Heavy-duty supplier outlook for 2021: 'Clouded by uncertainty'

Heavy-duty parts suppliers are looking forward to a better quarter than this time last year, as supply chains remain in recovery mode. However, COVID-19 continues to create challenges, noted Richard Anderson, director of market research for the Heavy Duty Manufacturers Association (HDMA).

While sharing findings from HDMA’s most recent Pulse Report, as well as the organization’s annual outlook, Anderson noted that supply chain difficulties continue to bring fears of bottlenecks and delays as recoveries occur. The HDMA Pulse Report is a periodic survey sent to HDMA members and provides regular insight on the current state of the heavy-duty parts market, including manufacturing, supply, and distribution.

“The outlook for 2021, while widely positive in direction is both highly variable and clouded by uncertainty,” Anderson said. “COVID will continue to make life difficult for suppliers.”

Suppliers are anticipating continuing many of the adaptations they had to make last year, while also reporting operations and structural changes that will endure regardless of ongoing COVID infection levels, Anderson said.

“This gives an indication of what major implications will be even five years from now,” he emphasized. “How is this changing business? How is this changing our industry? Obviously, there have been many short-term changes, but we are also finding out that there have been structural long-term changes. We are starting 2021 with many of those changes in place, but suppliers are anticipating that many will endure well beyond the end of the pandemic.”

Over the past year, Bob Dieli, an economist with MacKay & Company, has been talking about a W-shaped structural recession. With several different areas of improvement in construction and manufacturing, but due to continued difficulties in the service sector, particularly in hospitality, Dieli believes the nation is entering the third phase of that W shape.

“Whether or not it will turn into an actual decline in economic activity is still not clear because of the pattern that has begun to emerge in the latest data,” Dieli said during HDMA’s Jan. 13 webinar. “We will be monitoring that very closely. The reports we are getting about problems with the supply chain involve imports, exports, as well as the entire domestic economy, suggest that we are going to have some trouble going forward in getting back to what I would consider the type of stance we would need to have to sustain an expansion or a renewed expansion of the economy.”

Dieli referred to business cycle peaks and troughs over the last several months that are indicative of that W shape. Those cycles are also beginning to foreshadow what recovery might look like.

“We see elements that are still associated with recession and others that are associated with recovery,” Dieli explained. “What we are going through now compared to historical patterns is completely different. What we end up with when we get through the pandemic is going to be something considerably different than what we had when we started the pandemic.”

“We shouldn’t be looking to replicate what has gone before, but we shouldn’t discard what has gone before,” he added, noting that new opportunities will be heavily dependent on the vaccination and how other aspects of public health unfold.

Dieli also said there will be some changes that are going to affect both international and economic activity, but they are going to present significant opportunities for the market.

“Rather than hunker down, I think the time is to start looking up and to start looking forward into seeing what plans can be made to take advantage of those opportunities,” he urged.

Anderson pointed out that for some, Q1 2020 was almost fully normal. For others, more than half the quarter was lost because of COVID impacts. It really depends on where each is located geographically and also somewhat dependent on where the company sits in the supply chain, he explained.

2021 market outlook

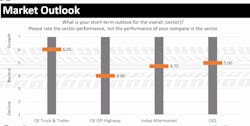

To gauge market performance, HDMA asked its members to rate performance (on a scale of one to seven) in the following sectors: OE truck and trailer, OE off-highway, independent aftermarket, and OES. With a rating of 6.05, the OE truck build sector is the clear favorite of the markets for suppliers with the highest rating for any sector in more than four years, Anderson noted.

“Unfortunately, that level of growth isn't predicted everywhere, we shouldn't expect it to be quite honestly, as it is the highest number we have ever seen,” he said. “But both sides of the aftermarket are expected to be quite positive. And within the historical perspective, a rating of neutral is far above what our members have been saying for the off-highway sector in many years.”

Regarding Class 8 builds, Anderson anticipates a solid year that is slightly above what is considered replacement for Class 8. Although he projected similar results for medium-duty, he did point out that there is more volatility in the medium-duty sector because certain parts of that market don't follow the normal buying patterns, thus making it more difficult to forecast.

Trailer build is also predicted to be quite strong.

“There's a lot of information out talking about how there will be an increase in trailer demand and trailer build,” Anderson explained. “Because of new cleaning protocols and things that can happen where trailers can be taken offline for longer, there are different uses for trailers. So, trailer build really is pushing through, and is even more strongly positive than truck build at this time.”

Over the last year, one of the biggest concerns for suppliers has been a shortage of raw materials—namely steel and aluminum but also wood and rubber—that have created volatility with production. “We've also seen reports of shortages of electronic components and even complete losses of certain suppliers in that sector, which is obviously very concerning,” Anderson noted.

In addition to those material shortages, more time built into the manufacturing process has been necessary to adhere to increased safety measures and plant shutdowns because of COVID-19 outbreaks.

Part of that demand may be driven because of hoarding by some supplier customers and other manufacturers vying for the same items, Anderson pointed out.

One area heavy-duty parts suppliers will continue to monitor for the foreseeable future is the demand for original equipment supplier versus the aftermarket parts. “Our members believe that long term, the OES supply sector is going to continue to erode some of the independent aftermarket,” Anderson said.

When it comes to restarting normal operations, Anderson referred to the following “big three” problems: forecast accuracy, labor availability, and supply chain stability. He noted that once there is clarity for these issues, the supply side might see a return to some semblance of normal operations.

Shop utilization and parts sales

John Blodgett, vice president of sales and marketing for MacKay & Company, noted that “since the bottom of the pit” of the pandemic, shop utilization, although 5.3% below this time last year, has been steadily increasing month by month.

“We aren’t back to where we were in January 2020, but the trend has been positive and it’s headed in the right direction, and that’s what we want to see moving forward,” Blodgett said.

In its DataPulse Plus survey, MacKay & Company asks independent parts distributors and truck dealers about their parts sales year-to-date. For three years through 2019, dealers and distributors reported 36 months of positive year-over-year parts sales. That changed at the beginning of 2020, but stakeholders anticipated that.

“Obviously, we did not anticipate the pandemic,” Blodgett said. “We got down to about 12% year-to-date parts sales. In the April and May timeframe, parts distributors and truck dealers were trying to figure out how to sell parts if they couldn’t go to the fleets. It is coming back, but still down about 6-7%."

In both the U.S. and Canada, aftermarket distribution points are down 14% year to date, Blodgett noted.

When it comes to power units, MacKay & Company saw that a portion of fleet utilization came in at 79.8%, which was forecast to be up for the fourth quarter over the third quarter. “That’s pretty unusual,” Blodgett said. “Usually, the third quarter is pretty much the strongest quarter in the year because a lot of freight gets moved before the holidays, so it’s not unusual for the fourth quarter to be down compared to the third quarter.

“The forecast for fleets is fairly positive,” he added. “Keep in mind when I say fairly positive compared to where we are, the normal utilization rates are higher and have been higher pre-pandemic.”

Trailers are a bit different, Blodgett advised, as the fourth quarter, which was primarily driven by lease and rental, came in strong. Capacity issues and e-commerce have driven utilization in the trailer market and the forecast is good for the first and second quarter as well, Blodgett said.

Overall, when it comes to expectations for 2021, as the pandemic continues, the market is keeping an eye on how things will shake out. Additional and updated details will be disclosed during the virtual Heavy Duty Aftermarket Dialogue on Jan. 25.

About the Author

Cristina Commendatore

Cristina Commendatore is a past FleetOwner editor-in-chief. She wrote for the publication from 2015 to 2023.