The number of load posts fell 13% last week and activity on the spot truckload freight market tapered off significantly as Easter weekend approached, said DAT Solutions, which operates the DAT network of load boards. The number of trucks posted was virtually unchanged compared to the previous week, and with less freight available, rates slumped on lanes across much of the country.

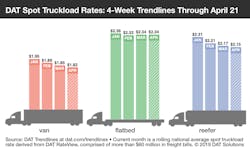

National average spot rates (through April 21):

- Van: $1.82/mile, down 3 cents compared to the March average

- Refrigerated: $2.15/mile, 2 cents lower

- Flatbed: $2.34/mile, unchanged

Van and reefer rates declined despite a 3-cent rise in the national average price of diesel, which was $3.15 a gallon last week. Spot rates include a fuel surcharge portion.

Van trends: Rates were up on 42 of the top 100 van lanes week over week. The van load-to-truck ratio peaked on Tuesday at 1.8 loads per truck and skidded to 0.8 by Good Friday as shippers and receivers curtailed their activity for the holidays. Van freight volume last week is actually 11% higher year over year.

Markets to watch: Los Angeles and Denver had higher average outbound rates, but those were the only standouts. Just a handful of lanes had double-digit rate increases compared to the previous week, including:

- Los Angeles to Seattle, up 10 cents to $2.27/mile

- Denver to Dallas gained 10 cents to $1.24/mile

- Atlanta to Philadelphia rose 17 cents to $2.10/mile

All major van markets lost volume as many shippers and receivers ran on a reduced schedule on Good Friday. In general, demand and rates were weakest in the Northeast and parts of the Midwest. Buffalo to Charlotte dropped 20 cents to $1.93/mile, while Chicago to Denver fell 15 cents to $2.29/mile.

Flatbed trends: Flatbed volume has slowed after a strong first quarter. Weather appears to be a factor, as well as reduced oil production in West Texas.

On the bright side, recovery from flooding in the Midwest is creating opportunities to move heavy equipment and construction supplies. And with produce season under way, onions, potatoes, and melons can be moved short and intermediate distances in open-air containers on flatbeds.

Markets to watch: Flatbed rates increased on major lanes from Houston, Los Angeles, and Las Vegas. Among them

- Houston to Los Angeles surged 46 cents to $2.24/mile. Such a large rate increase on a relatively high-mileage flatbed lane is a sign that the Los Angeles market is picking up.

- Las Vegas to Phoenix gained 42 cents to $2.97/mile. Usually it’s L.A. that drives up rates in Las Vegas, so to see Phoenix here is another unusual occurrence.

Southeast and Northeast markets faded last week, driven by lower rates from Atlanta, Cleveland, and Harrisburg, Pa. Harrisburg to Springfield, Mass., plunged 46 cents to $3.60/mile, still a good rate for this lane.

DAT Trendlines are generated using DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $60 billion in freight payments. DAT load boards average 1.2 million load posts searched per business day.

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director