Too much, not enough? Comment period to close on FMCSA insurance minimums

Tick-tock. The clock is running out for truckers who want to comment on a proposal to increase insurance minimums for carriers. The deadline for submissions is Thursday.

The Federal Motor Carrier Safety Administration (FMCSA) issued a notice of proposed rulemaking (NPRM) last fall seeking industry input on the matter of increased liability coverage. The NPRM followed an agency report to Congress that determined while catastrophic crashes involving motor carriers are rare, the costs for resulting severe and critical injuries can far exceed $1 million and that current insurance limits do not adequately cover these costs.

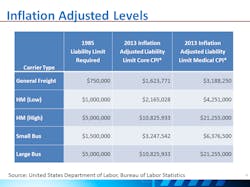

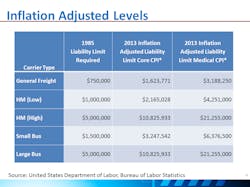

An FMCSA-sponsored study by DOT’s John A. Volpe Transportation Systems Center showed that simply keeping up with inflation would put the minimum at $1.6 million, or even more, $3.2 million, to keep up with rising medical costs. (See the chart.)

A similar study by the Pacific Institute for Research and Evaluation, posted on the rulemaking page, notes that the current $750,000 minimum has been in place for more than 30 years, while the upper range for liability awards in large truck crashes involving death or catastrophic injury is $9 to $10 million. The U.S. Department of Transportation in 2013 adopted a $9.1 million value per life saved for regulatory analysis use, the report notes.

“Thus a policy limit per crash of at least $10 million dollars seems appropriate,” the PIRE study concludes.

Following the April report, FMCSA put the rulemaking on a fast track. The Motor Carrier Safety Advisory Committee devoted its meeting last May to the issue. That meeting featured a presentation by FMCSA staff as well as a presentation by several personal injury attorneys who calculated that uncovered costs due to truck crashes come to $10 billion a year. (See the chart below.)

But as Robert Moseley, Jr., chairman of the transportation practice at the law firm of Smith Moore Leatherwood LLP, explained to Fleet Owner when the notice was published, FMCSA is actually playing “catch up” in terms of carrier insurance levels demanded by shippers and brokers.

“The main driver of higher insurance amounts required of trucking companies is not FMCSA [rules]; it’s the freight contracts,” Mosely said. “Most shipper and broker [freight] contracts require $1 million in coverage and they’ve required that for a long time.”

Yet he emphasized that a regulation mandating higher insurance coverage levels for motor carriers will most likely raise insurance costs across the board within the industry – even for carriers that maintain insurance coverage levels well beyond the $1 million level.

“Let’s say you have $2 million in overall coverage,” he said. “You’ll have to pay a higher premium for that [coverage amount] under the proposed FMCSA rules because now the cost of your ‘primary’ insurance is going up as it is being raised from $750,000 to $1 million or whatever level the FMCSA settles on.”

The Owner-Operator Independent Driver Assn. contends the issue “could have as much, if not more, of an impact on you as a professional driver than changes to the hours-of-service rules or other FMCSA-regulatory mandates.”

That’s from OOIDA’s Fighting for Truckers website, which also provides a Q&A section for owner-operators with their own authority, for those who are leased to a carrier and for company drivers, respectively.

Both OOIDA and American Trucking Assns. (ATA) contend that less than 1% of claims exceed the current $750,000 minimum, and ATA has suggested that increased insurance coverage does not necessarily lead to improved safety.

Nearly 1,600 comments had been received through Monday, according to the regulations.gov website.

Comments may be submitted here.

About the Author

Kevin Jones

Editor

Kevin has served as editor-in-chief of Trailer/Body Builders magazine since 2017—just the third editor in the magazine’s 60 years. He is also editorial director for Endeavor Business Media’s Commercial Vehicle group, which includes FleetOwner, Bulk Transporter, Refrigerated Transporter, American Trucker, and Fleet Maintenance magazines and websites.

Working from Beaufort, S.C., Kevin has covered trucking and manufacturing for nearly 20 years. His writing and commentary about the trucking industry and, previously, business and government, has been recognized with numerous state, regional, and national journalism awards.