INDIANAPOLIS—Three things are certain in this world: death, taxes, and the urge to avoid both.

That’s nothing new. Neither, essentially, is the Modern, Clean, and Safe Trucks Act of 2023, a bill filed this week that is the latest attempt to do something about the federal excise tax (FET) on heavy-duty trucks and trailers.

In addition to FET’s making equipment more costly (at 12%, that’s the highest such fee on the books), the tax long has been the source of confusion and, behind the scenes, the source of dubious interpretations of its applicability—i.e., cheatin’. (Ask your local reputable equipment dealer for some stories.)

See also: Trucking groups say FET impedes fleets’ zero-emission adoptionSo, once again, the trucking industry has enlisted lawmakers from both sides of the aisle (a substantial achievement!) to repeal a century-plus-old tax on the most essential equipment to the American supply chain. Previous efforts have fizzled—if they even managed to spark some hope that common sense would prevail.

But this time is different, maybe, according to several veterans of futility.

“There's a great bipartisan set of sponsors that I think provides the best opportunity we've ever seen for action,” Michael Kastner, NTEA SVP and government affairs expert, told FleetOwner—and electric and other zero-emission vehicles could be the decider. “With the new technology that's coming out, vehicles will become more efficient but probably more expensive—which means more FET. And that defeats the purpose of trying to get more fuel-efficient vehicles out there and keeps people holding on to their old vehicles longer.”

See also: Intellistop pulsating brake lamp exemptions flood Federal Register

EVs to the rescue?

In essence, the FET penalizes the buyers of expensive new electric trucks even more than it has long penalized the buyers of the latest and most sophisticated, safe, and efficient conventionally powered trucks and trailers on the market.

But the costs for cleaner engines, advanced driver assistance systems, etc., have been relatively incremental and not exactly rockstar-level influencers.

Yet EVs are so cool that even Luddite-leaning lawmakers should wake up to the absurdity of demanding zero-emission equipment upgrades while a World War I-based tax negates the EV subsidy taxpayers provide to cover the transition costs. And commercial fleets are less interested in cool than total cost of ownership—while some allowances are granted for a little chrome here and there. If the math doesn’t work, EVs won’t work.

See also: Electric truck production expected to triple in 2023Still, the argument that fleets are penalized for doing the right thing is the same one repeal supporters have long made, just turned up to 11.

“As increasing regulatory burdens are mandated by the EPA, CARB, and other government agencies, the costs of heavy-duty trucks and trailers continue to increase, making the FET that much more burdensome,” Gwendolyn Brown, National Trailer Dealers Association president, said in an email.

Brown responded so quickly to my query that I suspect most everyone in the transportation equipment business realizes we’ve basically said and heard all of this before.

Still, for the record, I include a sample of re-charged comments from previous leaders on the FET-repeal merry-go-round.

“The current federal excise tax has become a barrier to our progress in encouraging cleaner and greener technology,” said Sen. Ben Cardin, a Maryland Democrat who sponsored the Senate bill, S 1839, along with Indiana Republican Sen. Todd Young. “I am proud to support tax policy that enables Maryland manufacturers to innovate and deploy cleaner and safer technologies in our trucking industry. Our legislation will spur growth and competitiveness while making our roads safer and less polluted.”

American Trucking Associations supports the legislation, again.

“By moving to repeal this antiquated tax, Senators Cardin and Young are showing that they’re serious about improving highway safety, reducing emissions, and creating jobs,” said ATA President and CEO Chris Spear. “The federal excise tax was created more than 100 years ago to help the nation win World War I. Eliminating it will help us win the 21st Century by getting rid of a barrier to putting safer, more environmentally friendly trucks on the road.”

Rep. Doug LaMalfa, a California Republican, and Rep. Chris Pappas, a Democrat from New Hampshire, reintroduced legislation in the House.

“Truckers are an essential cornerstone in our supply chain, yet the tax code disincentivizes them from purchasing the most up-to-date equipment,” LaMalfa said. “I’m urging Congress to support this common-sense, bipartisan bill, and drop the burdensome tax preventing our truck drivers from having the most modern, highest technology, and safest equipment on the road.”

American Truck Dealers likewise maintains its support—and a handy webpage for tracking the legislation’s progress.

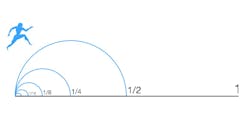

“Nearly half of America’s trucking fleet is over 10 years old,” said Scott McCandless, chairman of ATD and president of McCandless Truck Center of Aurora, Colorado. “Repealing the FET will be a giant step toward achieving our national goal of turning over America’s aging truck fleet.”

If I were a betting individual, I’d put the over/under at an FET exemption for EV-related equipment purchases, which will make a complicated tax all the more difficult to assess. Sure, there's some benefit to some equipment users—but it’s not an immediate win for fleets.

Maybe Congress will surprise us.