After week of calm, U.S. diesel surges another 8.6 cents

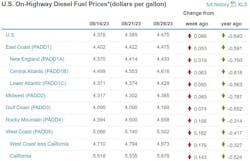

The U.S. average for diesel fuel resumed its summer of 2023 surge the week of Aug. 28, rising 8.6 cents to $4.475 per gallon, according to the U.S. Energy Information Administration, meaning trucking's main fuel has climbed more than 66 cents since mid-July and is only 64 cents below last summer's historic highs.

And luck might not be on the side of fuel prices going into September and October, either, as an Aug. 25 storage tank fire at least partially shut down the Garyville, Louisiana, Marathon Petroleum Corp. refinery—the third-largest in the U.S.—and sent diesel futures in New York to a seven-month high, according to Bloomberg.

See also: As rates still lag, trucking forecast is cloudy going into 2024

The fire was so serious that officials in the area of the Marathon refinery had to order residents within a 2-mile radius to evacuate. Another two large refineries, one near Philadelphia and another in New Brunswick, New Jersey, are set to shut down soon for regular maintenance as well. Diesel futures rose 5% on all this news, while gasoline futures rose 4%. Oil futures also climbed 1% on Aug. 25 on the fire and an unrelated drop in the number of available oil rigs, CNBC reported.

"The main thing was concern about diesel prices, the diesel crack spread, and worries about diesel shortages when refineries go into maintenance," Phil Flynn, an analyst at Price Futures Group, told Reuters. He added prices also reacted to the Louisiana refinery fire and the reduced number of U.S. oil platforms.

"While GasBuddy is closely monitoring Florida for challenges related to [Hurricane] Idalia and is prepared to activate the fuel availability tracker, the rest of the nation could see gas price declines reversing pending the outcome of refinery issues that continue to put upward pressure on wholesale gasoline prices," said Patrick De Haan, head of petroleum analysis at GasBuddy.

De Haan added: "For the first time in weeks, the national average price of gasoline has fallen over the last week as the wholesale price of gasoline has been under seasonal pressure as we near the end of the summer driving season. However, the drop may be short-lived, as one of the nation's largest refineries partially shut last week after a fire at a storage tank, and as we see more tropical activity that could lead to further disruption."

Calm before another storm of higher fuel prices?

Trucking fleet operators might have thought diesel and gasoline prices would show some stability after modest 1.1-cent diesel and 1.8-cent gasoline increases the week of Aug. 21. Before last week, diesel had surged 13.9 cents, 11.2 cents, 22.2 cents (the most significant spike in 16 months), and 9.9 cents, sending the EIA average well above $4 per gallon. Even going into this week, motor club AAA's U.S. diesel average on Aug. 28 was only 3 cents higher to $4.377 than the week before.

See also: Remember to celebrate trucking's successes

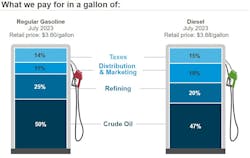

EIA data this week, however, showed the reprieve to be short-lived, at least for diesel. The U.S. oil and fuel-price data aggregator did say the nationwide average for gasoline declined 5.5 cents to $3.813 per gallon for the week of Aug. 28 and was lower in most EIA regions and subregions. But gas, used widely by consumers and pumped by smaller fleets and work truckers in considerable quantities, is only 1.4 cents per gallon cheaper than a year ago.

After this week's 8.6-cent diesel increase, the U.S. average for trucking's main fuel sits 64 cents below last summer's record highs after prices started to ease late last summer into the fall and winter of 2022 to the spring and early summer of this year. Fuel prices now are joining other market forces in aggravating business conditions for trucking to the point where analysts see uncertainty for the industry in 2024, despite the outlook brightening for the overall U.S. economy.

Diesel surges again in U.S. regions, subregions

Diesel sits significantly above $4 and $5, respectively, in the Rocky Mountains (up 15.8 cents to $4.658 per gallon) and on the West Coast (16.2 cents higher to $5.302, driven by double-digit hikes in its subregions).

The diesel increases weren't as severe in other EIA regions: the East Coast, where trucking's main fuel elevated 5.3 cents to $4.475 a gallon; the Midwest, where it surged 8.3 cents to $4.385; and the Gulf Coast, where the fuel increased 7.4 cents to $4.169, the cheapest region in the U.S. for diesel.

Other factors also are at work on fuel prices. Oil per barrel is elevated this week, with West Texas Intermediate crude above $80 and Brent almost $85. Petroleum demand in July also was the highest for that month since 2019, according to Oil & Gas Journal, FleetOwner's sister publication.

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.