Things look bad and most of us are afraid (or ordered) to leave our homes. As dark as things are right now due to the COVID-19 pandemic, it appears one bright spot for the U.S. supply chain may be last year’s trade war with China.

“I hate to use the word stockpile, but all the trade tension a year or so ago with China caused a lot of these manufacturers, wholesalers and retailers to invest in inventory to pad themselves for an event like this,” said Ken Adamo, chief of analytics for DAT Solutions. “It's nice that it's insulated a bit so that we're truly not yet feeling the full brunt of the disruption in Southeast Asia.”

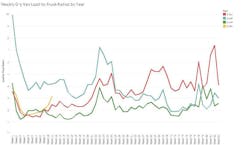

In fact, judging by DAT’s numbers, trucking is (right now) healthier than it has been for a few years. Load-to-truck ratio (LTR), or the difference between freight availability and trucks’ capacity, is matching the 2018 levels, which as DAT notes, was a “high watermark.”

“Since the start of March, we've seen a substantial decoupling,” Adamo said, which means the data isn’t acting in accordance with previous predictions. Adamo said while the down-cycle was already supposed to end, this was “much more dramatic than expected.” As of mid-March, spot dry van rates are up at least 5%, while last year rates continued to dip until late spring.

This is in contrast with what experts believed would happen, Adamo said.

“The talking head consensus was this was going to be very deflationary, like crisis level deflationary for rates and volumes and no freight would be moving,” he noted. “And then fast forward three weeks, and everything's blowing up.”

DAT reported that LTR rose in 63 of 100 of the top van lanes, with only five—connected to long haul—dropping. Dallas-to Houston increased the most at 14¢ for a $2.23 per loaded mile cost.

This is clearly driven by demand, as everyone has been rushing out to buy supplies such as toilet paper and hand sanitizer, before they hunker down in their homes to prevent the spread of the insidious and still mysterious coronavirus. And the supply chain has risen to the challenge to keep up the supply. Amazon has hired 100,000 new workers as ecommerce is the preferred method for consumers to obtain necessities. According to Gordon Haskett Research Advisors, 41% of the people now buying groceries online have never done it before. And they will likely continue to do so, as President Donald Trump admitted the coronavirus outbreak could continue through the summer.

Bloomberg reported that U.S. grocers are also responding by limiting item variety of in-demand goods including hand sanitizer, disinfecting wipes and toilet paper to ensure easier replenishment.

“That will simplify our stocking,” said Kevin Holt, U.S. CEO of European grocer Ahold Delhaize NV. “This is not just about our supply chain. It’s about all supply chains.”

There is plenty of uncertainty going forward, though, which could lead to false sense of security in the supply chain.

“What we don't know is the compounding effects of a couple different things: coronavirus, spring, seasonal returns shipping, the start of a 12-to-18 month traditional upcycle, and now you add in sort of the impending potential for technical recession in the United States,” Adamo said. “It’s too soon to tell the impact from more aggressive social distancing, but we are seeing spot truckload rates continue to climb nationally and expect that trend to hold for the next several weeks at a minimum.”

One thing the economy will have going for it is that productivity will be forced to restock what has been hoarded.

“I think there will be a rush to replenish further up the supply chain right to manufacture more toilet paper, to get more bottled water,” Adamo said.

Just as the dry van spot rate is an indicator of a working supply chain now, if it drops then the opposite may be true.

"If we start to see a decrease in demand (loads) driving down LTR as a result of the aggressive distancing, then we would likely see rates crest and then retreat," Adamo said. "It’s a major unknown right now and probably the biggest question I’m getting from the industry."

The situation is always changing, and the crisis could diminish if a miracle vaccine or a cure is found (the U.K. is starting a trial next month), or it could get much worse as budget travelers and spring breakers who did not heed CDC warnings return to their hometowns to potentially reintroduce the virus into the community. There is also the question of how long HOS waivers will be in effect

And on the supply side, "if we see new policies in place that restrict the movement of goods domestically, all bets are off," Adamo said.

There is one thing that is absolutely for certain. The country needs trucks to operating at full strength right now, because times may be lean ahead.

“These are the times when the wheels have to turn if it's safe to do so,” Adamo said. “Even if you think about a one- or two-month span with five or 6% uplift in rates, every mile those wheels are turning, that's money in the bank.”

He does stress vigilance and closely monitoring where fleets are sending their drivers.

“In this new age where you can log into software (such as what DAT Solutions provides), and see the load-to-truck ratio, you can pretty well target where a lot of the freights going and coming from and make wise decisions about what to accept and what areas to go into to maximize your time.”

Adamo had one last bit of advice: “Get comfortable with a little bit of uncertainty for a while.”