The price of diesel fuel dropped for the sixth straight week, as the U.S. average for the trucking industry’s main fuel fell by 13 cents to $5.138 per gallon and declined at least 11 cents in every region of the country, according to the latest government data.

As fears of recession depress demand and oil prices decline, prices for distillates are starting to follow a similar track. Gasoline also was down for the week of Aug. 1, dropping 13.8 cents from the week before to $4.192 per gallon, according to the U.S. Energy Information Administration (EIA). Motor club AAA also saw gas down from the week prior—14.8 cents. The national average for gasoline is down 38.3 cents in a month, according to AAA.

See also: Fuel prices continue to fall across U.S.

Diesel is still $1.771 more per gallon than it was a year ago, and gas is 1.033 more than at this time in 2021, according to EIA.

The wave of price declines nationwide is clear, based on data from every region of the U.S. tracked by EIA.

Oil is dropping, but the main driver is demand

What is driving these price declines? It’s coming down to demand. In the U.S., demand for oil distillates—diesel, gasoline, and jet fuel among them—is down more than 10% compared to 2019, before the pandemic began, according to EIA. Fueling stations have responded by lowering prices.

Distillate markets also are down because investors are worried that interest-rate hikes from the Fed will slow the economy as central banks get aggressive in combating inflation, according to Reuters. Fears of a recession are putting downward pressure on fuel prices, too, according to market watchers.

See also: Trucking index falls mostly on diesel price gains

The U.S. benchmark oil price is forecast to fall to an average of $90 a barrel for the second half of this year compared with $101.35 in the first half, RBN Energy analyst John Auers told Politico. This would drag gasoline prices lower than they are now, barring a major upset in oil markets already roiled by factors such as supply chain crunches and the Russian war in Ukraine. It was the beginning of the war in March that sent diesel prices to a record increase of 74.5 cents in one week, according to EIA. Prices continued at record levels until the fever began to break in mid-June.

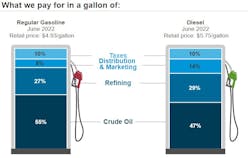

Meanwhile, oil companies are proving to be the prime beneficiaries of fuel prices that soared to records this year. ExxonMobil, Chevron, and Shell posted a combined $46 billion in earnings for the second quarter, according to earnings statements from the three companies. Exxon reported $17.9 billion in earnings, and Chevron said it earned $11.6 billion. The huge profits set records as Americans and the trucking industry, particularly owner-operators, struggled to stay in business in a climate of record fuel prices.

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.