The used-truck market has always been connected at the hip to commercial vehicle production by OEMs and the availability of all classes of brand-new CVs, most especially Class 8 over-the-road tractors.

In no years has this been more apparent than in 2021 and 2022, a period when OEMs have struggled because of component shortages and clogged supply chains to meet the demand for new models and to keep up with their usual supply and ship them to dealerships, fleets, and lessors across the U.S.

The market for used CVs—even older models with higher mileage—has been the beneficiary of the new truck market’s slow recovery, which sources told FleetOwner may take through 2023 into 2024. Settle in to an unusual used-truck market for many months, they advised.

See also: Used Class 8 sales down 10% in July, ACT reports

Volatility, which these sources said has rarely been seen on this level before, is apparent in the most recent used-truck reports from industry data miners ACT Research and FTR Transportation Intelligence and even used-vehicle valuation stalwart J.D. Power, North America’s largest auctioneer Richie Bros., and Fleet Advantage, which remarkets used CVs that have come out of contracts with their lease customers.

See also: The struggle continues for truck, trailer OEMs

Prices have eased since this spring, but they are still about 65% higher now for the same 3-year-old CV, meaning that vehicle will set you back about $135,000, Visser estimated, when it should normally be in the $80,000 to $90,000 range. By comparison, a new Class 8 was about $117,500 as recently as four years ago, in 2018, according to online data aggregator Statista. Brand-new trucks today, spec’d relatively generously, run about $165,000 to $175,000 or higher, but their supply is much scarcer, sources said.

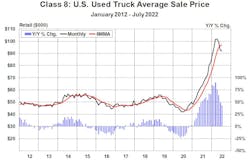

“It’s unprecedented territory, the explosion in pricing” for used trucks, Visser said in a recent interview. “It’s once in a lifetime. We’ve been examining the market with our current methodology since 2009. It’s probably at the highest it’s ever been.”

“The trucks that are getting remarketed today are older, and they have higher miles. In terms of [Class 8], values—including auction, retail, and wholesale—they are still running 30-35% above where they sat a year ago. We’re still sitting in a time of scarce inventory. Demand remains elevated, but it is slowing,” Steve Tam, VP at ACT Research, said in his chat with FleetOwner.

ACT compiles the State of the Industry: United States Classes 3-8 Used Trucks, a widely circulated monthly report on used trucks, mileage, and age trends. It’s generally regarded as a stalwart in the trucking industry along with competitor FTR in their deep dive into the data and predicting movement in the tractor market.

What’s caused prices to skyrocket?

“We collected the most money for a truck historically ever” in the first quarter of 2022, said Rob Slavin, senior valuations analyst at Richie Bros., the largest trucking auctioneer in North America (and probably the world) specializing in selling older used trucks, in the 6- to 8-year-old range, though it also auctions used models in their prime, generally in the 3-year-old range. Even pricing for the older CVs jumped about 130% in the first quarter of 2022 but have since abated, Slavin said.

“The numbers were jaw-dropping,” Slavin said.

Don Ake, who has said he will retire at the end of September as VP of commercial vehicles at FTR, said the spring peak in used prices was tied to more demand for them because OEMs couldn’t keep up with the demand for new commercial vehicles.

See also: ‘Stable’ medium-duty market shows positive signs for mid-decade growth

Much publicized component shortages—about 25 parts, by Ake’s estimation, including semiconductors but also electrical wiring and harnesses, axles, tires, mirrors, and plastic components—meant OEMs had to scale back their 2022 build plans and set conservative goals for 2023.

“The Class 8 OEMs were not able to build enough trucks to satisfy demand,” Ake told FleetOwner in an interview. “Primarily, [this was because] of a lack of semiconductors, but that was only one component in short supply. Then you have this ripple effect that goes through the industry as a whole. The fleets couldn’t get enough new trucks, so they were trading in fewer used trucks.”

“Then it gets compounded when you can’t get the new trucks that you need, and you have freight to haul, [but] you don’t have enough trucks,” Ake added. “Do I trade in these used trucks at all, or do I use them to make money was the calculation. They kept their trucks.”

He continued, “Trucks are being held onto longer. That data is true, but it’s because if you had a working truck, you’re going to repair that because you can’t get new. You want good used trucks. Your trade-in cycle is you buy them at three years, and you trade them at five years. But you go out to buy a used truck and [the] price is up 50%, you can’t spend that much money and make money. What do you do? Are you getting rid of that 5-year-old truck? No, you must run your freight. You do have all that population being run farther, more than normal. You do that because it makes economic sense.”

What’s causing used prices to slow?

In this environment through 2021 into the first quarter of 2022, there was plenty of freight to haul. Fleets and independent owner-operators—who were coming into trucking in record numbers and benefiting from generous spot-market rates, according to FTR—needed even more used trucks, so demand for them and prices shot up, Ake explained. “You did have some smaller fleets that couldn’t get new trucks, so they bought up some of the late-model used trucks,” he said.

“Spot rates at record levels encouraged a lot of owner-operators to come into the market, and they bought used trucks. At the time, used trucks were in short supply, so the demand for them spiked.”

ACT’s Tam said the spot-market story also was complicated by nervous shippers moving freight out of the spot market and into contract.

Where did the owner-operators’ equipment go? A lot of it went back into the resale market, bringing prices down, the sources said.

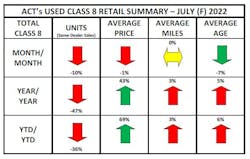

This sag showed in July. Some of this slowdown was seasonal, according to ACT’s State of the Industry report, but the lull also was a sign that used-truck and freight markets were cooling. Sales were down 10% over June. Average price and miles were down 1% and 0.4%, respectively. Average age also was down 7% compared to June. But compared to July 2021, prices were still 69% higher.

“Same-dealer retail sales of used Class 8 trucks took a nosedive in July,” Tam said. “Historically, used-truck sales are typically flat from June to July, so it is a safe bet the decline is a reflection of softening freight, particularly in the spot market.”

J.D. Power also saw a slowdown in July on the auction market for most models, according to the company’s own report, released in August.

Model-year 2021 Class 8s averaged $145,278, 5.6% lower than June; 2020s averaged $116,840, or 5.3% higher; 2019s averaged $80,347, or a half percent lower than the month prior; 2018s averaged $61,323, or 18.9% lower than June; and 2017s averaged $42,778. In the retail resale market, the same used model years were 15.3% to 2.7% lower from June to July, according to J.D. Power.

See also: Used truck sales slower in May, ACT reports

ACT’s report for July said, “It bears repeating that while the market is slowing, it is coming off all-time record highs. Longer-term comps underscore the point, with y/y and ytd gains of 43% and 69%, respectively.”

In his more recent interview with FleetOwner in September, Tam said used Class 8s are still running 30% to 35% above where they sat a year ago. “We’re still sitting in a time of scarce inventory. Demand remains elevated but is slowing.”

Is the honeymoon over for used-truck sales and prices of all classes? Is the market returning to some semblance of normal?

“It’s going to take a couple of years to rebound fully,” FTR’s Ake said remarked. “When the OEMs start to crank up production, and the fleets start to trade in more used trucks than normal, I don’t know what that influx of inventory does to used-truck prices.”

“It may take them down below 2020, 2019,” Ake added. “The market will reach balance, will reach equilibrium, but that’s going to take time. It may take to 2025 until you get a balanced market.”

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.