Trucking is decarbonizing, with emissions regulations pushing the industry to do so at warp speed.

Long-haul fleets do have options they can adopt today on their journey to zero and near-zero emissions. The journey, however, isn’t straightforward. In fact, it’s quite messy. That’s at least how the North American Council for Freight Efficiency (NACFE) has described it.

NACFE recently released a new report, “The Messy Middle: A Time For Action,” that breaks down several powertrain options of today and tomorrow that fleets can deploy to reduce their emissions. Jeff Seger, the lead author of the report, detailed some of the factors that fleets must consider during this period, including economics in terms of fuel and energy prices, regulations, and sustainability goals for the carriers and their customers.

"The messy middle is applicable to all commercial vehicles, but we're targeting long-haul Class 8—that's kind of the tough nut to crack in terms of decarbonization," Seger explained.

While the messy middle can be complicated, NACFE emphasized that messy isn’t bad, but rather it’s a time when fleets will want to act, will have to evaluate many options, and will need to look beyond just the truck to the infrastructure needed to support that truck. It’s also a time in which fleets have a lot of decisions to make.

Diesel remains the gold standard today in terms of availability, infrastructure, and range, whereas battery-electric and hydrogen fuel cell are the gold standard in terms of zero emissions. However, as fleets well know, battery-electric range isn’t there yet for long-haul, while the technology and infrastructure for hydrogen fuel cell, which is ideal for long-haul applications, isn't yet built out or mature enough to meet the needs of the trucking industry sector.

Now might be the best time to consider hybrid or other sustainable options that fall in line with a fleet's financial situation, sustainability, and the availability of one powertrain over another.

See also: NACFE: 'Waiting is no longer an option' for realistic emissions reductions in trucking

OEMs develop alternatives

Along with cleaner diesel, manufacturers are looking ahead at alternative-fuel engine solutions, including propane, natural gas, and hydrogen. Cummins is one of the most prominent OEMs leading the charge in this space.

“The X15N big bore natural gas engine is essential to our commitment to improve NOx,” Katie Zarich, director of on-highway communications at Cummins, told Fleet Maintenance, FleetOwner’s sister publication.

The X15 produces up to a 10% fuel economy and greenhouse gas emissions improvement over Cummins’ ISX12N and can be specified with ratings matching diesels up to 500 horsepower and 1,850 lb.-ft. of torque. Its size is also reduced compared to a diesel X15, and it weighs more than 500 lb. less than a current 15-liter diesel and is 200 lb. lighter than the current ISX12N.

“Our vision for a zero-emissions future includes internal combustion engines (ICE) running on net zero-carbon fuels,” Zarich explained. “We expect to see alternative fuels play a significant role in the future as we ultimately transition to net-zero technologies. Propane already is widely distributed, is low cost per mile, and offers reduced greenhouse gas emissions. Natural gas, and particularly renewable natural gas, also offer significant environmental benefits. And there is tremendous momentum for hydrogen.”

See also: Cummins reaches engine milestone: 2.5M engines made at Jamestown plant

Various truck OEMs and fleets are taking notice of what Cummins has to offer. Last summer, Paccar announced it will offer the new Cummins X15N natural gas engine in Kenworth and Peterbilt trucks. The engine will include the integration of the Cummins Clean Fuel Technologies fuel delivery system.

“Paccar can help customers achieve their business goals by offering sustainable, affordable power solutions that use proven engine technology and existing infrastructure,” John Rich, Paccar's chief technology officer, said at the time.

Paccar, Cummins, and several customers, including FedEx Freight and Knight-Swift (No. 1 and No. 3, respectively, on the FleetOwner 500 for-hire fleets list) will demonstrate the ability to achieve lower carbon emissions for long-haul transport using ICE technology.

Further, Cummins also unveiled a fuel-agnostic powertrain solution last year with a common architecture designed to provide the flexibility needed to start integrating low-carbon fuel technologies.

According to Zarich, Cummins’ hydrogen low-emission ICE program allows for enabling next-generation fuel-agnostic midrange and heavy-duty engines by incorporating parts and components from existing platforms to drive cost advantages while also delivering reliability equal to diesel.

