Diesel prices see biggest surge since Russian invasion

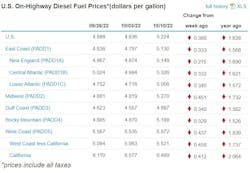

After 15 weeks of declining fuel prices, commercial carriers undoubtedly will feel more cost pressure after the national average for diesel spiked 38.8 cents to $5.224 per gallon, according to the latest U.S. Energy Information Administration (EIA) data for the week of Oct. 10.

The increase for the week reached two milestones:

- It was the largest rise in the average for trucking’s main fuel since the 74.5-cent surge for the week of March 7 that followed Russia’s bloody invasion of Ukraine, which sent diesel to a record that was followed by several weeks of more record highs.

- The Oct. 10 increase also shot diesel well above $5 again in almost all regions of the U.S.

Diesel surged the most in the Midwest, where it rose 45.1 cents to $5.270 per gallon. That was even higher than the increase on the West Coast (traditionally and easily the most expensive region in the country), where trucking’s main fuel rose 43.7 cents to $5.972. The fuel rose 33.3 cents on the East Coast to $5.224 per gallon, while on the Gulf Coast, it was up 34 cents to $4.897. The fuel was up 32.9 cents to $5.199 in the Rocky Mountain region of the U.S.

See also: Diesel continues slide, falls another nickel

The U.S. diesel average has not risen above $5 since the week of Sept. 12, when it was $5.033 a gallon. According to EIA, the all-time high was set the week of June 20 this year, when the average rose to $5.81. There was one anomalous 20.4-cent spike to $5.115 the week of Aug. 29, but that increase was followed by several more weeks of declines to below $5 until this week.

Meanwhile, motor club AAA, which uploads fuel price data daily and weekly and state-by-state whereas EIA reports weekly and regionally, pegged diesel much higher but not as lofty as EIA at $5.16 per gallon on Oct. 12, already a 3.8-cent increase from the previous day and a 29.4-cent increase from a week ago.

See also: Fleets try to meet shippers’ newest request: sustainability

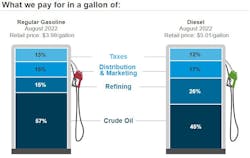

Both EIA and AAA had gasoline, widely used by consumers and some commercial fleets, on a similar trajectory as diesel, though not as drastic of a climb. EIA had the national average for gas at $3.912, a 13-cent increase over the week before. AAA reported on Oct. 12 the U.S. average for gas at $3.922, a marginal rise from the day before but a 9-cent increase from the week before.

OPEC+ could be the culprit

Analysts struggled to pinpoint a reason for the surge in fuel prices, but they did mention one possible factor: The OPEC+ alliance of oil-exporting countries on Oct. 5 agreed to cut their oil production by 2 million barrels per day—about 2% of global supply and a move that outraged the Biden administration.

OPEC+ members are already unable to meet production quotas, leading to the cut. Oil supply could diminish further before the end of the year as a European ban on most Russian imports takes effect in December. A separate move by the U.S. and other G7 democracies to impose a price cap on Russian oil could reduce supply if Russia retaliates by refusing to ship to countries and companies that observe the cap, according to The Associated Press.

Fuel-price reporting is all about trends. A new one toward higher diesel prices will only become apparent as AAA reports over the coming week and EIA releases data for the week of Oct. 17. Then the trucking industry will know whether to brace for another sustained period of climbing prices.

FleetOwner digital editor Scott Keith contributed to this report.

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.