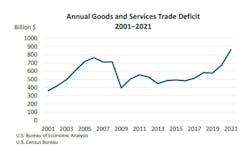

This increase of foreign purchases led to congestion at U.S. ports and supply chain problems. With more goods to move across the country than ever before, carriers charged record-high rates to move those goods from point A to point B. Because carriers were able to name their rate, a flood of new trucker owner-operators and carriers entered the market looking to capitalize on the perfect storm that the pandemic caused.

See also: What were fleet leaders' top challenges of 2023?

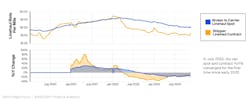

“We had a doubling of for-hire truckload capacity during the pandemic,” Dean Croke, principal analyst for DAT Freight and Analytics, told FleetOwner. Now that Americans are spending less, the demand for truck capacity has waned, and many in the industry are struggling to make ends meet.

This year saw spot and contract rates plummet, interest rates soar, and—though currently falling—high diesel prices. This perfect storm of factors has caused some of that extra trucking capacity to leave the market already.

However, Croke believes the trucking industry will begin to see some relief by the second quarter of 2024.

“That bubble in capacity from the pandemic will have worked its way out of the market during the first quarter because of two things,” Croke told FleetOwner. “One is demand falls in the first quarter and so do rates, seasonally, every year. So, these carriers are going to really struggle. And I think the marginal carriers will exit the industry in the first quarter.”

See also: How AI could change trucking in 2024

A potential upswing in the spring

Just like most other aspects of the economy, trucking and the movement of goods operate on a pendulum. There are times with more goods to move than there are trucks to move them—with 2020 and 2021 being perfect examples. During these times, spot and contract rates are higher, and the trucking industry is more profitable. Then, there are times when there are more trucks and drivers available than there are goods and freight to spread among them, which causes rates to fall and can put trucking companies and owner-operators in a bind if they aren’t adequately prepared.

“When times get tough like this, you have to become more of a businessperson and really understand your operating costs and the freight market,” Croke said. “The opportunists that joined the market, they are certainly leaving the market because they were only here for the good times. … And what we'll be left with next year is the same core group of carriers that were here in 2019 during the last trade cycle. So, we will get back to equilibrium at some point.”

However, those “opportunists” are leaving the market much more slowly than many anticipated, Croke said, because they made so much money in 2021. But with the effects of a slow 2023 and the seasonal slowdown expected after the holidays, Croke believes these remaining opportunists will finally exit the industry in the first quarter of 2024 and make way for a stronger trucking market in the spring when the seasonal movement of goods picks up.

This market upswing in the spring could change, however, if diesel prices continue to fall, Croke told FleetOwner, which would give those struggling truck companies a bit of “breathing space” and result in fewer carriers leaving the market.

See also: Small fleet finds room to grow with adaptive TMS software

What to expect in 2024

When asked about predictions beyond the spring of 2024, Croke said the “wildcard” we all should look out for is interest rates.

Croke said a bump in the housing market, which would be brought on by lower interest rates, might be the biggest turning point for the trucking industry as it requires the movement of timber, steel, wall panels, roofing, shingles, "things like that,” he said.

“On the dry van side, it's ovens, loungers, carpet. So, the single family, multifamily residential housing market, I think it's going to be one of the things that will help turn the trucking industry around in a material way," Croke said. "But that's not going to happen until we see something significant happen with interest rates from the Federal Reserve.”

See also: Will the freight economy warm up in spring?

Croke anticipates a further market upswing toward the middle and end of 2024, when seasonal freight movement picks up even more around July 4, the back-to-school shopping season, Thanksgiving, Black Friday, and the holiday season.

Things to look out for

The future isn’t etched in stone, and though Croke has analyzed the market and consulted with other industry experts, he advises caution. There is always the possibility of additional factors coming onto the scene that could heavily impact the trucking industry.

One factor Croke said to watch out for is the Houthi rebel attacks on ships in the Red Sea that impact global trade. Roughly 12% of the world’s trade passes through the Suez Canal, including oil and natural gas. With the rebel attacks on ships taking this passage, shipping companies have rerouted their ships, extending trips and causing delays in the movement of goods. Croke said this could impact the price of oil here in the U.S.

See also: Truck orders and technology: What to expect in 2024

Another factor that could impact the trucking industry is the drought in the Panama Canal. The drought has affected trade for several months, with canal authorities allowing the passage of fewer ships than its typical capacity. By February, it’s expected that only 18 ships will be allowed passage per day compared to its typical capacity of 36 to 38 ships per day. Authorities are also limiting the weight on the ships that pass through the canal, causing shippers to decrease the amount of cargo on each ship, according to Fortune.

Finally, Croke said the rumors of labor strikes at ports on the East Coast are another factor to watch. At a conference in Nashville this past November, the leader of the International Longshoremen’s Association, the maritime workers union for 70,000 longshoremen on the Atlantic and Gulf Coast, warned the ILA to prepare for a strike in October of 2024 if “a new agreement is not reached by September 30,” according to a press release.

These three factors, Croke said, could lead to a shift in shippers sending their goods from the East Coast to the West Coast. Shipping to the West Coast, specifically California, in 2024 will deliver its own set of problems. With California pioneering the shift to vehicle electrification and stricter emissions rules coming into play for drayage beginning January 1, Croke said it will be much more expensive to move goods in California. With the higher cost of these electric trucks, these regulations could further push smaller trucking companies out of business, Croke told FleetOwner.

See also: Battery-electric terminal tractors have proved they can do the job

“What I can see happening is truckload capacity on the West Coast will be the sole domain of the large truckload carrier who can afford to buy these (electric) trucks and gobble up market share,” Croke told FleetOwner. “I think there's something's really interesting going to happen on the West Coast.”

Read more insight on 2024 from DAT’s 2024 Freight Focus Report its website.