Economy’s post-COVID potential hinges on next few weeks

As the COVID-19 pandemic stretches into its 10th month in the U.S., its lasting effects on the economy — from more companies embracing remote work to more consumers embracing last-mile delivery — are not going away, according to economist Bob Dieli of MacKay & Co. As coronavirus cases surge again, what happens over the next several weeks will tell the tale of what the 2021 U.S. economy will look like.

Just as major drug manufacturers announced recent successes in developing a coronavirus vaccine, the reopening rebound of the COVID-19 recession is coming to an end. This is creating some uncertainty for the winter months.

The U.S. economy appears to be on the edge of another slowdown as the virus surges across much of the country and more states are eyeing lockdowns similar to the spring phase that led to the pandemic recession. “I think we are definitely in for some type of pause over the next several months — how long and how deep, I think, remains to be seen,” Dieli said during a Heavy Duty Manufacturers Association (HDMA) Pulse Series webinar on Nov. 18.

With the vaccine on the horizon, John Blodgett, VP of MacKay & Co., said to expect an uneven 2021. “We've got a vaccine on the way, so our concern has been the first half of the year,” he said during the same HDMA event. “At least the first quarter is not going to be as good as the rest of the year is. But at least things look a little bit more positive from that standpoint.”

Blodgett said the expected strength at the end of 2021 could balance out the weakness at the start of the year, bringing trucking and other economic indicators back up to 2019 levels.

Third phase

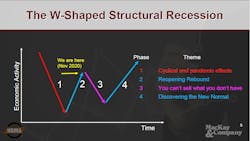

Dieli has described the COVID recession as a potential W-shaped recession. The first part was the initial decline as the pandemic shut down much of the economy before a rebound during the summer as states reopened. Right now, he said the U.S. finds itself between that second phase rebound and the third phase decline, created by supply chain woes and more lockdowns. The fourth phase, or fourth leg of the “W,” would be a second rebound where the economy bounces back as it discovers the “new normal.”

The best way to judge short-term economic figures is through employment data, Dieli said, as the Bureau of Labor Statistics (BLS) releases jobless claims statistics weekly along with other data throughout each month. With data compiled for the first two legs of the “W,” Dieli said the “size and composition of the changes of the next three reports are going to really tell the tale. We’ll find out what is being restrained and what are now permanent losses that have resulted from the downturns that have already taken place.”

While nonfarm payroll employment has slowly been on the rise since its 2020 nadir in April (130.3 million jobs), October’s 142.4 million jobs are still more than 10 million fewer jobs than the U.S. had on record in February.

Dieli said not to expect to see the mid- to late-November shutdowns affect the next round of monthly employment numbers, which will be released on Friday, Dec. 4. “It’s going to replicate what happened last March and April,” he said, “where we had the slowdowns begin in late March with some effect on employment then. But the brunt of the effect was seen in April — where we know it had taken place over both March and April.”

Two employment sectors most affected by the COVID economy, which Dieli is keeping an eye on, are leisure and hospitality and local government education. Like most other jobs, leisure and hospitality have been returning slowly over the summer and early fall. But employment figures for this segment were still down by nearly 3.5 million in October compared to the 16 million payroll jobs it had in February.

Government education jobs, which topped eight million in February (a total that had held steady over the previous couple of years, Dieli noted) have not seen the same steady increase as other sectors: Jobs continued to decline into the summer months before slight gains in July and August were followed by declines in September and October. As of October’s jobs report, education jobs were down 666,200 since February. “One thing to keep in mind here is that more than teachers work in schools,” Dieli said. “When we talk about rearranging where and how we are going to take care of education, it’s not just the teachers that we are counting.”

Since the pandemic first hit, the lingering effects of hybrid learning patterns — with talks of more school closures on the horizon — has turned this sector of the economy into a “source of weakness that is likely to get weaker as we go through the next couple of months,” Dieli said.

