Truckload van freight volume falls 3%, rates slip lower

Spot truckload freight volume increased 1.2% during the week ending Aug. 11, with the availability of spot reefer and flatbed freight making up for a decline in van loads, said DAT Solutions, which operates the industry’s largest network of load boards.

Nationally, the number of available trucks increased 3.7% compared to the previous week. Average spot rates in August remain below July averages.

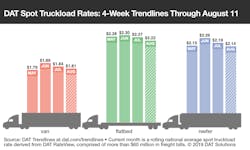

National average spot rates, through Aug. 11

- Van: $1.81 per mile, 3 cents lower than the July average

- Flatbed: $2.28 per mile, 5 cents lower than July

- Reefer: $2.14 per mile, 5 cents lower than July

Van trends: Van volume slipped 3% last week, and 57 of DAT’s top 100 van lanes by volume had lower rates. Among the few positive markets was Buffalo, where van freight volume increased 3% compared to the previous week and the average outbound rate rose 7 cents to $2.08 per mile. Otherwise, spot van volumes have been sliding over the past four weeks, especially in large Southeastern freight hubs:

- Atlanta, down 8% over four weeks

- Charlotte, down 5%

- Memphis, down 7%

- Houston, down 5%

The national average van load-to-truck ratio dropped from 2.2 to 2.1. That’s nearly a full point lower than the August 2018 average.

Reefer trends: Demand for reefer trucks trailed off in California and Texas last week, and the majority of high-traffic reefer lanes paid lower last week. There were early signs of activity shifting northward, as significantly higher volumes from Denver (up 34%) and Grand Rapids (up 71%) helped elevate the national average reefer load-to-truck ratio from 4.2 to 4.3.

While apple harvests won’t kick-in strongly until the end of August, demand for trucks—and sent rates higher—on key Midwestern lanes:

- Grand Rapids to Cleveland surged 62 cents to $3.71 per mile

- Grand Rapids to Atlanta added 31 cents to $2.59 per mile

- Chicago to Atlanta rose 20 cents to $2.77 per mile

- Chicago to Philadelphia was up 16 cents to $3.03 per mile

- Chicago to Denver increased 13 cents to $2.40 per mile

Key takeaways:

- Fewer reefer loads out of California meant truckload capacity was more available elsewhere. Reefer load volume out of Los Angeles fell 10% last week, Sacramento was down 5%, and Ontario declined 3%.

- The national average spot van rate is 20% lower year over year, when the average rate was $2.31 per mile.

- There’s still uncertainty over how shippers will react to shifting tariff deadlines on Chinese imports. So far in August, spot van volumes indicate a lack of urgency to move goods ahead of the Sept. 1 deadline for additional taxes to take effect.

DAT Trendlines is a weekly snapshot of month-to-date national average rates from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $65 billion in annualized freight payments. DAT load boards average 1.2 million load searches per business day.

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director