The Covid consumer changed the supply chain: logistics report

The most successful shippers this year—and this decade—will be those that develop strategies to link delivery execution capabilities to their consumer promises and regain leverage with carriers, which are charging record-high rates right now move freight across the U.S. The COVID-19 pandemic forced shippers and fleets to evolve to meet last-mile delivery needs that accelerated in 2020 and have shown few signs of abating in 2021—even as the pandemic recedes.

In 2020, freight logistics and supply chain resilience was tested again and again. As the U.S. emerges from the pandemic, “the story is one of adaptation under the most severe conditions in memory,” according to Michael Zimmerman, a partner with Kearney and co-author of the Council of Supply Chain Management Professional’s (CSCMP) annual "State of Logistics Report," which was released June 24.

The report notes that the pandemic interrupted many global supply chains, which were forced into stops and starts over the past year. “Shippers and carriers had to continuously change plans as the means of logistics they relied on strained and sometimes broke,” Zimmerman said during a press briefing on the eve of the 2021 report’s release. “In the latter of the year and to the day, rates for critical modes and nodes soared—and relief is still not in sight.”

While the U.S. GDP is expected to grow about 7.7% in 2021, according to Kearney, there are still global economic risks on the horizon related to COVID-19 and inflation. After the sluggish pandemic economy of 2020, government stimulus, low-interest rates, and increased consumer spending are spurring growth in 2021. But CSCMP’s report warns of potential wild cards—natural disasters, trade policy shifts, reshoring, and the tight labor market—that could threaten that growth and change the logistics landscape this year.

The 32nd annual logistics report, which CSCMP titled “Change of Plans,” offers a snapshot of the U.S. economy from the logistics sector within the overall supply chain. The report compiles logistics observations worldwide and focuses on industry trends and insights on evolving supply chains.

U.S. business logistics costs fell 4% in 2020 to $1.56 trillion, which represents 7.4% of 2020’s $20.94 trillion GDP, according to the CSCMP. “Most logisticians will be surprised by this drop, expecting a rise,” Zimmerman noted, “but shipping volume and price drops in the first half [of the year] had a big impact. And more importantly, the financial costs of inventories fell as interest rates were lowered and inventory sales ratios hit 20-year lows in May of 2020—and kept falling. There was simply less inventory-generating cost in the system.”

Trucking and the modern consumer

Compared to 2019, motor carrier costs dropped 0.6% in 2020. While full truckload carriers dropped 1.6% last year and less-than-truckload carrier costs were down 5%, private and dedicated fleets saw a 1.5% increase in costs during 2020. Parcel delivery costs jumped 24.4% last year, driven by the surge in ecommerce and changes in consumer behavior, Zimmerman noted.

As consumer behavior changes global and domestic supply chains, fleets are forced to adapt to the ongoing pandemic and other disruptions continuously. Supply chains are being reset and reconfigured as manufacturers shift their sources and consumers shift their spending habits.

The “dramatic increase in parcel and last-mile activity” is causing shippers “to look at segmentation within their supply chains,” Andy Moses, SVP of sales and solution for Penske Logistics, said.

This year, trucking volumes rebounded from the early pandemic dearth to trend toward record highs on the backs of increased consumer spending. However, as capacity continues to be strained, CSCMP said that successful shippers will need to rely on technology to reduce costs and improve efficiency to stay competitive.

The segmentation of supply chains is becoming essential for shippers rushing to meet consumers’ expectations of quicker delivery times, Zimmerman added. “The Amazon-driven trend in the marketplace of consumers expecting next-day, same-day [delivery] used to be three days; in some cases, it’s now a matter of hours,” he said. “There’s been a rush by shippers to try to meet these rising expectations—first as a loss leader because they want to stay in the game. But as ecommerce has risen to about 14% of retail sales, it’s becoming an increasingly important portion of expenditures.”

Zimmerman said that companies are segmenting consumers into groups: those that must be served at all costs with the highest promises; those that are willing to wait, and how that varies according to the product is very much top of mind for shippers; and those that are working with their marketing people and consumer surveys to understand how they can segment the offering of this service.

3PLs creating visibility

At the same time, fleets are focusing on how to create dense supply networks that lower the costs per delivery “because there’s no sign that this growth of ecommerce and last mile is abating,” Zimmerman said.

Third-party logistics providers (3PLs) are doubling down on ecommerce fulfillment, according to CSCMP, which notes that these logistics providers “have the scale, expertise, and extensive network to achieve needed resilience.” While COVID-19 increased costs, disrupted efficiencies, and caused shippers’ needs to diverge, it also highlighted the value of end-to-end visibility, data, and analytics. “This is an area, as a 3PL—and other 3PLs—we tend to excel in delivering,” Moses said.

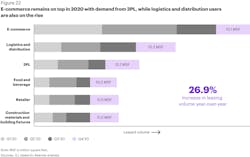

Ecommerce, particularly, is exacerbating shippers’ tensions to meet consumer expectations along with managing costs associated with quicker delivery expectations, according to CSCMP. Up by 33% last year, ecommerce purchases totaled $792 billion in 2020, representing 14% of all retail sales.

Warehouse space is also in high demand, thanks to ecommerce that was spurred by consumers stuck at home during the pandemic. However, the biggest need for warehousing is for urban last-mile distribution facilities. While capacity is growing in 2021, it is not keeping up with demand, according to CSCMP.

Key report findings

The 32nd annual CSCMP State of Logistics Report is researched and prepared by global consulting firm Kearney and presented by Penske Logistics. It is available free for CSCMP members and available for purchase by non-members. Here are look at some of the key findings in the report:

- The K-shaped recovery of 2021 reflects changed consumer habits. Hospitality, restaurants, and airlines struggled. Grocery retail, home improvement, and ecommerce prospered.

- Ecommerce purchases (some of which was picked up in-store) grew by 33% to $792 billion, representing 14% of all retail sales.

- The control tower concept is taking on an added importance. Resilience is most effective when paired with visibility. Companies need knowledge to make quick decisions, and the control tower serves as an information hub to enable better planning and reacting.

- Sustainability efforts by the transportation sector are increasing. Consumers are considering environmental impacts in their purchasing decisions while governments across the globe are instituting more stringent regulations.

- Moving forward, supply chains must continue to provide goods and services to the American public while dealing with tight capacity and volatile rising rates; H1 2021 has the highest rates the market has ever seen.

- The U.S. economy is now expected to grow 7.7% this year with advancements related to increased vaccinations and a return to normal.

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.