Coalition puts $1 trillion price tag on electrifying U.S. trucking industry

Electrifying the entire U.S. commercial trucking fleet could cost nearly $1 trillion, according to a new industry-funded study. That merely includes the cost of building out charging infrastructure—not replacing diesel-powered equipment with the more expensive battery-electric, heavy-duty trucks, which aren’t yet able to handle long-haul freight.

Commissioned by the Clean Freight Coalition, industrial consultant Roland Berger produced Forecasting a Realistic Electricity Infrastructure Buildout for Medium- and Heavy-Duty Battery Electric Vehicles. The CFC is a transportation alliance comprising industry trade groups, including American Trucking Associations, American Truck Dealers, National Association of Truck Stop Operators, National Motor Freight Traffic Association, National Tank Truck Carriers, and Truckload Carriers.

Here are some highlights from the report’s executive summary:

Six key findings

-

To electrify all U.S. medium- and heavy-duty vehicles, fleets and charge point operators must invest $620 billion in charging infrastructure, including chargers, site infrastructure, and utility service costs.

-

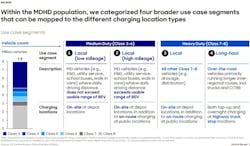

Local medium- and heavy-duty vehicle (MD/HD) vehicles would need a $496 billion investment in on-site charging infrastructure, but heavy-duty vehicles will require more significant charging infrastructure and investment compared to medium-duty vehicles—requiring an average charging infrastructure investment of $145,000 per HD vehicle vs. $54,000 per MD vehicle.

-

In addition to on-site charging infrastructure, high-mileage vehicles (most of which are Class 7 and 8) require a $69 billion investment in a reliable local on-route charging network before they can be electrified. Utilization risk poses a major investment challenge, requiring significant government intervention and business model innovation.

-

Full electrification of long-haul vehicles would need $57 billion to develop a sufficiently dense highway-charging network; the pace of transmission grid infrastructure buildout constrained this development.

-

Utilities need around $370 billion in distribution grid upgrades and new builds to support local CV charging demand, nearly equivalent to the entire grid investments over the past 15 years.

-

Power system operators are anticipating substantial growth in generation and capacity to meet the needs of electricity generation and transmission. This planned growth, driven by factors beyond the projected demand from MD/HD charging, is expected to exceed the demand created by MD/HD charging tenfold.

Industry leaders warned during a media briefing detailing the study that those lofty costs and complicated electrifications will be passed on to U.S. fleets, their customers, and consumers.

“We thought about how you can possibly calculate the end cost to the consumer, but that’s just impossible to do,” said Jim Mullen, executive director of the Clean Freight Coalition, which commissioned the Roland Berger study. “But I think we all know the cost of the tab is eventually going to be picked up in part by the consumer.”

However, the study details the upfront costs to the commercial trucking and transportation industries: $620 billion to build charging infrastructure to electrify all medium- and heavy-duty vehicles. Wilfried Aulbur, a senior partner with Roland Berger, said that cost includes on-site chargers, power infrastructure, and utility service costs.

“That’s a huge amount of money,” Aulbur said during the March 19 media briefing on the study. “And that compares to about $800 billion in revenue that the logistics industry typically generates at a 5% return on sales. I think these numbers, by themselves, already indicate the size and the challenge that we have to fund this transition.”

Due to economic and operational constraints, heavy-duty vehicles face more challenges than medium-duty vehicles in electrification. The study forecasts that average charging infrastructure will cost fleets $145,000 per heavy-duty vehicle and $54,000 per medium-duty truck.

Adding to these costs, the study found that utility companies would need to invest another $370 billion in electric grid upgrades and new builds. That price tag is close to the amount the utility industry has spent on grid distribution over the past 15 years.

The study did not address other near-zero and zero-emission alternative fuels, such as green hydrogen and biofuels. But Aulbur said a takeaway from his research is that the industry should “continue to be technology agnostic—whether it’s biofuel, whether it’s biodiesel, whether it’s hydrogen ICE—so that we do not become dogmatic in the choice of technology and solutions as we drive to decarbonize the transport industry.”

See also: Diesel’s dominance continues as trucking plans clean energy shift

Consumers will feel this supply chain ‘unfunded mandate’

“This study illustrates a $1 trillion unfunded mandate on the supply chain, including our industry,” Chris Spear, chief executive of the American Trucking Associations, said during the briefing. “So that reflects in the price consumers pay, which is going to be tremendously inflated.”

He said the regulatory push to electrify trucking over the next six to 10 years would result in fewer trucks moving freight. “It’s going to come very quick,” he said of consumers feeling the decarbonization pinch. “For an administration that’s concerned about inflation, concerned about the supply chain, they need to take a holistic approach to this. Be transparent. We’re not saying ‘no’ to zero emissions. We just need a path to get there. This is not it.”

Last week, the Biden Administration laid out its National Zero-Emission Freight Corridor Strategy, which major vehicle manufacturers supported. It shows how the nation could support medium- and heavy-duty transportation with charging and hydrogen refueling infrastructure along major freight corridors.

