World oil demand might not return to 2019 levels until the end of 2021, which could create opportunities for the U.S. freight industry as the COVID-19 pandemic lingers on during a year like no other.

“Coming into the year, we thought things were going to be very different,” Laura Speake, Caterpillar’s chief economist for energy and transportation, said during her keynote address at FTR Engage, a virtual speaking series from FTR Transportation Intelligence on Aug. 13. While economists like Speake expected slower gross domestic product (GDP) growth in 2020 than in recent years, they were not expecting a U.S.-led or global recession. “The economy was moving to a slower growth pattern, but it was still expected to grow as we went from ’19 into ’20.”

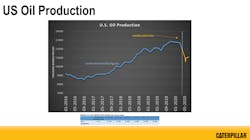

That reserved optimism was based on a record-low unemployment rate in the U.S. and the first part of a new China trade deal. At the start of 2020, oil prices were showing the potential for the continued growth of U.S. shale oil production. “U.S. shale has really become a bigger overall impact on the U.S. economy over the last decade or so, as more industry is tied to what's happening in the shale markets.”

All of this added up to net positives for the U.S. economy in 2020 — despite the expected slowdowns in business investment that often come during a presidential election year. Then the COVID-19 pandemic started in China in January before spreading to Europe in February and then to the U.S.

“By March, everything had changed,” Speake said. “And it changed quickly. We went from having a positive outlook for 2020 to now the consensus forecast for the U.S. GDP is negative--5.5%. This is substantially more dramatic of a drop than what we saw during the Great Recession in a single quarter.”

Most of the worst economy-dragging action of COVID-19 happened in the first half of the year, Speake noted. She expects the second half of 2020 to “be a little better than the first half” of the year but still much worse overall than 2019.

Unemployment, which skyrocketed in March and early April, has started to recover. “Even as it’s improved over the last two to three weeks, it’s still substantially higher than what we saw in any given week in the ’08-’09 recession,” Speake added.

Oil demand down

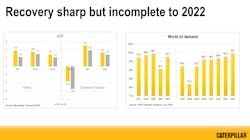

With the record unemployment, the country’s push to limit travel and more people working from home, oil demand plummeted this spring. In 2019, world oil demand was about 100 million barrels a day, according to the Organization of the Petroleum Exporting Countries (OPEC). The international organization saw demand drop by 20% in the second quarter of 2020 and expects demand to be down 10% overall this year.

“It's really fueled by a couple of things,” Speake explained. “If you look at global oil demand, about 40% to 45% of it comes from light-duty vehicles. About 10% to 12% is aviation. And those are the two areas where we saw demand hit hardest.”

She added that the maritime and chemicals industry also saw decreased oil demand. But with fewer people traveling — by car or plane — this year, that is where the oil markets were hurt the worst. Speake noted that major U.S. cities are seeing 10% to 30% less vehicle traffic than usual. With more people working from home and fewer people traveling in general, oil prices were driven down considerably, Speake said.

This drove oil prices into negative territory in April as oil producers worried about running out of storage. The average for oil so far this year is $16 to $20 a barrel, Speake said. In 2019 it was $64, according to OPEC.

This month, oil is back up to more than $40 per barrel. “We've gotten back to an area where we think we're not going to run out of storage in the way that we anticipated in April,” Speake said. “However, there is still a lot of surplus capacity in the market that needs to come back to to make the oil-producing countries healthy — including in the U.S.”

Expect more volatility

Speake said to expect price volatility the rest of this year as demand ramps back up and oil producers try to manage capacity. The current oil price, while better than it was in April, is still low for the petroleum industry. “So if you’re a consumer of oil in the freight industry, it’s still a very, very good market price going forward,” according to Speake, who added that prices could creep up a bit but would get nowhere near the nearly-$100-a-barrel prices at the start of 2019.

Diesel fuel prices in the U.S. are down nearly 60 cents a gallon if you compare August 2020 ($2.43) to August 2019 ($3.01), according to the U.S. Energy Information Administration (EIA). Regular gasoline prices in the U.S. are down more than 45 cents per gallon over the same period: Nationwide gas prices averaged $2.17 per gallon on Aug. 10, compared to $2.62 the second week of August 2019.

OPEC doesn’t expect oil demand to near 100 million barrels a day until the fourth quarter of 2021, Speake noted, which means it will take until at least 2022 for global demand to average 100 million barrels a day. Some forecasters, she said, are speculating that demand will never return to peak levels of 2019 because of reduced aviation demand and increased fleet vehicle efficiency.

“I personally disagree,” Speake said of the more dire forecasts. “I think we will see it. But I think it does reduce the long term peak that we would expect to see in the next decade.”

According to the latest EIA numbers, demand in May was 10 million barrels a day. And while production has resumed, it is still down about 85% this year, Speake noted. “So you have two factors that are going to influence production over the rest of this year: One, you have base declines in existing wells that will drive production down. And then you have some of these producers that are going to bring shuttered production back online. So overall, I think that we will continue to see production, hover around that 10 million barrels a day.”

She said that so long as oil prices remain around $40 per barrel, don’t expect to see a lot of additional drilling and production in the U.S. With uncertainty still surrounding the COVID pandemic, Speake said to expect a lot of volatility in the coming months.

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.