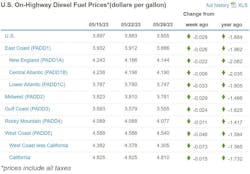

Average prices in the U.S. for diesel fuel continued their gradual declines for the week of May 29, falling another 2.8 cents to $3.855 per gallon nationally but by more in several regions critical to trucking, according to new federal government data.

Meanwhile, better business data also emerged (if only temporarily) early this week when the annual International Roadcheck inspection blitz in North America took some capacity off the road, sending spot-market freight rates soaring as a result, one load board and industry data researcher reported.

The price picture for diesel was much the same this week as it has been much of this year, with the nationwide freight slowdown reducing demand for trucking’s main fuel and causing prices to slide. This continued to show in the U.S. Energy Information Administration’s weekly fuel data into Memorial Day week—diesel was lower in every region of the country, according to EIA. Motor club AAA also is seeing its diesel data follow the same path; AAA has its U.S. average for the fuel 3.4 cents lower to $3.954.

See also: Truck tonnage hits lowest level since 2021

According to EIA data for the week of May 29, trucking’s main fuel was down the most along the West Coast (4.6 cents lower to $4.54), though diesel there still is the most expensive, with California keeping prices elevated. On the Gulf Coast, diesel fuel is the cheapest in the U.S. and is down 2.4 cents to $3.555 per gallon. In the Midwest, the fuel fell 2.9 cents to $3.781 for the week. In the East Coast region, diesel is down 2.6 cents to $3.886 per gallon, with Central Atlantic diesel keeping prices there higher. The Rocky Mountain region showed the smallest decrease for the week: 1.1 cents to $4.077.

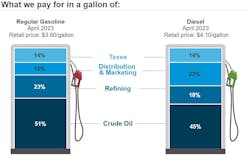

Per-barrel crude oil prices continue to fall, with West Texas Intermediate now well below the $70 mark and Brent just a few dollars higher.

Gasoline, possibly in anticipation of the summer travel season, has started to go in the opposite direction of diesel, according to EIA, though even gas was less inflated over Memorial Day weekend than it usually is thanks to flagging crude.

The U.S. average for gas was up 3.7 cents to $3.571 per gallon for the week of May 29, but still 28.4 cents cheaper than diesel, according to EIA. As consumers do widely, some smaller commercial fleets pump gas to keep their power units going and producing profits. One analysis by GasBuddy, however, cautions that even the busy summer travel season in 2023 might be tempered by the economy.

Roadcheck cuts capacity, lifts spot rates

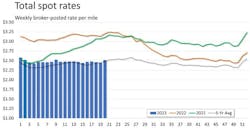

Slumping spot rates combined with sky-high fuel prices have acted the most in tanking business conditions for many small fleets, but there was better spot-rate news for the week of May 19 following International Roadcheck 2023, which took place May 16-18. The annual event usually cuts capacity, by taking trucks off the road with out-of-service violations but also with fleets reducing their runs to avoid the hassle and scrutiny of stepped-up inspections.

There is no data on how many trucks were placed out of service after the North American inspection blitz (that usually arrives from the Commercial Vehicle Safety Alliance by early fall), but load board Truckstop and FTR Transportation Intelligence, which analyzes data for the trucking industry, saw a corresponding surge in spot rates as a result of capacity being take off the road.

Broker-posted rates in the Truckstop system rose to their highest since the December holidays for both the dry van and refrigerated (reefer) segments of freight-hauling, according to a Truckstop/FTR weekly report, Spot Market Insights. Rates in the flatbed segment also rose significantly, according to this report, although that segment had seen a larger increase twice this year and the increase was far smaller than it had been during Roadcheck 2022.

“The jump in load postings was the largest week-over-week increase since the beginning of the year, and the uptick was especially strong in refrigerated and dry van,” according to a summary of the report emailed to FleetOwner. “Even with the certainty of earning much stronger rates, Roadcheck resulted in a significant reduction of truck loadings in the spot market.”

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.