During a year full of capacity constraints, private fleets relied on the stability of their own transportation systems to control costs and keep customers happy, according to the National Private Truck Council’s annual benchmarking report. A busy year of COVID-19 recovery was spent trying to keep drivers happy and equipment running a little longer as the industry wrestled with the supply chain and rising costs.

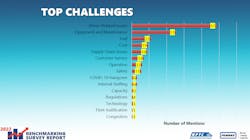

The most common challenges for private fleets involved drivers, according to the survey of more than 100 NPTC member companies. Moore said respondents cited the aging driver population, driver recruiting, driver turnover, driver hiring, driver retention, and the driver shortage. The other top challenges are equipment and maintenance, fuel, costs, and supply chain.

See also: Fleets can pivot to fight chronic driver turnover

“It’s been another growing year for our fleet, and it’s largely due to the outside contract carrier market being really rough and escalating quite rapidly in price,” Mike Cramer, corporate VP of transportation for Quikrete Cos. (No. 171 on the 2022 FleetOwner 500: Private Fleets), said during a media briefing on the 2022 NPTC report.

“We pushed to add drivers,” Cramer added. “Not only on the outbound side of things but the inbound side. Hauling on common carriers is just getting expensive—and it’s making the private fleet more and more attractive every day.”

The 2022 report is based on 2021 data gathered from private fleets that are part of companies whose primary business is not transportation. NPTC member fleets use the extensive benchmarking report to compare operations and performances. Nearly half of those companies surveyed (46%) cited customer service as the top reason they run their own transportation; 22% said cost control, 13% distribution control, and 7% capacity.

Private fleet shipments increase

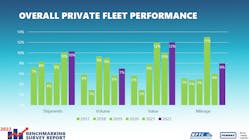

“It was a pretty robust year for us with activity on the part of our members up year-over-year,” said Tom Moore, executive VP of NPTC. “Every year, we continue to hit a new high when it comes to measuring shipments, volume, or the value of those shipments.”

Survey participants reported shipments increased by 10.3% in 2021 from 2020. That percentage increase is up over levels that rose 9.7% the previous year and 8% three years ago. Reported volume was up by 7.3% on the heels of 2020’s reported 5.6% gains and the 9% growth rate in the previous year. Also, shipment values rose in this year’s survey by 11.5%, compared to 9.7% last year and 12% two years ago.

“That was the second full year of pandemic pressures,” Moore said of the 2021 data during the Oct. 19 briefing. “We also had a pretty brisk economic outlook there—but we’re seeing some of that economic growth slow as inflationary pressures creep in. We had a real capacity crunch on the part of outside carriers that led to higher rates—if you could find service. We also had supply chain shortages on the equipment side. So many of our members were not able to get that equipment on a timely basis.”

Despite equipment shortages that pushed some fleets to extend the life of their trucks, tractors, and trailers, NPTC fleets were more efficient in 2021, Moore said. Private fleets in the survey reported an 8.2% mileage increase last year.

Safest year in history of NPTC survey

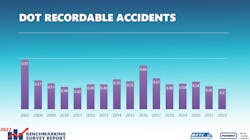

They were also safer than the average motor carrier. NPTC fleets reported the lowest U.S. Department of Transportation Recordable Accident rate—0.4 accidents per million miles—on record. Down from the 0.45 rate in 2021, the participating private fleets’ crash rate is nearly three times better than the trucking industry average, according to the Federal Motor Carrier Safety Administration.

“If we’re not operating safely as an individual fleet or as a collection of fleets, then the rest of the stuff doesn’t really matter,” Moore said. “If you’re not safe, you’re not going to be efficient.”

Respondents reported their fleet was at fault in just one of every five crashes, down from more than one in four cases reported in 2020 and one in three in 2019. Moore credited the “broad implementation of active safety technologies” for improved safety records.

At least 70% of NPTC fleets’ vehicles are equipped with speed monitoring, in-cab cameras, collision warning, lane departure, automatic transmissions, and adaptive cruise control.

Aging workforce drives up turnover rate

Moore said that it appears most fleets were working this past year to keep their drivers healthy, happy, and safe. The typical driver’s work week fell slightly from 53.5 hours in 2020 to 53.1 hours in 2021, with average driving time falling from 34.8 to 34.1 hours. The rest of the drivers’ weekly working time was in other roles, such as loading (5.7 hours), unloading (10.6 hours), and “other duties” (3 hours).

Ellen Ingram, human services director for America’s Service Line, the private fleet for America’s Food Group, said she constantly thinks about the quality of drivers’ work weeks. “We are coming out of a period in which our drivers had a spotlight on the importance of being a driver and the freight they were hauling,” she said of the COVID-19 pandemic period of 2020 and 2021. “It’s been interesting to keep a pulse on what those driver experiences are coming out of these last 12 to 18 months and how that differed the prior two years.”

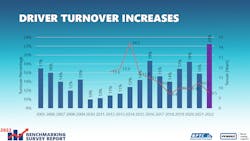

However, private fleet driver turnover saw its highest rate in the 15-year history of the survey, with participants reporting a 22.5% turnover rate. Moore said this is the first time NPTC members surpassed a 20% turnover rate. The 15-year average is 14.25%.

This turnover level, he noted, is consistent with the aging workforce and more retirements. Another reason Moore cited the turnover increase could be a pandemic holdover when many drivers were reluctant to switch jobs and wanted to ensure their regular paycheck. By 2021, more drivers were willing to seek new jobs as 2021 was a driver’s market. Moore said this higher turnover in 2021 was still significantly outpaced by for-hire carrier drivers.

Cramer said turnover could be attributed to drivers chasing sign-on bonuses at other fleets.

“We choose not to do sign-on bonuses, and I think we fared just fine compared to previous years,” he said. “Anybody that has signed on to a signing bonus typically is somebody that’s going to take his money and run as soon as he gets through that period. It’s somebody that we’ve typically seen as a guy who’s jumped through a lot of jobs.”

The 2022 NPTC benchmarking report

The annual benchmarking report, sponsored by Penske Truck Leasing, is available to NPTC member companies. The trade organization also offers customized data comparisons based on the annual survey.

“Our customers always want to know how they’re doing compared to others—others with private fleets, others in their industry, others running similar types of equipment,” Jim Lager, executive VP at Penske Truck Leasing. “We see it as very valuable information to put out there because people want to know how they stack up.”