Hanjin’s bankruptcy woes cause market ripple effect

As the US West Coast feels ripple effects from the bankruptcy of Hanjin Shipping Company, nationally the number of loads fell 5% during the week ending September 24, 2016, while capacity was up 3%, according to DAT Solutions, which operates the DAT network of load boards.

Those conditions helped send average van and refrigerated load-to-truck ratios down 10% the week ending September 24: reefers to 5.5 and vans to 2.8. The flatbed load-to-truck ratio was 13.2, unchanged from the previous week.

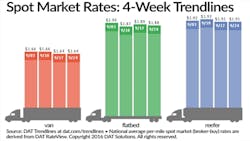

The ratios are back on par with August levels, but spot truckload rates didn’t move much:

•Reefers—Unchanged at $1.91/mile

•Vans—Unchanged at $1.64/mile

•Flatbeds—Down 1 cent for an average of $1.88/mile

Several van lanes showed strength the week ending September 24 while two Los Angeles-inbound lanes created opportunities for carriers looking to position trucks in that market:

•Columbus OH-Buffalo NY, $2.75/mile, up 6 cents

•Atlanta GA-Lakeland FL, $2.37/mile, unchanged

•Philadelphia PA-Boston MA, $3.15/mile, down 3 cents

•Chicago-Los Angeles, $1.29/mile, up 9 cents

•Dallas TX-Los Angeles, $1.08/mile, up 2 cents

Spot reefer prices were higher in the Los Angeles market, where the average outbound rate was up a penny to $2.36/mile. The highest-paying reefer lane in the West was Ontario CA-Phoenix, up 2 cents to $2.90/mile.

Twin Falls ID held onto the top spot the week ending September 24 for available reefer loads, due in part to strong potato harvests. The average Twin Falls-Chicago rate was up 24 cents to $1.89/mile. Midwest reefer rates were mostly down, but Green Bay WI-Minneapolis MN paid 20 cents better the week ending September 24 at $2.10/mile.

A September 30 article by Rachel Uranga of the Long Beach Press Telegram discusses the plight of the recently bankrupted Hanjin:

As many as 15,000 steel cargo boxes leased or owned by the failed Hanjin Shipping Co have nowhere to go.

Since the company collapsed at the end of August, the orphaned containers have piled up in and around the ports of Long Beach and Los Angeles—and no one’s quite sure what to do with them. They can’t stay here; the real estate is too scarce, especially ahead of the busy holiday season.

“Some people were hinting to take (the boxes) out in the desert and abandon them,” said Dan Monnier, who sits on the board of the Los Angeles Customs Brokers & Freight Forwarders Association, which arranges transportation for retailers. “It sounds cute, but remember, (the containers) still belong to the bankrupt company Hanjin.”

Spot market rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

Look for more information about load availability and rates at www.dat.com.