Sherlock Holmes, that great mythical detective, once said (by way of author Sir Arthur Conan Doyle in A Study in Scarlett) that "it is a capital mistake to theorize before one has data."

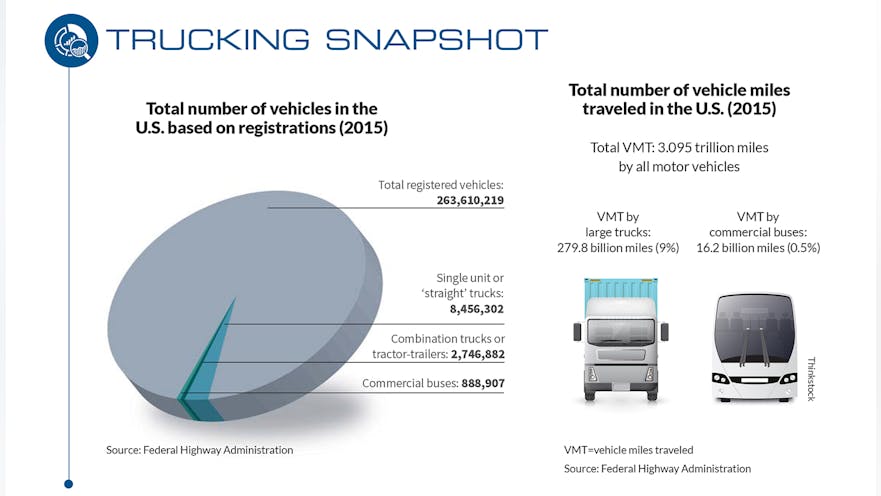

The very same can be said in a way about the trucking industry – especially about the many facts and figures that by necessity determine its size and scope (2.74 million tractor-trailers hauling 11.39 billion tons of freight) as well as the value of what it carries (just north of $700 billion last year, according to the Bureau of Transportation Statistics).

Plainly put, trucking is a very big enterprise – one that serves as a critical linchpin for the U.S. economy. Trucks move over 70% of all the freight tonnage in the U.S., skillfully piloted by some 3.1 million commercial driver license (CDL) holders. Oh, and they burn over 38 billion gallons of diesel fuel annually in the process, too.

That's a pretty big job, by anyone's slicing and dicing of the numbers.

Yet it is numbers like those that help illustrate just how important motor carriers are in allowing everyday modern life to function smoothly – dare we say effortlessly – here in America.

We forget that all of the goods now delivered on an almost same-day basis to our doors, that the tons of fresh foods appearing every day on grocery store shelves, even our ability to get up and travel thousands of miles across the country – if not the world – on a moment's notice, all relate back to a vast global transportation and logistics capability unknown to our predecessors just a few decades past.

It's all become so routine, this speedy movement of goods, that we in many ways take it all for granted.

For example, a report by global consulting firm AlixPartners LLP last year found that the demand for "free shipping" of goods bought online keeps increasing, with consumers expecting faster delivery times in the bargain as well – two issues that pose problems for trucking companies that need revenues to pay for their equipment, driver wages, insurance, fuel, and taxes. "Free-shipping: this is what matters and it is here to stay," noted Marc Iampieri, one of AlixPartner's directors, at the time.

"People want more, they want it for less, and they want it faster," he added, pointing out that the expected "wait time" for free shipping of online goods is now an average of 4.8 days versus 5.5 days back in 2012, according to the firm's latest poll.

"The old saying that ‘beggars can't be choosers' doesn't seem to be true anymore – apparently they can," Iampieri stressed.

That's just one reason why we started compiling this special annual feature four years ago – not to provide a definitive end-all, be-all source for trucking data (there are far richer compendiums of such factoids out there to peruse) but to give you, our readers, a quick "snapshot" of just how vast and how vital the business of hauling cargo really is in big black-and-white numbers.

Numbers also offer a way to help motor carriers and private fleets alike better prove their worth to the customers who hey haul freight for. That, unfortunately, remains a significant challenge for those in the trucking business.

John Larkin, managing director and head of transportation capital markets research for Stifel Capital Markets, noted earlier this year that most shippers seem poised to continue hammering truckers with the cudgel of low freight rates, despite the myriad of challenges faced by the motor carriers tapped to carry their goods.

"With all the respect in the world for shippers that appear at industry events, we must understand that these are the enlightened shippers," Larkin explained during the executive capstone seminar held by the University of Denver's Transportation Institute back in January.

"Talk of collaboration, gain sharing, compensatory rates, real-time data exchange, and asset utilization enhancement is still the conversation of the enlightened shippers. Our fear is that still a good 75% of shippers have yet to be enlightened," he stressed. "Instead these less desirable, almost detestable shippers focus on low price – not service or mutual value creation. They don't care about driver turnover, hours of service, levels of insurance coverage, [or] ELD [electronic logging device] installation."

Larkin warned, though, that a "cold hard truth" is on the way, in the form of what he has long dubbed "the mother of all capacity shortages" due to the implementation of ELDs this year, a capacity shortage he expects will finally materialize late in 2017 or in early 2018.

If that happens as predicted, then the numbers herein will become all the more important in terms of measuring just how much capability the trucking industry will retain to haul our economy's vitally-needed cargoes.