Trucking

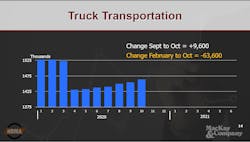

Truck transportation jobs were also not immune to the COVID recession — but continue to see steady employment gains since losing about 100,000 jobs between February and April this year. Trucking added nearly 10,000 jobs between September and October, which puts the industry at 63,600 fewer jobs than pre-pandemic BLS figures. (Diel noted that these figures don’t reflect private fleet employment numbers, which fall in the private fleet’s main business category. So Walmart and Amazon drivers, for example, are counted as retail employees, he explained.)

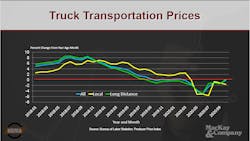

Along with slow-and-steady truck transportation employment gains, the industry’s Producer Price Index (PPI) is on the rebound for both local and long-distance sectors. “The anecdotal evidence I see from various sources suggests that prices are continuing to firm both because the level of freight appears to be increasing,” Dieli said, “and also because some of the factors that lead to what I would call disorganization in some of these markets are being resolved.”

What to watch

Diel said he is watching five forward-looking indicators for the trucking economy: Single-family building permits, single-family housing starts, gasoline prices, diesel prices, and Class 8 retail sales. “These are chosen for a couple of very specific reasons,” he said. “The first two relate to construction, which is a truck-intensive activity … Construction activity has a large multiplier for the rest of the economy: you build a house, you have to furnish that house, and you have to move into that house. You have to do all sorts of things that cause Truckable Economic Activity (TEA).”

Fuel prices and heavy-duty truck sales also have direct impacts on the trucking industry.

The Census Bureau has recently released good news for the industry, Dieli said. Housing permits issued continued on an upward trend in September, which is the latest data available. This marks the third straight month of 2020 where more housing permits were issued than the same month of 2019. “Not only have permits been extended, but the houses have been started,” he said, noting that housing starts in June through September 2020 have outpaced the starts over the same period in 2019.

This data reflects the good “financial and human” demographic in the housing market, Dieli said. “This is good news. This is what we were expecting. This is the type of activity that I think we can expect to see more of. The restraints that were applied here were directly pandemic related and as those restraints were removed, activity improved.”

As mobility decreased during the height of the spring shutdowns, gasoline prices plummeted to sub-$2 averages across the U.S. until June. “As we began to move around again, prices began to move up,” Dieli noted. “But they have been moving sideways to slightly down for the last several weeks, which suggests that we may have at least momentarily reached the level where demand for fuel isn’t going to change very much.”

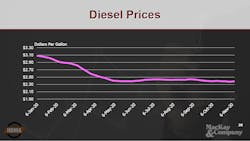

Diesel prices saw a similar drop this spring and have remained below $2.50 on average across the nation since May. Dieli said he hadn’t seen any indications that diesel prices will increase soon. “As was the case with gasoline, flat is acceptable at this juncture,” he said. “It will be interesting to monitor what goes on here — especially now that we’re looking at potential lockdowns in several parts of the country.”

Class 8 truck retail sales began to rebound in June after falling below 10,000 in May. Sales topped 15,000 in August, September and October — but October numbers were slightly down month-over-month for the first time this year since May. “We knew going into 2020 that Class 8 sales would be down from the rather torrid pace of ’19,” Dieli said. “But the question was going to be how and when we were going to sell trucks. And that’s the question that came up in the October report, where while the total saw little change, the internals gave me a little reason to wonder whether we again might not be reaching some type of natural flattop.”

Dieli said he’ll have a better understanding of these numbers over the next few months. He added that December is typically a big truck sales month.

“The key point here is that as pandemic restrictions were removed, we began to see improvement — the improvement we anticipated,” he said before adding that all these numbers still mean that the recession will likely last the rest of 2020. “The pace of the recovery is still going to be governed by how we deal with public health issues.”

According to the economist, the broader implication is that the U.S. economy is going through structural changes. As more and more companies find success working remotely, “those changes are not going to go away,” Dieli said. “The effects this has had on various other parts of the economy are lasting and are not going away. As a consequence, what 2021 is going to look like will depend in part on what happens over the next several weeks with the lockdowns … and what becomes temporary and what becomes permanent.”

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.