I hear talk in the media that companies are sitting on a lot of cash, just waiting for confidence in the economy’s future to emerge before they invest in job creation, thereby stimulating the economy. Well, I disagree with this. The economy needs stronger growth in business sales. This will create incentive for businesses to invest in capacity expansion, which will then result in new jobs.

For-hire carriers are not increasing investments on trucks and trailers beyond replacement since freight volumes are expanding at sluggish growth rates. In the current environment, for-hire carriers must grab market share from their competitors, probably through pricing, to support capacity expansion. If for hire carriers fail to gain share, then truck utilization suffers. There is substantial risk to profitability through lower freight rates to gain share or lower truck utilization if carriers fail to gain share in the current sluggish freight environment. Most carriers have focused on increasing profitability through increased fleet utilization and improved pricing. The current business environment of sluggish freight growth does not support investment spending for expansion.

When will economic growth accelerate? During this political season, both parties have laid out their platform for growth. But regardless of who wins, the next administration must deal with budget deficits that are unsustainable.

In the medium term, federal government policy will change from expansionary to contractionary despite the election’s winner. There are large differences between the two parties’ fiscal policies (taxes/spending), but adoption of contractionary federal fiscal policy is necessary to put federal government budget deficits on a downward path.

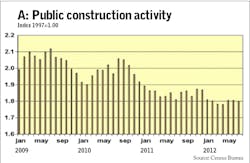

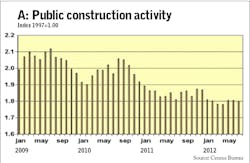

State and local governments have already started down this road, and this has been a drag on the recovery as government employment and public construction activity have been decreasing (Chart A). These policies are necessary if governments are to meet future obligations such as pensions, bond payments and infrastructure requirements.

Spending today without regard for consequences in the future, i.e., large budget deficits, ultimately results in the adoption of tight fiscal policies down the road. Just look at Greece, Portugal, Spain, Italy and Ireland. The adoption of contractionary fiscal policies by state and local governments will provide the foundation for stronger growth in the future.

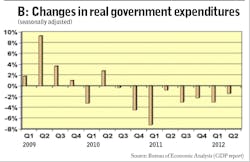

Commercial Motor Vehicle Consulting predicts sluggish to moderate freight growth for an extended period of time and the adoption of contractionary fiscal policies on all levels of government. Government spending (Chart B) at the local, state and federal levels makes up about 18.5% of final sales to domestic purchasers. Final sales to domestic purchasers are the pull upon the supply chain that stimulates freight volumes.

Freight volumes can expand at sluggish to moderate growth rates, but are not likely to expand at strong growth rates in the medium term because of policy changes.

About the Author

Chris Brady

Founder of Commercial Motor Vehicle Consulting and former FleetOwner contributor.