Class 8 orders slow in December, but market still at ‘high level historically’

While freight markets cooled in 2023, it didn’t stop fleets from ordering new equipment last year, as the Class 8 market saw a historically high level of order-board action over the year's final months, according to preliminary numbers from commercial vehicle research firms.

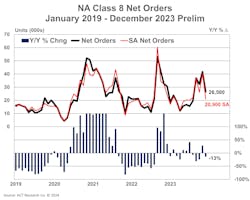

North American Class 8 orders fell during the typically slower December after a busy November for major truck OEMs. FTR Transportation Intelligence pegged December’s orders at 26,620 Class 8 vehicles, down 26% from the firm’s November figures and down 6% compared to December 2022. Preliminary figures from ACT Research put Class 8 orders at 26,500 units, down 15,000 from November.

See also: What's ahead for trucking in 2024?

“After a strong and upside-surprising November, Class 8 orders surprised in the opposite direction in 2023’s last report,” said Kenny Vieth, ACT president and senior analyst. “With the largest seasonal factor of the year, seasonal adjustment pushes December’s intake sharply lower to 20,900 units."

ACT’s full-year 2023 Class 8 order tally was 278,500, down 7% compared to the busy 2022, when lingering pandemic supply chain problems eased, allowing OEMs to take in more orders after limiting build slots at the start of the decade.

FTR’s 2023 Class 8 order total came in at 253,000 units but noted order figures grew stronger throughout the year. Orders over the last six months were at an annualized rate of 302,000 units, according to FTR. The final quarter of 2023 had a three-month annualized rate of 362,000 units as OEMs have been able to fill more build slots recently.

“Despite the slight year-over-year decrease in orders in December, the market is still performing at a high level historically,” according to Eric Starks, FTR chairman. “Even as the freight markets have been weak for an extended period, fleets are still ordering equipment. Order levels were above the historical average but continue to follow seasonal trends, reinforcing our expectations for replacement demand in 2024.”

Medium-duty truck orders jump year-over-year

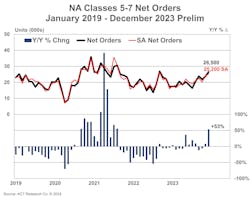

For Class 5 through Class 7 vehicles, which ACT tracks, net orders totaled 26,500 units, a 53% increase compared to December 2022, bringing the 2023 total to 245,700 medium-duty orders.

See also: Will the freight economy warm up in spring?

“Unlike Class 8, medium-duty seasonality is modest in December, lowering the seasonally adjusted order tally to 25,200 units, up 4.6% from November, and the best month of the year on both a nominal and seasonally adjusted basis,” Vieth said. “For all of 2023, Classes 5-7 orders were 245,700 units.”

Both research firms usually finalize their monthly order data by the middle of the following month.

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.