The federal strategy, which did not include a price tag, outlines a four-phase approach over the next 16 years. It starts by funding zero-emission freight infrastructure in areas with substantial freight volume and for regional operations. Over time, the ZE infrastructure area would expand and support long-haul operations and Class 8 vehicles.

Six implications and takeaways

-

A phased electrification approach is needed for MD/HD vehicles, with an initial focus on the medium-duty segment and heavy-duty and long-haul vehicles addressed over time as technology and infrastructure improve.

-

Given the significant (in some cases, prohibitive) investments required for electrification, being open to alternative decarbonization routes might be more valuable than being prescriptive about technology.

-

Meeting ambitious electrification and decarbonization targets may require fleets to explore and innovate alternative operational and fleet management strategies to optimize upfront investments and long-term value.

-

Without sufficient government and regulatory support, the transition to fully electric fleets would likely result in increased freight rates, costs that would have to be passed down to American consumers.

-

If faced with completely "unmanaged" charging demand, distribution grids will require extensive infrastructure investment, creating a bottleneck for fleet electrification given the need to maintain affordable rates. This highlights the need for technology solutions and regulatory support to help fleets and utilities manage charging.

-

These findings highlight the need for greater cross-industry collaboration to increase alignment and certainty for all stakeholders.

Methodology

Roland Berger calculated these costs by modeling a commercial fleet with today’s technology compared to a fleet with modest but realistic performance improvements. The team then went county by county, modeled vehicle populations, and projected electricity usage to identify areas needing investment to support those fleets.

Fleets need better ROI to electrify

Major truck OEMs in the U.S. have pledged to sell all net-zero-emission vehicles by the 2040s before becoming carbon neutral by 2050, matching the international Paris Agreement on climate change.

While Aulbur believes this is more easily accomplished with medium-duty vehicles over the next 10 to 15 years, he said Class 8 vehicles are the most challenging part of the supply chain to decarbonize.

A 2022 North American Council for Freight Efficiency study on trucking electrification found that EVs could replace 65% of medium-duty vehicles in California and New York. However, other NACFE studies have found that electrified heavy-duty operations work better for some regional operations where vehicles can charge at electrified depots.

Even if battery prices come down and technology improves, Aulbur said fleets still need to be convinced that the solution works for their operations.

“You will not find a fleet that will buy electric trucks just because they want to buy electric trucks,” he said. "Yeah, they're great. Low emissions, they're silent, there's no vibration, and they're great for the driver. But if it doesn't make money, [a fleet] cannot afford to invest in this technology. And I think that's basically where we are saying, ‘Let's be realistic.’”

Aulbur added that fleets need to be able to get a return on their investment. Spear added that a Class 8 electric truck can cost three times more than a diesel.

“I'm sure that the OEMs are also looking at this very carefully from their own efforts to bring down the cost of the vehicles and make them more applicable for the use cases that we see in the United States,” Aulbur added.

See also: It’s not too early to think about your fleet’s future power

Trucking continues to focus on improved emissions

Three of the four major trucking OEM parent companies—Daimler, Navistar, and Volvo—recently founded the Powering America’s Commercial Transportation coalition, known as PACT, to educate policymakers and advocate for nationwide commercial ZE fueling infrastructure.

In response to the Clean Freight Coalition study, Daimler AG’s Ritchie Huang, who serves as PACT board treasurer, told FleetOwner: "PACT did not contribute to this report but welcomes any findings that can provide insights towards the build-out of nationwide infrastructure for M/HD ZEVs. We look forward to working with all stakeholders on these issues."

Mullen, CFC executive director, said he hopes the new study and data help drive deeper conversations and planning with utility companies that could assist the trucking industry in designing a decarbonized future.

The Clean Freight Coalition is an alliance of truck transportation advocates, such as trucking trade organizations that represent various industry sectors, including carriers, dealers, and truck stop operators.

“The truck community has long been a good steward and supporter of our environment,” said Jim Ward, president of the Truckload Carriers Association, a founding coalition member. “Who doesn’t want to pass on clean air and clean water to the next generation?”

Ward noted the industry has been tackling the challenges of improving emissions over the past four decades. He said each new emissions-reduction technology for diesel equipment has also pushed costs onto fleets. Ward supported ATA’s push to repeal the Federal Excise Tax, a World War I-era fee that adds 12% to the costs of new heavy-duty trucks.

ATA has said that repealing this tax would not only make new zero-emission equipment cheaper but also make more environmentally friendly diesel trucks more affordable. In California, for example, more than half of the Class 8 trucks on the road are pre-2010 models, which don’t have the same emissions-reduction technology as today’s Class 8 trucks.

Ward added that there are still many unknowns about the ROI of commercial EVs, including maintenance challenges and battery disposal. “We’re not here to say no—we do want to be good stewards of the environment,” he said. “But we need to step back, take a look at this thing, involve the stakeholders in this conversation, and figure out what that path is going to look like going forward.”

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.