had the in-person interaction with customers, dealers and TEMs that’s so important in the vocational segment, Hames noted. She characterized TEMs and upfitters as an “extension of the manufacturing process,” and Navistar discovered “there's still an awful lot we can do virtually” with new technologies that put engineers “right there on the truck” to understand the problems they need to solve, such as the best location for the fuel water separator, for example.

“That's due to some of the internal changes we've made between the application engineering, the platform engineering, and the product strategy functions,” Hames said. “We’re trying to better align so we can increase the voice of customer from the market, whether it's a TEM or end customer, into our development process.”

Hames also noted that Navistar is maximizing the capabilities of the Diamond Logic system, to better serve the data-sharing needs the emerging “smart bodies” in the marketplace.

Game on

My take is this: Competition is a good thing—so long as everyone plays by the same rules. A Navistar chief executive in the mid-2000s didn’t think much of the rules for running a publicly traded corporation (or of the rules for chemistry and thermodynamics) and the company has paid a heavy price. But they’re still building trucks.

From here, the market decides.

Kevin Jones is editorial director for the Endeavor Commercial Vehicle group, with titles including FleetOwner, Fleet Maintenance, Trailer/Body Builders, Bulk Transporter, Refrigerated Transporter, and American Trucker.