Why the COVID-19 recession won't be like the Great Recession

The looming pandemic recession won’t compare to the Great Recession. The economic instability of more than a decade ago won’t offer lessons for the COVID-19-driven economic crisis facing the U.S. and the rest of the world, according to economist Bill Witte of FTR Transportation Intelligence.

“I don't think this is a normal recession-recovery situation. It's not a business event. It's a completely artificial event,” Witte said during an FTR-hosted webinar on April 10 about the economic outlook for freight in the wake of COVID-19. “That means that looking at how this is going to unfold in terms of past recessions — and particularly a lot of people are going back to the Great Recession about a decade ago — is probably not going to provide much in the way of useful guidance, at least that's my opinion.”

As COVID-19 spreads across the country, different regions and transportation-related sectors are working in different time frames. This could be exasperated if a larger wave of the virus hits industries in the Midwest and South in the coming weeks, according to FTR forecasts.

“This is where we see that the pressure on the output of production becomes somewhat constrained,” noted FTR CEO Eric Starks.

He added that the concept of “flattening the curve” of the spread of the COVID-19 virus might be interpreted differently. While for some it might mean that things get back to normal sooner, that is not the case.

“The reality is that if we flatten the curve, it suggests that we are pushing out the peak so that it becomes flatter in the sense of when people get the virus,” Starks pointed out. “We, in essence, are not saying that people are not going to get the virus, we’re just saying it’s not going to happen in this particular time frame, and we’re trying to elongate that so we can have a better response as it relates to health care.”

While that would be good for health care capacity, it could also push out economic pain into the third quarter this year. “So the ability for us to get back to normal — whatever the heck normal is — becomes more difficult because of that,” according to Starks. “And so this is the push-and-pull that we're dealing with trying to understand the impacts on the basic economy.”

This is not your typical recession

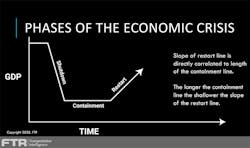

Unlike typical economic recessions where the downturn is followed by a trough and then the recovery, the coronavirus is being driven by the initial forced shutdown of the economy, followed by the containment and eventually a restart.

The shutdown began at the end of March, Witte said. “We are now, I think, in the containment phase, probably about three weeks into it, or so. It varies a little bit depending on the part of the economy you're in and your geographic location. The key question is how long this containment is going to last. And that's key because it determines, we think, how the restart is going to look.”

Witte compared the containment to leaving a piece of equipment out in the rain: the longer something is left idle in adverse conditions, the harder it is to get it back to where it was. “You can get away with it for a week or two with a couple of rainstorms,” he noted. “But if you leave it out there for a whole spring and summer season, a piece of equipment is probably going to be in pretty rough shape. And I think that same kind of logic applies here. That also means that if the containment period is short, the restart could be a pretty rapid event.”

Like that unprotected equipment, the longer the pandemic containment lasts, more parts of the economy start to deteriorate. Witte, who is also the chief forecaster for Witte Econometrics, expects this storm to last until at least late into the second quarter of 2020, adding that thoughts of a May bounceback are probably optimistic.

“Our forecast is predicated on sometime in June so that we're really in the restart phase by the time the third quarter starts, which means the shutdown and containment is going to be basically a second-quarter event,” he explained.

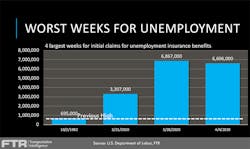

The worst weeks for unemployment in U.S. history were recorded over the past three weeks: 3.3 million were reported on March 21, 6.9 million on March 28 and 6.6 million on April 4. Before the pandemic, the previous worst unemployment week was recorded in October 1982 when 695,000 people filed jobless claims.

Witte said that the recent CARES Act, passed by Congress in response to the pandemic, which includes forgivable loans for small businesses to keep payroll and other expenses, could soften unemployment figures.

“As I look at the stimulus programs, particularly the small business stimulus program, these forgivable loans are really designed to get people back on the payrolls — even though they probably won't be doing much work in many cases, they're not going to be unemployed,” he said. “It's not clear what the economic implications of that are, except that it keeps people tied to their jobs more closely. But it will affect these numbers as we go forward… Even with all that I've just been saying, these numbers are really bad.”

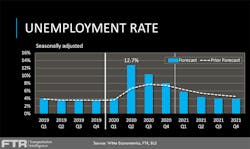

Witte is expecting about 15 million jobless claims in the private sector during the second quarter of the year, which began April 1. His forecast shows the job market rebounding in the third quarter, followed by larger gains at the end of 2020 and start of 2021. “But we don’t really get back to where we were until toward the end of 2021,” he said.

These forecasts show an unemployment number greater than what the U.S. saw during the Great Recession — but not reaching the highs of the Great Depression. “There are forecasts out there that say we're going to hit those levels of unemployment of 25-30%,” he added. “I think, at this point at least, that's too pessimistic.”