“H2 ICE will be familiar for our customers,” she said. “It looks like an engine, it sounds like an engine, it fits where an engine normally fits, and mechanics know how to work on it.”

Cummins also just announced a more than $1 billion investment across its manufacturing network in Indiana, North Carolina, and New York, providing upgrades to those facilities to support the company’s fuel-agnostic engine platforms that will run on low-carbon fuels, including natural gas, diesel, and eventually hydrogen.

Aside from Cummins’ advancements, the industry also is seeing a lot of interesting developments coming from truck OEMs.

Daimler Truck, for instance, has a joint venture with market rival Volvo Group—an independent company called cellcentric—to accelerate the development and use of hydrogen-based fuel cells for heavy-duty commercial vehicles. Prototypes have been undergoing testing on tracks and public roads in Germany since last year, and a North American introduction is targeted for the end of the decade.

Daimler Truck North America also has plans to collaborate with Cummins to upfit a Freightliner Cascadia with a Cummins hydrogen fuel-cell powertrain.

At Volvo Trucks, current offerings include renewable diesel and biogas driven products, and work is underway to develop fuel-cell technology that can utilize green hydrogen. “There will be a need for a combustion engine running on renewable diesel and biofuels as a complement to battery-electric and fuel-cell electric trucks,” said John Bartel, Volvo’s director of product strategy-driveline. “Green hydrogen is another potential fuel source that could be used in a fuel-cell electric or internal combustion engine.

“The different bio and renewable fuels have pros and cons in terms of their potential to replace diesel and their climate benefit,” Bartel added. “But we believe the road to a decarbonized transportation future falls within various paths and that there is not a single solution to fit all applications.”

Part of the Volvo Group, Mack also will be able to take advantage of any future advances in hydrogen fuel-cell technologies that cellcentric develops, said Andrea Brown, Mack's powertrain director. “We already offer trucks that run on diesel, CNG, and electricity,” she added. “While diesel is the most popular fuel at the moment, we continue to monitor market conditions and local market regulations to deliver trucks that run on the fuel that best meets the needs of our customers.”

See also: Volvo finding fuel cell success in Arctic conditions

And then there’s Navistar's newly updated International LT Series tractor and all-new S13 Integrated Powertrain that includes the final ICE offering the company will develop as it moves toward its zero-emission goals. Navistar is targeting 50% zero-emission vehicles by 2030 before reaching 100% by 2040.

Navistar’s new International S13 Integrated Powertrain has been designed in close collaboration with the Traton Group for the North American market. Difficulties with heavy-duty emission-control systems are one of the biggest pain points in trucking today, leading to revenue-depleting downtime and huge headaches for fleet managers left to deal with issues like clogged diesel particulate filters, exhaust gas recirculation failures, sensor malfunctions, and more. That’s why Navistar has reimagined its clean-sheet design and dual-stage aftertreatment system, which was devised concurrently with a selective catalytic reduction-based engine.Tackling NOx, CO2 simultaneously

For Mihai Dorobantu, director of technology planning and government affairs for Eaton’s Vehicle Group, mild hybridization technologies and thermal management are the lowest hanging fruit to tackle both NOx and CO2 emissions reductions in the long-haul segment.

The power management company has been investing in technologies that emphasize more advanced catalysts with thermal management to meet more stringent regulatory NOx and CO2 emissions rules. Eaton has invested in developing cylinder deactivation technology, which keeps selective catalytic reduction at optimal temperatures by operating just two or three cylinders rather than all six in light-load conditions. That process delivers higher exhaust temperatures from the functioning cylinders at low speeds and loads or when the truck is neutral coasting, two conditions that can quickly cool aftertreatment systems.Though relatively unpopular due to failures in 2007, Dorobantu pointed out that fuel burners are another way to dump a lot of heat in the aftertreatment system to reduce those initial spikes of NOx and the NOx that is produced at idle and low load when the aftertreatment system is too cold to be effective.

