Spot rates rise as weather, freight availability improve

Better weather combined with a 4.2% increase in the number of available loads pushed spot truckload freight rates higher during the week ending May 5, according to DAT Solutions, which operates the DAT network of load boards.

The number of available trucks, which has steadily increased in recent weeks, rose 1.6%.

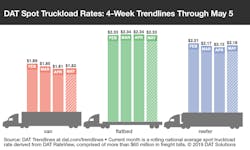

National Average Spot Rates Through May 5

- Van: $1.82/mile, 1 cent above the April average

- Refrigerated: $2.18/mile, 3 cents higher than April

- Flatbed: $2.33/mile, 1 cent lower

The price of fuel was $3.17 per gallon as a national average, nearly unchanged from the previous week.

Van trends

Individual lane rates are trending up as rates increased on 53 of the top 100 van lanes last week, the first time in six weeks that more lanes were up than down. The national average van load-to-truck ratio rose from 1.6 to 1.8 last week.

Market to watch: The average outbound spot van rate from Charlotte increased 3 cents to $1.99/mile as several outbound lanes improved:

- Charlotte to Buffalo, up 11 cents to $2.24/mile

- Charlotte to Atlanta, up 5 cents to $2.30/mile

- Charlotte to Memphis, up 6 cents to $1.57/mile

One caveat: The load-to-truck ratio from Charlotte peaked around April 29 to May 1 and declined through the first week of May. It remains to be seen whether this is an end-of-month surge or the beginning of a sustained upward trend.

Reefer trends

The national average reefer load-to-truck ratio popped up from 2.5 to 2.9 last week, a sign that produce-shipping season in the Southeast is stepping into higher gear.

Market to watch: In Florida, the number of spot reefer loads from Lakeland increased 13% and freight paid an average of $2.21/mile, up 49 cents compared to the previous week. Volume from Miami jumped 20% and paid an average of $2.59/mile, a 51-cent increase. Key lanes:

- Lakeland to Baltimore, up 85 cents to $2.86/mile

- Lakeland to Charlotte, up 57 cents to $2.62/mile

- Miami to Boston added 62 cents to $3.09/mile

- Miami to Baltimore gained 51 cents to $3.05/mile

California has been slower than usual, with freight volumes down nearly 3% compared to the previous week. The wet winter and spring delayed planting in many regions but should deliver strong harvests in the coming weeks, including substantial numbers of cherries and table grapes.

DAT Trendlines is a weekly snapshot of month-to-date national average rates from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $60 billion in freight payments. DAT load boards average 1.2 million load posts searched per business day.

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director