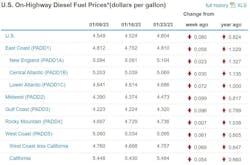

The U.S. average for diesel fuel proved its volatility the week of Jan. 23 as it rose 8 cents to $4.604 per gallon, reversing the declines of most weeks recently. Trucking’s main fuel also was up for the week in all regions that the U.S. Energy Information Administration (EIA) monitors.

Diesel was down slightly, 2.5 cents, last week. And it was looking like the national average might be headed toward the benchmark that EIA established for 2023—$4.48 per gallon—or lower but it went in the opposite direction the week of Jan. 23, perhaps because oil prices, both West Texas Intermediate and Brent, are now creeping up or on several more predictions that the markets may be headed toward a chaotic February based primarily on lower U.S. refining coupled with stronger-than-usual demand and jitters over restricted Russian energy.

See also: It's time to deeply evaluate your operations

Diesel is 82.4 cents higher than it was a year ago at this time, according to EIA. The national average for the fuel has dropped in nine of the past 10 weeks, however.

Trucking's main fuel tracked by motor club AAA had been inching up all week, so analysts could see the EIA news coming. AAA had the U.S. average for diesel up slightly for the week—3.5 cents to $4.636 per gallon—but the motor club also tracks the averages, both diesel and every grade of gasoline, daily.

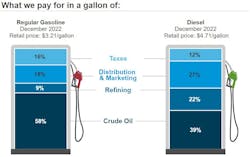

Gasoline is now 9.2 cents higher than it was a year ago, by EIA's measure, a change from recent weeks when gas fell below its year-ago level.

Area-by-area indicators of more expensive fuel

Regional (EIA) or state-by-state (AAA) measures can be useful in telling trucking companies that run in certain critical or higher-traffic places for freight transportation what they might actually be paying for diesel.

Trucking's primary fuel rose everywhere, but the increases for the week of Jan. 23 were acute in some regions of the U.S. that are critical to freight hauling. The increase was almost 10 cents, 9.9 cents (to $4.473 per gallon), for example, in the Midwest while it was 9.6 cents (to $4.320) along the Gulf Coast. Along the East Coast, the increase was 5.8 cents for the week to $4.810 per gallon but higher in a vital subregion, the Lower Atlantic, where trucking’s main fuel rose 7.2 cents to $4.686.

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.