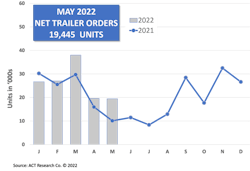

U.S. trailer orders in May were about even with April’s order total, ACT Research reported. The 19,445 units ordered in May were down 0.8% from April’s total—but were 93% higher compared to May 2021, according to ACT’s State of the Industry: U.S. Trailer Report.

“Order placement remained choppy in May, with dry vans, up 32% m/m, and bulk tank, 42% m/m higher, responsible for the total industry uptick,” said Jennifer McNealy, ACT director of CV market research and publications. “OEMs continue to negotiate with fleets, and that effort is building a large group of staged/planned orders that are not yet officially posted to the backlog. Once OEMs gain sufficient confidence in their availability to open 2023 production slots, expect a surge of orders to be ‘officially’ accepted.”

The report provides a monthly review of the current U.S. trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments. It is accompanied by a database that gives historical information from 1996 to the present, as well as a ready-to-use graph packet, to allow organizations in the trailer production supply chain, and those following the investment value of trailers, trailer OEMs, and suppliers to better understand the market.

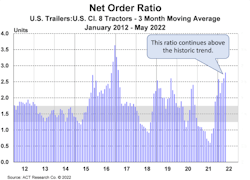

“The industry has normally not been willing to push commitments past 12 months, nor open a new calendar year this early in the preceding year, but recent years, including the pandemic-battered 2020-21, have been anything but normal,” McNealy added. “We expect some OEMs to begin considering longer order boards, with appropriate cost/price protections.”

She said the order board slid sequentially again in May—the second month-over-month decline in backlog since last October. “Dry vans, platforms, and lowbeds all shared responsibility for the slide, with the backlog for tanks, both liquid, and bulk, growing,” McNealy said. “Expect backlog to contract as we move through early summer, and for this trend to reverse when 2023 order boards are fully opened.”

About the Author

FleetOwner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Josh Fisher, Editor-in-Chief

Jade Brasher, Senior Editor

Jeremy Wolfe, Editor

Jenna Hume, Digital Editor

Eric Van Egeren, Art Director