Growth in the Gross Domestic Product (GDP) and stronger freight pricing should combine to make 2014 a good year for trucking, forecasting firm FTR said in its periodic State of Freight webinar on Feb. 13. But the growth in freight volume is not likely to match what the industry saw in 2013, it says. On the other hand, FTR believes a better-than-forecast economy could strain the trucking industry’s capacity to handle freight demand.

“We are mildly optimistic about 2014,” says Noel Perry, FTR senior consultant. “We are less optimistic about 2015 and 2016.”

Concerns include a history of slowing growth during recoveries along with softer economies in China and elsewhere in Asia and lingering threats from sovereign debt in Europe.

“I think this is a 2015-2016 exposure,” Perry says. “I don't think it's a big deal for 2014.”

In good times, truck and intermodal growth typically outpaces GDP growth, which FTR sees at just under 3% for 2014 compared to under 2% in 2013. But this “freight multiplier” has been declining recently, and FTR’s forecast for truck freight volume for 2014 is in the range of 3% rather than about 5% in 2013. FTR assumes a slower multiplier in 2014, but “there is an upside opportunity if indeed truck and intermodal resume their typical multipliers on GDP,” Perry says.

There is upside potential with freight rates as well, FTR believes. The firm is forecasting a modest truck freight pricing increase of about 4%, but the gains could be double that if trucking’s capacity crunch is worse than forecast, Perry says. The driver shortage in 2014 is about the scope of the shortage in 2004, he says. “Regulatory drag on capacity is becoming the big long-term issue.” The question is whether the Federal Motor Carrier Safety Administration does everything it says it plans to do regarding regulations that tighten the supply of drivers.

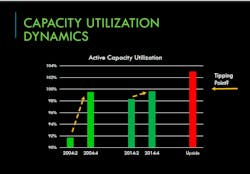

The supply of drivers as well as lagging equipment purchases is keeping active capacity utilization very high, Perry says. FTR expects utilization to hit about 99% by the end of the year – basically what the industry saw in late 2004. An uptick in freight volume and/or a worsening of the driver shortage could push that utilization even higher, he says. “At what point do we exhaust the ability of the industry to handle freight without problems? We believe we are getting close.”

Uncertainty over the strength of the economic recovery makes it difficult for trucking companies to plan, Perry says. “This is the year to stay flexible.”