In April, thieves in Mesquite, TX, stole a Wells-Cargo 15-ft. trailer loaded with 86 cases of cookies, and they figured it was a sweet deal. However, owner-operator Joe Mills called local police, who logged the theft into the Texas Crime Information Computer, part of the National Crime Information Center (NCIC) network, and an alert popped up on law enforcement screens nationwide. The log-in also activated a LoJack transmitter hidden in the trailer.

The LoJack signal was picked up by Dallas police, who tracked the signal to a home in Southeast Dallas within a few hours. The trailer and cookies were retrieved and returned to the owner. Three arrests were made. More important, the alleged thieves signed statements admitting to thefts of 25 other trailers.

This incident is rare. Too often when a stolen trailer is found, the cargo has already been unloaded, and the goods are either on their way in a different trailer or divided up and loaded onto smaller trucks. According to police, stolen cargo is often offloaded within an hour or two.

Cargo thefts in the United States are growing, with FBI estimates ranging up to $10 billion annually. Countries like Mexico and Italy have escalating rates, too. “I've been in business for 20 years. I used to get a call about a cargo theft every few weeks; now, I get at least one call before I have my first cup of coffee in the morning,” says John Albrecht, vice president of Transport Security, Waconia, MN. During recent economic boom times, trucking companies were more willing to absorb the cost of a loss, but that attitude has changed, he says. “A few years ago the industry could write off the losses — people were making money — but not anymore.” He estimates that for every dollar lost through theft, a company must bring in $10 to $15 in revenue to make up for it.

Carriers are faced with several choices. Ideally, they would like to prevent cargo theft in the first place, but that isn't always possible. Second, they'd like to find it before the cargo is unloaded and the trailer is damaged. Next on the list would be to find the trailer in one place and the cargo in another, with both intact.

While systems exist to find stolen trailers, finding the cargo once it's been removed from the truck remains illusive, both technologically and financially. However, the rewards can be great because the cargo is often worth more than the trailer. In addition, crooks, like those who stole the cookies, can often be tagged for other heists, and putting career truck thieves out of commission yields dividends for everyone in the industry.

THEFT ON THE RISE

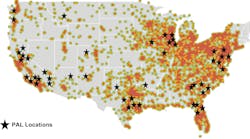

Seeing the rise in cargo thefts, Dedham, MA-based LoJack decided this year to transfer its expertise in retrieving stolen autos to retrieving purloined trailers. The product, dubbed “LoJack for Trailers,” is a police-operated system that works the same way as the company's car-locating system. When a truck is stolen, the theft is reported to police, who enter the incident into the NCIC computer. Each LoJack unit is pegged to a vehicle identification number (VIN), which automatically triggers a signal sent out on a special FM frequency. This signal activates the LoJack device hidden in the truck, which in turn sends out a homing beacon to police, who can track it in their cars. The tracking device, given free to police agencies, has a five-mile radius and uses arrows to show police which way to steer their cruiser to locate the stolen vehicle.

The quick timeframe makes this a viable option for fleets because the crooks may not have unloaded the cargo yet. “Most vehicles are recovered within three hours,” says Kathy Slatcher, LoJack's national sales manager-commercial. She notes that the LoJack signal can penetrate into warehouses and even into the cargo hold of ships. So far, about 1,000 trailers have been outfitted with their device, which is about the size of a Palm Pilot. The company takes great pains to install it in what she calls “stealth” mode: No one is allowed to watch installers work, they don't wear LoJack logos and they vary the device's placement in trailers. “We don't even tell the owner where it's installed,” says Slatcher.

The company boasts a 90% recovery rate for cars over its 14-year history, and Slatcher expects commercial recoveries will mirror that rate. The cost is about $595 per unit, and volume discounts are available.

One volume buyer is St. Paul Companies, an insurance carrier in St. Paul, MN, that purchased 5,000 units and is selling them to customers at their cost. “We found that we weren't getting our equipment back; we were just paying bills,” says Dan Murphy, vp-risk control. He estimates the value of lost trucks and construction equipment at $21 million over the last five years.

He says it's too early to measure return on investment, but says the units will most likely pay for themselves not only in replacement value of lost trucks, cargo and construction vehicles, but in savings on not having to process claims. “If we can recover equipment in a few hours, we don't have to do the paperwork. That saves us a lot of money,” says Murphy.

LoJack does have its limitations. First, the system only operates in about 20 states. Second, while it may help find the trailer, it can't always do so while the cargo's still intact. Because LoJack is tied to the VIN, it can't be placed in cargo that can be unloaded and transferred to another truck in less than an hour.

