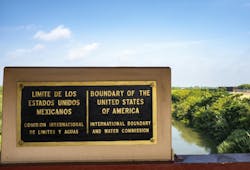

With more freight moving between the U.S. and Mexico, Ryder System is growing its operations and capacity on both sides of the border. The company has opened a new logistics operation in Laredo, Texas, and expanded its drayage yard across the Rio Grande in Nuevo Laredo, Mexico.

“If you look at the market, truck border crossing activity between the U.S. and Mexico is up more than 20% annually since the pandemic as more businesses look to nearshoring to diversify their supply chains and shorten lead times,” said Ricardo Alvarez, Ryder Mexico VP of supply chain operations. “The savings from manufacturing overseas can be offset by inventory sitting on ships or in seaports incurring storage fees; and, of course, by the product being unavailable to meet demand. With Mexico, you put what you need on a truck and it can be in a final-mile distribution center within days, not months.”

See also: BrightDrop EVs expand into Mexico

Ryder began operations in Mexico in 1994. Today, Ryder Mexico manages more than 250,000 freight movements across the Mexican border each year. Ryder also operates 5 million square feet of warehouse and yard space across Mexico.

An expanded drayage yard

In Mexico, Ryder expanded its Nuevo Laredo drayage yard, which helps transfer freight across the border to U.S. drivers.

The project expanded its maintenance shop, growing its service stations from nine to 15.

Ryder also restructured several parts of site to add more office space, larger driver dorms, a larger cafeteria, and more parking.

The expanded parking increased the yard’s capacity by 42% for tractors and 39% for trailers. A significant portion of the expansion’s expense had to do with paving the additional parking, Bateman said.

Overall, planning and execution of the expansion took about one and a half years.

See also: Production, sale of Class 8 vehicles forecasted to rise

“A lot of it was talking to our automotive and industrial customers, trying to understand their strategy,” Bateman told FleetOwner. “What their plant volumes were going to be between the U.S., Mexico, and Canada; what trends they’re seeing; if there’s going to be some supplier shifts to Mexico, and that, in turn, would guide us as far as their needs for import/export; and how the growth is going to be in Mexico.”