Fleets slow to adopt ELDs may well find themselves penalized by customers rather than the Federal Motor Carrier Safety Administration—and shippers increasingly will adopt deadlines ahead of the December 2017 implementation date set by the government, suggests a carrier relations expert with a billion-dollar 3PL.

“In March or April, shippers are really going to really want to know who’s going to be fully implemented by June, and you’ll probably see some shippers with mandates months before December,” said Ben Cubitt, Transplace vice president of engineering, procurement and consulting, speaking on a Stifel conference call Monday.

The upside for fleets: “I see a tremendous opportunity for shippers to do some better planning, with these constraints in hours of service. ELDs will help this discussion, as an unintended advantage.”

Transplace manages between 100 and 150 bids a year for shippers, primarily truckload and intermodal, with transportation spends ranging from $3 million to $350 million and using from 40 carriers to more than 300. Transplace has recently added ELD questions to the request for information (RFI) form carriers submit, including whether ELDs have been implemented, in what percentage of the fleet, and the carrier’s timetable for implementation.

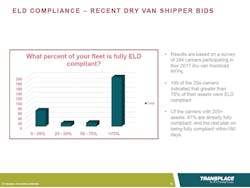

The results from RFIs submitted in the last 30 days align very closely with the Transplace survey published in September. Broadly, 199 of 294 carriers reported that greater than 75% of their assets were ELD compliant, and among carriers with more than 200 trucks, nearly 9 in 10 are already fully compliant.

In looking at the results from one shipper, again with 90% of large carriers already ELD compliant, only a third of the smaller carriers had implemented ELDs, a third anticipated being compliant in 90-180 days, and yet another third said they wouldn’t be compliant for at least 180 days.

Cubitt noted that it’s difficult to collect hard data and quantify just how much non-compliant carriers depend on running illegally, and therefore what the mandate will mean to the supply chain, but he does see additional reasons why some small truckers are still holding out: most costs (equipment, driver pay) are going up and rates are depressed, and now they’re expected to install ELDs and train drivers and dispatchers to use them—and to adjust operations accordingly.

“If you’re under duress and you’re very independent minded and you hope that this doesn’t become a mandate, then that’s why you hold out,” Cubitt said. “I think there are some people who will hold out and then make a decision about whether to stay in business.”

In the previous survey, a number of carriers said they were delaying implementation until an appeal by the Owner-Operator Independent Drivers Assn. had been decided—but the court ruled the ELD rule is good to go. Since then, the election of Donald Trump to the White House comes with the expectation of a substantial reduction in the federal regulatory agenda. But carriers shouldn’t put off ELDs based on the change of administration.

“There’s a lot of momentum behind [the ELD mandate]. This would not be a rule you’d want to hang your hat on [President-elect Trump] not implementing. They vast majority of large fleets have implemented it and many small fleets are doing it. It’s a hard argument to make to the public that it’s a good rule to kill. Electronic logs make sense.”

But, he noted, the mandate will lead to some “good discussions” between shippers and carriers.

“I think the [shipping] industry does a great job of telling carriers when they’re late picking up or late delivering—but we don’t do as good a job of tracking when we make a carrier or a driver unproductive. I think shippers are open to data and communication, and if ELDs arm carriers with better data, they can use that—that’s a good outcome.”

Stifel’s John Larkin, however, was somewhat skeptical.

“Back in 2014, when we had more freight than we had equipment, shippers universally became very ‘touch-feely’—they used the words ‘collaboration’ and ‘partnership’ a lot more frequently than they have in the last 12 months or so when there’s been a lot more trucks than freight out there,” Larkin said.

He noted that a single carrier, typically, has little influence when it complains to a shipper about delays at the docks and productivity losses—especially when there’s plenty of capacity in the market. Similarly, shippers have been slow to adjust networks even when they know the lanes and schedules couldn’t be run legally; that’s because carriers who were willing “to bend the rules” were always available to take the loads.

“Maybe finally with some of this gray area being eliminated, and the tightening of supply and demand over the next year or two, that we’ll be in a period where the collaboration and partnership discussion will be a truer discussion than it has been. It’ll have some legs and be sustainable. And it will have a little bit of flexibility both ways, to make sure the equipment is utilized and the shipper or receiver can share in the savings that the incremental productivity [improvement ] generates.”

Indeed, “tweener freight”—700+-mile runs that stretch the limit how far a single truck and driver can within a day’s HOS limits—will get more attention with the mandate looming.

“There’s no shipper I’ve worked for that wants a carrier to do something illegal,” Cubitt said. “Having said that, we’ve told our shippers that if they want to be good partners with carriers, they really have to do more planning. They may have to tailor that with a longer lead time, and 24/7 shippers are going to become much important. We’ve been in an environment where shippers haven’t had to negotiate much. Shippers have to become more aware.”

About the Author

Kevin Jones

Editor

Kevin has served as editor-in-chief of Trailer/Body Builders magazine since 2017—just the third editor in the magazine’s 60 years. He is also editorial director for Endeavor Business Media’s Commercial Vehicle group, which includes FleetOwner, Bulk Transporter, Refrigerated Transporter, American Trucker, and Fleet Maintenance magazines and websites.

Working from Beaufort, S.C., Kevin has covered trucking and manufacturing for nearly 20 years. His writing and commentary about the trucking industry and, previously, business and government, has been recognized with numerous state, regional, and national journalism awards.