North American Class 8 vehicle orders rebounded in May after a sluggish April, according to projections from two commercial vehicle research firms. Despite the order boost in May, the activity remains below replacement demands, and build slots remain scarce for the rest of the year.

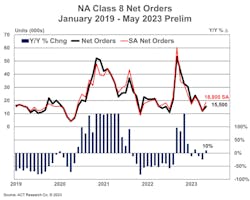

ACT Research’s preliminary numbers were up 29% month-over-month to 15,500 Class 8 orders in May after the firm reported about 11,600 orders in April. FTR Transportation Intelligence’s preliminary May data show a 9% increase to 13,600 from April’s roughly 12,000 orders.

The nearly 2,000-unit order gap between the two leading industry research firms has yearly data diverging. ACT has May Class 8 orders up 10% year-over-year, while FTR has May orders off 2% year-over-year.

See also: Trucking conditions continue to weaken

“With essentially all the build slots accounted for in 2023 and 2024 slots not yet open, a low level of activity in orders was no surprise,” Eric Starks, FTR’s chairman, said. “In fact, there was an expectation that the number could move below 10,000 units. Sub-10,000-unit order months are still possible over the summer.”

Starks added that FTR does not expect order activity to “surge” until OEMs open build slots for 2024, which would likely be August at the earliest.

“Given robust Class 8 orders into year-end and the ensuing backlog support, coupled with normal seasonal order patterns, orders were expected to moderate into Q2 and remain at relatively soft levels into mid-Q3 ’23,” according to Eric Crawford, ACT VP and senior analyst. “May orders were in line with this view,” shared.

Like FTR, Crawford said that ACT doesn’t expect “meaningful traction in the coming months” until OEMs open up more build slots. While truck makers are pacing orders, carriers are still looking for equipment, according to Starks.

“Fleet demand for equipment does not appear to be waning as they still want to take delivery of new equipment,” Starks added. “Strong backlogs are keeping build demand strong, and FTR doesn’t anticipate any negative impact on build activity due to the recent order activity.”

Medium-duty May figures

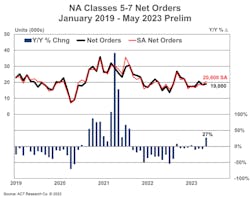

Medium-duty demand this May was 27% higher year-over-year, jumping to 19,000 units (a 3% increase from April), according to ACT, which also tracks Classes 5 to 7 orders.

This increase reversed a three-month trend of year-over-year declines, Crawford said. The seasonally adjusted May intake of 20,600 units shows a 28% year-over-year increase compared to the same adjusted data from May 2022.

While the Class 8 figures focus on straight trucks and trailers with and without sleeper cabs, the medium-duty figures can bleed into non-commercial vehicles. ACT Research notes that its State of the Industry report differentiates market indicators by Class 5 and Classes 6-7 chassis, segmented by trucks, buses, RVs, and step van configurations.

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.