For fleets interested in both trailer and cargo retrieval, the game becomes more challenging. Terion, Melbourne, FL, comes close with its FleetView device, which works off the nation's cell phone network. Consisting of a black box about five inches by eight inches and one inch thick, the units are installed inside the trailer liner. The antenna looks like a marker light, making it less obvious to would-be thieves. In concert with a cargo movement sensor, the unit telephones the company's data center when something is amiss and the owner is notified.

The user can set time parameters that allow normal cargo movement during certain times but not others, so the device is activated when a truck is sitting overnight in a warehouse or yard, for example. Because it can be used for cargo management — fleets are sent emails detailing when cargo is moved — this feature itself can help pay for the cost of the product. “The real payback is in trailer management,” says Edward Mushill, director of FleetView marketing. He adds that a door sensor can also be added, which might be the most telling sign that a theft is taking place outside of a specified time window.

ULTIMATE GOAL

The cost is $425 to $500 for each device, with a monthly fee of $11 to $16 based on volume. By September, XTRA Lease had already installed almost 25,000 units, with an option to buy more. J.B. Hunt will install 17,000 units by year's end.

The system currently uses analog phones, but Mushill says the next step is to go totally digital in some metropolitan areas. “Right now, analog gives us the largest footprint and reaches into rural areas,” he says.

Tracking cargo on pallets remains the ultimate goal, but it's tough to accomplish: The size of the tracking device must be small, it must be powerful enough to send a signal through warehouse walls and ship holds, and it must have nationwide coverage.

Albrecht's company and an undisclosed truckload carrier are Beta-testing a device that is about the size of a pager and is aimed at high-value freight. “It's GPS oriented, but that won't give us line of sight, so there's also going to be a wireless (cellular) component, too,” he says. The as-yet-unnamed device is about six to nine months away from rollout. It will always be activated, and uses AA batteries that are good for about 30 days. The unit will lease for around $100 monthly.

Another future possibility is so-called radio frequency identification or RFID tags. These are inexpensive chips that can easily fit inside a pallet or even in individual merchandise boxes. They operate like tags in retail stores. Walk through the doors without paying and the alarms goes off. For trucks, the units would always be on and transmitting a signal to a reader or ‘interrogator’ in the trailer or cab. When the reader no longer detects a signal from the RFID tag, an alarm goes off or a signal is sent to a remote location.

The big problem is price, according to John Paepcke, senior analyst at Stanley Associates, Alexandria, VA, a company that consults and installs satellite and other tracking devices for the transportation industry. “The chips cost only a dollar or two, but the interrogator can cost up to a thousand dollars.” He also notes that these devices might have the same limitations as other devices; they must have a strong enough signal to penetrate walls of a cargo hold or warehouse.

Airplanes have special problems with transmitters, he says, because they could interfere with navigation equipment. Another limiting factor is range of the RFID tag. Currently, readers usually have a range limited to 100 ft. but that might be extended especially in metropolitan areas using the digital cell phone network.

OTHER OPTIONS

Qualcomm Inc., San Diego, CA, is looking at RFID technology. “Historically, the RFID system we have for our military freight tracking product is too expensive for commercial applications,” says Chris Wolfe, president, Wireless Business Solutions Div. “But we're relooking at that now.”

Companies are also examining sophisticated seals on pallets that once broken send a signal to an interrogator. As with RFID tags, the main roadblock is short transmission distances. As all of these new technologies come on board, the best answer is not to put all your eggs in any one basket, but to use many different technologies.

That includes strong locks that can go a long way towards cutting some thefts. According to Gail Toth, executive director of the New Jersey Motor Truck Assn. and director of the Cargo Loss Prevention Network, in some metropolitan areas like New York City, thieves are becoming so brazen that they routinely break open trailer doors with a sledgehammer while the driver is stuck in traffic. By the time he exits the cab to see what's happened, they've run away with merchandise. “For the average carrier, sometimes a strong lock may be the simplest and most cost-effective protection for low-value cargo,” says Toth.

“My equipment has been stolen…now what?”

How does LoJack work?

- After equipment with LoJack is reported stolen, a signal from a police radio tower activates the LoJack unit in the stolen equipment.

- The LoJack unit sends a silent signal to police.

- The LoJack Police Tracking Computer receives the LoJack signal, identifies the stolen equipment, and …

- …leads police directly to it.

See this story and more online at www.fleetowner.com