GDP rebound is more uncertain

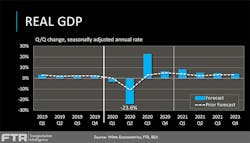

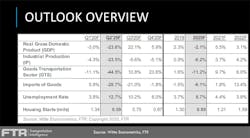

The GDP forecast is harder to pinpoint in these unprecedented times, Witte conceded. His forecast shows a seasonally-adjusted GDP drop of nearly 24% this quarter.

“That's a huge drop much, much more than anything we've seen on a quarterly basis at any point in my memory, which goes all the way back to the ‘60s. And I think you could go all the way back to the Great Depression to find numbers like that — and even there, you might not have a quarterly number that large on the negative side.”

But if the shutdown and containment end by late June, Witte expects a healthy 20% bump in GDP during the third quarter. “You have to remember that 20-plus percent off the base was established after the 23-plus percent drop in the second quarter — so it doesn't get you back where you were,” he said. “In fact, again, with these numbers, the economy doesn't really fully recover until toward the end of next year, but most of the recovery is over the third, fourth and first quarter of next year.”

But predicting the future in a once-a-century pandemic does not breed confidence. And Witte said that the further out he looks, the less faith he has in his own numbers because there is more guesswork involved in the GDP forecast than the employment forecast.

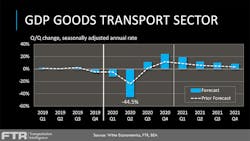

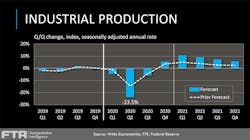

FTR is expecting industrial production to be down (-23.5%) along the same lines as the GDP in the second quarter — but an even more drastic reduction in the goods transportation sector (-44.5%) and the imports of goods (-28.7%). Adding to this, fewer than 600,000 housing starts are expected this quarter — compared to 1.34 million starts in the first three months of 2020.

Along with the drastic GDP Goods Transport Sector drop FTR foresees, the group revised its first-quarter estimate from -5% to -11%. The economy linked with goods transportation is hit harder by COVID-19 because many services are less affected by stay-at-home containment protocols than are goods production and consumption, according to Starks.

The sharper decline in GDP Goods Transport leads to the overall GDP forecast, but FTR also lowered its exports outlook. While this change hits both goods and services, it hits goods harder.

“With the global markets in disarray, the ability to see a resurgence in the export market is going to be very difficult,” Starks pointed out. “The focus is going to be more on domestic demand, and what does that look like?”

The demand destruction in FTR’s revised forecast further lowers imports to a 32% decline in the second quarter. Imports count as a negative in GDP, so the deeper decline acts to raise the floor a bit on the GDP calculation. However, the effect on the GDP goods transport sector (GTS) is quite the opposite, according to FTR.

The transportation markets

When it comes to the transportation market, Starks noted, the goods sector is easier to define than the services sector. Hospitality, for example, is a service sector that's not expected to come back first.

FTR’s forecast does expect a 10.8% bump in the GTS in the third quarter — “but nothing close to what I would call normal levels. We don't see a noticeable jump until the fourth quarter, but a lot of that is being driven by an increase in inventories,” Starks said, noting that the depleted inventories of the current quarter will start to be replenished the second half of the year.

This does not get the U.S. transportation sectors back to normalized levels of late-2019 and early-2020 until middle- or late-2021. “This is a recovery that is not a return to normal overnight,” Starks said. “And I think that’s a big deal for us to understand.”

On the other hand, the industrial production numbers tell a different story than the GTS. While goods are expected to rebound in the second half of 2020, industrial production could see further reductions.

“We see another decline into Q3 before seeing any uptick into Q4,” Starks said. “So it’s really not until the first quarter (of 2021) that we have what I would call a noticeable recovery in the output of the industrial sector.”

Starks said he’s seen a change in tone among FTR customers and in various production industries. “The initial tone was, ‘We can continue to produce, we're going to keep moving through this,” Starks said. But then over the last few weeks, the impacts of social distancing and more people staying home worked its way through the production economy.

“So you may find that a facility may be shut down for different reasons,” Starks added. “It may be shut down because they have had to send employees home. They may have shut down because they don't have the components that they need to continue to produce. Whatever that looks like, we believe over the next couple weeks that we'll continue to see more and more shutdowns happening.”

So while some of the economy — and most of the American public — is in the containment phase of the pandemic economic crisis, much of the industrial sector is still in the shutdown phase.

“I think it's another week or two before we finally start realizing that because as we see more and more impact for the coronavirus moving into the Midwest, for example, that's when you start seeing more shutdowns happening within the industrial sector,” Starks explained.

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.