The real issue behind the widespread adoption of commercial electric vehicles has always been a question of “when” rather than “if.” But we’ve been asking that question for quite some time. Not to be the whiny kid in the backseat, but, “Are we there yet?”

I bring this up because FleetOwner’s Commercial Electric Vehicle & Infrastructure Conference (CEVIC) takes place next month in Sacramento—arguably the epicenter of CEV adoption.

The goal for CEVIC is to put fleets in the same room with CEV makers, utilities, charging equipment suppliers, regulators, and public service commissioners to make sure the key players understand the diverse and sometimes divergent expectations of what’s required to make the transition work.

The Sept. 12 conference is a lead-in to T&D World Live, which is organized by the leading media source to electric utilities for 75 years (and an Endeavor Business Media brand, as is FleetOwner). So the utilities folks are going to be there by the hundreds.

See also: Grid not prepared for electric truck 'avalanche'

And, based on last year's inaugural T&D World event, where FleetOwner hosted something of an ad hoc session, there is a disconnect that needs to be addressed. Simply, adopting CEVs is not simple—not yet, anyway. Utilities know very little about freight operations, and fleets could be in for a shock as they plan to add electric trucks to the equipment mix.

In making some calls to invite fleets to join us, I chatted with Joe Rajkovacz, director of governmental affairs and communications for the Western States Trucking Association. I’ve known Rajkovacz for years, and he’s not one to pull punches. And he’s not one for adopting the latest trend because an influencer touts it on TikTok—though he surprised me a little bit when he expressed support for electric trucks. But only when and where they make sense.

“The economics of this is really not penciling out for anybody, even with all the subsidies,” he said. “Virtue signaling ain’t going to get a higher rate—cargo owners are always going to go with the rates.”

We in trucking know there has to be a payback, however small, when profit/loss is determined by costs measured at fractions of a penny per mile.

Indeed, a perusal of the archives shows that way back in 2010 FleetOwner reported on EV market research from IDC Energy which concluded that total cost of ownership (TCO) was going to be the key to commercial adoption.

But future TCO estimates for EVs are best guesses, at best: Who really knows what a battery is going to cost, or what the range is going to be when the technology is so rapidly evolving? Likewise, what are electricity rates going to be?

“PEVs are coming,” Sam Jaffe, research manager for consulting firm IDC Energy at the time, told FleetOwner. “Despite many doubters, this oft-promised technology is finally on the verge of becoming a reality. The electric utilities industry [which would supply power to PEVs] does not have the luxury of taking a wait-and-see approach: It must begin to prepare for their arrival now.”

Again, that was 13 years ago—and utilities still are not prepared for large-scale CEV deployment.

Three-year wait?

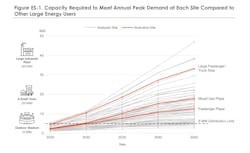

According to ACT Research’s newly released edition of Charging Forward, a multi-client decarbonization study of the U.S. commercial vehicle market, conversion of the CV sector will require “a very coordinated effort” to ensure adequate charging infrastructure is in place to support fleet needs.

“Early adopters of battery-electric commercial vehicles experienced rather lengthy timelines to install EV charging infrastructure," Ann Rundle, VP of electrification and autonomy with ACT Research, said. "Utilities have now been able to support timelines of nine to 13 months, from initial preliminary design to final design and construction, but those lead times reflect adequate, existing transformer capabilities.”

A “more conservative rule of thumb” indicates fleets should begin planning and coordinating behind-the-fence EV charging infrastructure to allow for an 18- to 24-month lead time, the report suggests.

See also: Fleets face 'very steep' learning curve on road to EVs

“If an area requires more extensive grid upgrades, increased lead times are needed, especially if they require additional levels of approval,” Rundle added. “Feeder upgrades could take more than a year. Substation upgrades could take one to two years. New substations could take three years or more, as this would encompass planning, load interconnection studies, and complexities in the permitting process.”

Similarly, and to help fleets understand charging infrastructure, the North American Council for Freight Efficiency recently updated its Charging Forward with Electric Trucks report.

This second-generation report on charging infrastructure comes out just as NACFE begins its Run on Less: Electric Depot, focusing on several fleets running more than a dozen EVs out of the same depot.

See also: Roeth: A passion for electric trucks

The depot study will be a centerpiece of the CEVIC event, the bridge between the fleet and infrastructure audiences. Attendees can look forward to hearing about the real-world experiences of shippers and fleets as they implement their charging plans.

A more complete and still-growing CEVIC agenda is here. Look for additional coverage ahead of the show. In the meantime, registration is now open. Promotional codes are available for a limited number of seats for members of trucking associations, so check with me if you’d like a free pass.

Let’s keep in touch.