Used truck sales in March exceed seasonal expectations

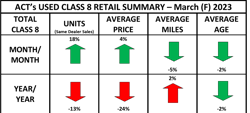

Used Class 8 retail volumes, otherwise known as same-dealer sales, jumped 18% in March compared to February, according to the latest State of the Industry: U.S. Classes 3-8 Used Trucks report, which is published monthly by ACT Research released on April 26. Average miles for March declined by 5%, average price increased 4%, and average age was down 2%, according to the ACT report.

In February, used Class 8 sales retreated 8% compared to January 2023, according to ACT.

See also: Several reports, experts sound trucking economy red alerts

“Same-dealer Class 8 retail truck sales continued their topsy-turvy run in March, jumping 18% from February. Granted, sales normally experience a boost in March, but the increase is usually smaller, about 12%,” said Steve Tam, VP at ACT Research. “The litmus test will come next month, with history indicating sales typically decrease around 10% from March.”

“As the year progresses, the year-to-date scenario continues to diverge from y/y performance,” Tam concluded in the report. “The overall market held onto a narrow gain (plus 1%). Our best estimate suggests that inventory continues to increase, supporting buyers working to refresh their used truck fleets. Units are flowing from both increased new truck purchases/trades, as well as owners exiting the market. The most recent fleet bankruptcy data available show failures have increased but remain well below historical levels.”

The ACT report provides data on the average selling price, miles, and age based on a sample of industry data. In addition, the report provides the average selling price for top-selling Class 8 models for each of the major truck OEMs: Freightliner (Daimler); Kenworth and Peterbilt (Paccar); International (Navistar); and Volvo and Mack (Volvo).

About the Author

FleetOwner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Josh Fisher, Editor-in-Chief

Jade Brasher, Senior Editor

Jeremy Wolfe, Editor

Jenna Hume, Digital Editor

Eric Van Egeren, Art Director