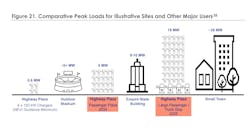

A new study of the coming EV charging requirements made the rounds in the automotive media, with headlines typically pointing to the report’s most eye-popping (and easily understandable) analogy: The charging capacity required to supply a large passenger vehicle travel center/truck stop site will be “roughly equivalent to the electric load of a small town.”

Of course, that's just one truck stop. Clusters of truck-intensive operations could blow a fuse—a really big fuse, as we'll discuss below.

The white paper, The Electric Highways Study, is meant to be a blueprint for the strategic buildout of fast-charging sites along highway corridors to meet an upcoming surge in demand from the electrification of passenger vehicles and commercial trucks.

National Grid, an energy company with a natural gas and electricity network in the Northeast, along with Calstart, RMI, Geotab, and Stable Auto, conducted the analysis of current traffic patterns and expected charger use to forecast charging demand at 71 highway sites across New York and Massachusetts.

See also: Fleets 'frustrated' with utilities slow to support electric truck charging

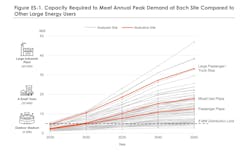

Currently, the electric grid does not have "sufficient delivery headroom” for highway charging to meet projected demand and policy targets, according to the report. Sites with significant charging loads will need “considerable” electric distribution system upgrades and, in many cases, high-voltage transmission-level interconnection. As we’ve discussed in this space recently, these interconnection upgrades are expensive and take four to eight years to complete.

While light-duty vehicle traffic will generate demand in the near term and could trigger initial interconnection upgrades, over the longer term medium- and heavy-duty vehicles will “drastically increase” the required capacity at many sites—and at a “much faster” timeline than may be expected.

So the report highlights the importance of preparing for commercial vehicle charging sooner rather than later. The good news: Many of the highway sites in the study are located near high-capacity transmission lines, making the substantial capacity upgrades feasible—which is better than unlikely or impossible. The study calls for “proactive investment to future-proof sites” that can reduce the need for “duplicative investments,” minimize grid infrastructure costs to site owners, and allow for faster and more efficient charging installations.

“By deploying these no-regrets upgrades at no-regrets sites, we can ensure that the electric grid becomes an enabler—even an accelerator—to the EV transition,” the study concludes.

But, as Brian Wilkie, National Grid's director of business development for New York transportation electrification, explained at last month’s T&D World Expo, that’s arguably wishful thinking.

Who pays for electric truck infrastructure?

At the T&D World show, Wilkie outlined the challenges revealed in an earlier study, on which National Grid worked with Hitachi ABB Power Grids. That analysis took a “bottom-up” look at fleet demand within a specific area of upstate New York. The report pinpointed major fleet operations and then did the math on the charging capacity the fleets would need.

Basically, a dense industrial area should be ripe for commercial vehicle electrification, and it’s time to plan. Because the grid, as it stands, can't support the projections.

“Is there an opportunity for utilities and regulators [public utility commissions] to work together?” Wilkie said. “Rather than process service requests from individual customers on a one-off basis, can we instead go into these clusters—where we know trucking fleets want to be—and can we create an area solution to this problem?”

See also: Fleets face 'very steep' learning curve on road to EVs

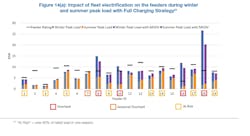

In explaining the chart below, Gary Rackliffe, VP for market development and innovation at Hitachi Energy, pointed to the feeders highlighted in yellow and red (13 of the 19) that would be overloaded or at risk of overloading, based on the projections. Circuit 18 is nearly off the chart (more than 300% of the feeder rating) for a circuit with a capacity of less than 10 MW, currently handling a load of 2.5 MW, needing to support 26 MW for electric truck fleets.

“As we move forward with electrification of transportation, particularly with medium- and heavy-duty fleets, and then overlay light duty electrification, the takeaway is we're going to have some problems on certain circuits, particularly those circuits where we get clustering of fleets,” Rackliffe said. “We can look at the macro level and see if we have enough energy generation to be able to serve these fleets but at the distribution level and at the substation serving these circuits, we're really going to have some challenges.”

Wilkie noted a couple of additional challenges.

First, fleets don’t know how much power they’re going to need—especially during the transition to EVs. For a fleet to pay for substantially more charging capacity than what’s initially required is very expensive, yet so is incrementally growing capacity until that major upgrade to a high-power connection is needed. So utilities proactively should consider the needs of multiple fleets in a given area to provide the capacity in advance—but that’s not how business typically is done by utilities.

“That just seems like a broken way of accommodating this,” Wilkie said. “But regulatory structures today don't allow us to do what we think is the lowest cost solution for our customers. From our perspective, we don't see them moving swiftly enough to create regulatory constructs that allow us to do this work. It's going to be an avalanche.”

The key will be to develop “long-term forecasts that are data-driven” and convincing regulators that the utilities and customers will come up with cost-effective solutions. Communities (and ratepayers) served by forward-thinking grid expansion will then benefit by becoming more attractive to companies with sustainability programs and to the secondary businesses that support them.

A second sticking point, however, will be that regulators need to think more widely than just their jurisdictions. For instance, regulators in New Jersey or Pennsylvania might resist making their ratepayers fund fleet electrification for trucks that serve New York City. And even utilities in the same state might not value investments to benefit a wider area, Wilkie pointed out.

Essentially, everyone—fleets, utilities, regulators, policymakers—needs to think ahead and think "holistically" so costs can be shared.

“Investments that we may be making could be benefiting another utility’s customers, right?” Wilkie said. “And there's lots of trucks that originate in New Jersey that operate within our service territory. So if they electrify their ports, our customers benefit because those trucks run through their communities.”

Regardless, there's a hefty price tag for CV electrification.

“Yes, it's going to be expensive. Nobody wants to hear that, but there are ways to make it less expensive. And our job as utilities is to identify those solutions and build them and start immediately,” Wilkie said. “And the sooner we start, the cheaper they will be. If you wait 15 years to address this, I can guarantee it will be double and triple the cost for the same exact thing.

“We've tried to impress on regulators, ‘let us start right now.’ Regulators have to get more comfortable with giving utilities a longer leash.”