SACRAMENTO—Key players in the commercial vehicle industry laid out the near-term risks and long-term rewards of the transition to zero-emissions trucks, and detailed why fleets will face a decade of challenges as operators are caught between increasingly aggressive regulatory mandates and the ability of equipment suppliers and infrastructure providers to deliver newly required solutions.

Indeed, representatives of the nation’s largest truck manufacturer, the largest truck dealership group, and the largest charging equipment provider say they’re prepared to lead the charge, but electric trucks aren’t going anywhere without charging infrastructure.

Jed Proctor, manager of infrastructure strategy for zero-emission vehicles at Daimler Truck North America, opened the panel on the CV market and outlook at FleetOwner's Commercial Electric Vehicle Infrastructure Conference here, where OEMs, fleets, and utilities gathered to understand who needs what, when, and where to make the EVs work.

See also: Truck charging in the 'real world'

Proctor outlined DTNA’s substantial credentials as the market leader, including a long-standing 40% market share in heavy-duty trucks, as well as its wide array of products ranging from school buses to delivery vans and RVs to vocational vehicles and Class 8 highway trucks.

Additionally, DTNA is already producing electric options for many of those vehicles, and the company has invested in public charging stations, battery manufacturing, and fuel cell development.

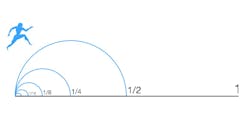

Then, with bona fides established, he got to the point. Displaying a chart that would be among the most complicated of the day, Proctor laid out the range of U.S. NOx and greenhouse gas regulations facing commercial vehicle manufacturers and operators heading into the 2030s.

“What are we up against as an OEM?” Proctor asked as he discussed the slide’s main elements, beginning in 2024 with CARB’s low NOx and Advanced Clean Fleet and Advanced Clean Trucks standards as well as national GHG reductions, extending to 2027’s stricter limits and ramped up electric truck requirements with additional mandates in the works. “This kind of gives you a flavor of the of the waters that we as an OEM are navigating. Our customers, and rightly so, are very worried about what the next decade holds.”

Illustrating the pitfalls of a broad and ambitious regulatory agenda, Proctor noted that the stringent, ultra-low NOx limits have required major investments to make the last generation of diesel engines compliant, with only incremental improvements in emissions.

“We would have much rather put that money into just leapfrogging these technologies and going straight to zero emissions—but that choice was not an option,” he said.

This summer’s Clean Truck Agreement, in which engine manufacturers and CARB agreed to go along to get along (along with a deal to stick to a single, federal standard) was meant to address some of the potential unintended consequences of multi-agency, multi-state rules.

“We don't want people to get the wrong idea that we're not trying to do what we can for the environment,” Proctor said. “What we're trying to do is make sure that we have regulatory stability and can produce products for our customers that gets the job done.”

See also: So many alt-fuel choices, but so little time?

And getting the job done is the real mandate. That’s why DTNA (and other major truck OEMs) are developing new partnerships, even new businesses, to make sure customers’ needs are met with the next generation of clean commercial vehicles. Daimer Truck, specifically, will collaborate with utilities to support infrastructure development by providing operational data, based on telematics, to help plan and implement charging capacity where it’s needed.

Proctor highlighted today’s clusters of distribution hubs, and the massive power loads that would be required to serve demand based current truck telematics.

“I can't name the trucking companies that are going to operate those [electric] fleets 5 to 10 years from now, but I can guarantee you the load’s going to be where it's needed—because those warehouses aren't going anywhere,” he said. “These are locations where we can confidently invest in infrastructure, and the offer we've given to utilities is we're willing to share this data for your utility area.”

Having such data, ahead of demand, will be critical to getting utility commission approval to invest in projects ahead of load demand—because, traditionally, that’s contrary to standard procedure. Proctor emphasized that fleets operate on thin margins and are, therefore, “risk averse.”

“Most of them are just trying to get freight from A to B, and keeping their head above water,” he said. “When they get hit by regulation or when cost curves change, and when they start getting out-competed, then they're going to scramble. They’re going to come to their utility to say, ‘When can I get connected?’ So it behooves the entire industry to say, ‘yes, we pre-planned for this; we have load in your area because we knew he was coming.’”

But those multi-megawatt loads aren’t there yet in most places—so temporary power solutions are critical, Proctor continued.

“Again, the risk averse nature of our fleets is that they want to try something first,” he said. “They want a handful of trucks, they want to know they do the job. They want to know they can operate efficiently and reliably.”

A slide featuring a diesel-powered generator provided the punchline.

“Temporary solutions also give you [utilities] a little room to get the big power to the site if you're able to give them something early,” Proctor said. “It's better than the alternative because, believe me, our customers will do this if they have to: Nobody wants to see an electric truck that's charging off of a diesel generator.”

The bottom line for a successful transition to zero-emissions vehicles will be the bottom line, Proctor concluded. And that means OEMs must provide viable products that are supported by a dependable and affordable charging infrastructure.

“It is critical for our customers to be able to operate profitably and successfully,” he said. “Again, commercial vehicles are tools. Tools are only purchased if there's a payback.

“We're going to get there, but it's going to take everybody working together to make sure we get there.”

Up next, the dealer perspective: Rush strives to be all things to all customers in alt-fuel transition