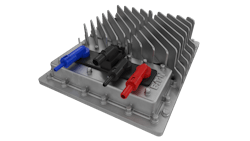

And then there are Eaton’s electric heaters. Eaton has developed a DC-DC converter for 48-volt system architectures that will enable future powertrains to comply with new emissions regulations and provide higher levels of electrical power for CO2 reduction and automated driving features.

Eaton’s 48-volt programmable power electronics control unit for electrically heated catalysts is designed to receive power commands from the aftertreatment system, provide soft-start and soft-stop capabilities for assisting in maintaining system voltage control, and diagnostic feedback of the heater element.When it comes to reducing NOx in the long-haul segment, Dorobantu believes the path today combines electric heaters with a 48-volt mild hybrid.

“A 48-volt mild hybrid solution not only gives the power to the electric heater to solve the NOx problem but also has a promise of around 5% fuel efficiency,” Dorobantu told FleetOwner. “Now, the expense of the 48-volt solution gets split between regulatory compliance on NOx but also fuel savings at the vehicle level.”

See also: 2023 alternative-fuel engine outlook

As commercial electric vehicle technology continues to mature, Dorobantu also noted that the support structures that work for medium-duty battery-electric vehicles could pair with heavy-duty diesel engines to create a heavy-duty hybrid. That heavy-duty hybrid concept, he added, has several advantages.

“One is the ability to drive EV inside the port and then drive diesel on the freeway,” Dorobantu said. “So, it would be a locally zero-emission vehicle but still maintain the advantage of the range of a diesel truck to run the highway applications."

“We believe there will be a significant number of internal combustion engines in long-haul freight for a very long time, which is why making the cleaner and more efficient diesels makes sense,” he added. “They need to be cleaner because of regulations, but they also need to be clean because they will be on the road for a very long time.”

In time, Dorobantu said it remains to be seen whether batteries will become so compact and charge fast enough that they will become viable for long-haul operations.

A future for hydrogen

Although hydrogen fuel cells for freight transportation are still in their infancy, they are currently the only viable zero-emission solution proposed for long-haul trucks, according to the latest guidance report from NACFE and RMI.

Their joint report, "Hydrogen Trucks: Long Haul’s Future?," focuses on using hydrogen-based powertrains for Class 8 long-haul freight routes pulling van trailers. These powertrains include a range of fuel cell battery-electric types and hydrogen ICE based on the diesel cycle.

“As we move to the zero-emissions freight future, in the long run, there are only two choices of power—battery-electric and hydrogen fuel cell,” said Rick Mihelic, the report's author and director of emerging technologies at NACFE.

While purely electric trucks have already accrued years of service on regional routes, their batteries' capacity and sparse amount of charging stations limit how far from home they can go.

When comparing hydrogen ICE to hydrogen fuel cells, the question really becomes whether hydrogen ICE from an efficiency standpoint will match what fuel cells can do in terms of the consumption of the hydrogen, Kevin Otto, NACFE’s electrification technical lead, explained.

“We’ve been looking at scenarios and how many technologies different fleets will go through,” said Mike Roeth, NACFE's executive director. “One thing to think about is you could transition to hydrogen engine on your way to hydrogen fuel cell, but that’s another step change and another step of education, capex, and changing your operations. How much of that can you handle?”

See also: What NACFE learned about hydrogen trucks

Eaton’s Dorobantu also stressed the fact that there is a trade-off with hydrogen ICE compared to hydrogen fuel cells.

“Hydrogen ICE is a way of drastically reducing CO2 emissions but doesn’t fix the NOx problem,” Dorobantu said. “So, all of the issues with diesel NOx emissions are carried over with hydrogen.”

The success of hydrogen for freight transport in both forms also hinges on the availability and cost of the fuel and the infrastructure.

According to its report, NACFE ultimately believes hydrogen fuel cells will be a factor in future long-distance freight hauling in combination with battery-electric vehicles for shorter range operations.

“When you do look at truly zero-emission freight, there are two solutions—battery-electric and hydrogen fuel cell,” Roeth said. “And it’s not going to be an either/or; it’s going to be an and. The question becomes how much of each?”