Roadcheck: Higher spot rates? Maybe. Higher penalties? Definitely.

Does an annual truck inspection blitz impact the market? A new analysis by DAT Solutions says it’s likely, and spot rate increases are going to cost shippers and could signal an improving summer freight season. Coincidentally, the federal penalties for violations of the trucking regs just went up, so carriers might have a little more skin in the game as well.

Granted, there are lots of moving parts to the supply chain, so determining the reason for a spike in the data invites the correlation/causation conundrum. Yet, as the statistician and informational graphics guru Edward Tufte succinctly puts it, "Correlation is not causation but it sure is a hint."

But I digress. Here’s what we know. The Commercial Vehicle Safety Alliance’s annual International Roadcheck is underway this week, and last year’s enforcement effort resulted in 73,475 truck and bus inspections, with nearly 50,000 of those being Level Is. Between vehicle and driver out-of-service rates, Roadcheck pulled 15,000 or so trucks off the road. And that’s not counting all the drivers who decide each year to take a few days off rather than to sit in an inspection queue.

Additionally, Roadcheck (as it often does) fell on the short week after Memorial Day last year, making for a rise in loads as the freight must catch up after the three-day weekend.

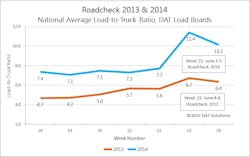

The result, as DAT market analyst Peggy Dorf nicely summarized in her blog post, DAT Load Boards saw a 9% decline in truck posts and a 37% increase in load posts.

“Why is that important? Well, during the week of Roadcheck 2014, that additional pressure on spot market capacity boosted rates by more than 3%,” she writes. “National average rates, including fuel, jumped 7¢ for dry vans, 8¢ for flatbeds and 6¢ for reefers.”

But, as she notes, 2014 was “extraordinary in many ways”—so the DAT team did some more digging: Turns out, the same pattern played out during Roadcheck week 2013, with loads up 30%, trucks up 9%, van rates up 8¢ per mile.

However, this year could be a little different, Dorf adds, as big fleets have bought a lot of trucks and the economy hasn’t been as hot as it was the last couple of years.

So what can we learn, once this week’s numbers are in? I chatted with Dorf and DAT industry pricing analyst Mark Montague to get some more insight.

First off, Montague points out that Memorial Day came early this year, so freight flows had the last in week in May “to get back to normal.”

And the early signs on Monday this week were “confusing,” he added, with rates dipping for vans and flatbeds but demand seemed to be “hot.” Still, he expects capacity to be constrained for the rest of the week, and rates to recover.

“From our data, there’s a lot of freight moving,” Montague said. “It’s not that there’s been a drop off, but this year’s a little different in that there’s some recovery of capacity because of hours of service and the oil sector being down—and the concerted effort to fill seats on those new tractors.”

Still, if Roadcheck does indeed take a comparable number of trucks off the road as in years past, and if rates do respond, that’s an indication that the supply-demand balance is again “on the razor’s edge” heading into summer, he explained.

The DAT folks were also kind enough to work up a chart illustrating the Roadcheck effect (at left), and we’ll update it next week to test the hypothesis and get a glimpse of what the summer is going to hold for spot freight and rates.

The load-to-truck ratio is the number of load posts divided by the number of truck posts on DAT Load Boards. As Dorf explained, they chose the ratio as a metric because the balance between demand (load posts) and capacity (truck posts) is a better indicator of market pressure than either of the two components alone, and because the ratio is relatively unaffected by Memorial Day or other holidays.

“It seems pretty clear that the event can have a disruptive effect on spot market capacity,” she concluded.

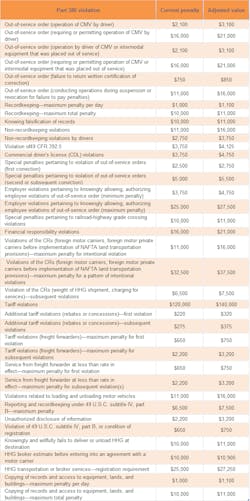

Now for the bad news: In case you missed the announcement earlier this spring, the Federal Motor Carrier Safety Administration has a new civil penalty schedule for violations of federal trucking regulations.

The penalty for a driver who violates an out-of-service order just got $1,000 more expensive on Monday, for example.

A table of the changes is below, or the official notice chart, complete with the statute citations, is here.

About the Author

Kevin Jones

Editor

Kevin has served as editor-in-chief of Trailer/Body Builders magazine since 2017—just the third editor in the magazine’s 60 years. He is also editorial director for Endeavor Business Media’s Commercial Vehicle group, which includes FleetOwner, Bulk Transporter, Refrigerated Transporter, American Trucker, and Fleet Maintenance magazines and websites.

Working from Beaufort, S.C., Kevin has covered trucking and manufacturing for nearly 20 years. His writing and commentary about the trucking industry and, previously, business and government, has been recognized with numerous state, regional, and national journalism awards.