FTR sees caution in market as April trailer orders decline

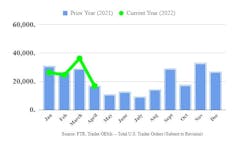

Preliminary trailer orders reported by freight transportation forecaster FTR fell back substantially in April to 16,800 units, a 53% decline in orders from March, which saw brisk activity.

Most trailer manufacturers experienced the pullback from March as the market shows signs of caution due to supply chain disruptions from COVID-19 pandemic-related lockdowns in China and the ongoing Russian invasion of Ukraine, according to FTR, which released its preliminary outlook May 16 on trailer orders for the prior month.

See also: Trailer orders surge in March, further increasing pent-up demand

The reductions likely will impact all trailer segments when final April numbers are tabulated. According to FTR, the preliminary numbers, however, show a 4% increase in trailer orders in a year-over-year comparison. Orders for the past 12 months have totaled 252,000 units.Don Ake, FTR’s vice president of commercial vehicles, said, “There is no reason for trailer OEMs to overbook, with increasing uncertainties regarding the supply chain. The situation in Shanghai is going to delay some components that are needed to make trailers. In addition, the war in Europe is creating shortages of aluminum with an associated spike in pricing. These and other doubts have delayed OEMs from issuing quotes for 2023 requirements. So, the low order volumes reflect OEMs filling in the months of the 2022 production schedule they feel more confident about.”

Ake added, “The pent-up demand for trailers is estimated at over 100,000 units. But now, the supply chain difficulties are expected to extend into 2023. OEMs will then have to build at high rates for an extended time to catch up to demand. The short-term prospects are subdued, but the long-term outlook remains bright.”

About the Author

FleetOwner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Josh Fisher, Editor-in-Chief

Jade Brasher, Senior Editor

Jeremy Wolfe, Editor

Jenna Hume, Digital Editor

Eric Van Egeren, Art Director