Spot market rates respond to freight volume’s strength nationally

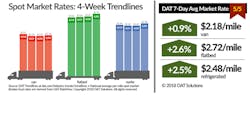

The number of spot market loads on the DAT network of load boards rose 1.3% and truck posts fell 1.0% during the week ending May 5, 2018, reflecting stronger shipper demand. National average rates for all three equipment types responded, moving higher compared with the previous week:

•Reefer—$2.48/mile, up 6 cents. This rate is 5 cents above the April average and 51 cents higher than one year ago.

•Van— $2.18/mile, up 2 cents week over week and 48 cents higher than a year ago.

•Flatbed—$2.72/mile, up 7 cents. This is the highest flatbed rate ever recorded in DAT Trendlines.

Spot truckload freight availability during the month of April was 3.9% higher than March and 100% higher year over year. Available capacity was up 2.2% compared with March and 7.5% year over year.

Reefer load posts climbed 10% while truck posts declined 2%, which sent the national reefer load-to-truck ratio up 12% to 9.2 loads per truck. With produce harvests heating up, Los Angeles ($3.02/mile, up 11 cents), Miami FL ($3.06/mile, up 59 cents), and Lakeland FL ($2.43/mile, up 40 cents) were among major reefer markets with sizable gains in the average outbound rate.

Van load posts inched up 1% the week ending May 5 while van posts advanced 3%. That caused the van load-to-truck ratio to gain 1% to 6.2 loads per truck. Key markets:

—Los Angeles—$2.42/mile, up 7 cents on a 2.8% increase in volume

—Memphis—$2.67/mile, up 9 cents with a 3.3% volume increase

Several van lanes showed higher rates:

—Memphis to Columbus OH—$2.76/mile, up 19 cents

—Atlanta to Philadelphia— $2.95/mile, up 14 cents

—Charlotte to Buffalo NY—$2.94/mile, up 17 cents

Nationally, the number of flatbed load posts was unchanged while truck posts dropped 3%. The flatbed load-to-truck ratio was up 3% to 111 loads per truck, which ties the record set during the first week of April. The flatbed load-to-truck ratio has been above 100 loads per truck for six weeks in a row.

This report is generated using DAT RateView, a service that provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. RateView’s database is comprised of more than $45 billion in freight bills in 65,000-plus lanes.

For the latest spot market load availability and rate information, visit www.dat.com/trendlines.